“Future Meat is uniquely situated in the landscape right now because it is taking this beyond the realm of the theoretical,” said Matt Walker, managing director at a Chicago-based VC firm S2G Ventures, which led the financing round along with Swiss VC firm Emerald Technology Ventures. Other investors include Monde Nissin CEO Henry Soesanto, UK-based VC firm Manta Ray Ventures, and Chinese VC firm Bits x Bites.

While S2G does not have complete visibility into every firm in this rapidly evolving space, many of the startups appear to require “incremental developments on the technical side before they can deliver a viable product,” Walker told FoodNavigator-USA. “Future Meat is offering a real solution in the very near future, and that was exciting for us.”

The plan is to release hybrid products combining plant-based and cell based meat in 2021 and a second line of 100% cultured ground meat products suitable for things like burgers and nuggets at a cost of “less than $10 per pound” by 2022 (current small-scale production costs are c. $150/lb for chicken and $200/lb for beef).

The pilot plant would not be capable of producing enough meat for a nationwide launch at a major retailer, he said, but it’s not just going to produce enough for a PR launch at a high-end restaurant: “We’re talking about thousands of kilos per month.”

‘You’ll see a second wave of investment in the space’

The cell-cultured meat space - which has not attracted anything like the investment capital recently pumped into plant-based meat – “is probably where the plant-based space was five years ago,” said Walker.

“A lot of the initial interest was more high level, hypothetical. That’s changing now, you’ll see a second wave of investment in the space. Table stakes, you need to think more granularly about how you’ll scale up, bring costs down and bring these products to market.

“People can argue over whether it takes 10% or 20% of the market, or whatever, but the [addressable] market is worth a trillion dollars, so this is not a tiny niche.”

Chief science officer Prof. Yaakov Nahmias added: "I personally think that the massive interest in cultured meat brought a lot of interesting scientific ideas to market, but some of them lack a path for commercial viability. We need smart money in this field, from investors that really understand manufacturing processes, scalability, and commercial strategy.

"Future Meat Technologies made it a point to cultivate a global network of investors from the food industry, like Tyson Foods, Neto, and Monde Nissan as well as venture capital partners that critically understand manufacturing processes like S2G Ventures, one of the forces behind Beyond Meat’s IPO, and Emerald Technology Ventures, a leader in industrial innovation."

Future Meat Technologies was founded by Yaakov Nahmias, a professor of bioengineering at the Hebrew University of Jerusalem and a specialist in tissue engineering techniques refined from regenerative medicine. Its technology is based on Prof. Nahmias' research at The Hebrew University of Jerusalem and is licensed through Yissum, the Technology Transfer Company of The Hebrew University.

Future Meat does not use animal serum (the liquid part of blood) in its process (some start-ups growing cultured beef, for example, began by using fetal bovine serum, a byproduct of the livestock industry, although they have since claimed to have validated animal-free alternatives).

"With this investment, we're thrilled to bring cultured meat from the lab to the factory floor and begin working with our industrial partners to bring our product to market. We're not only developing a global network of investors and advisors with expertise across the meat and ingredient supply chains, but also providing the company with sufficient runway to achieve commercially viable production costs within the next two years."

Rom Kshuk, CEO, Future Meat Technologies

Growing cell-cultured meat at scale

So how does Future Meat Technologies stack up against the growing number of start-ups in the space from a technical perspective, and how easy is it for investors to vet firms in the space given that this is virgin territory (no one has made cell cultured meat at scale before)?

Most startups have developed prototypes at the lab-scale, but when it comes to commercial viability, they need cell lines that can replicate/proliferate extensively (without having to keep going back to the original source) and differentiate into multiple cells types such as muscle, fat and connective tissue; in other words, to behave like embryonic or ‘master’ cells. They also need a production process that enables these cells to grow rapidly, and an affordable growth medium that doesn’t utilize animal serum, said Walker.

‘Our cells grow extremely fast and reach very high densities, about 10-times the industrial standard'

While several startups are using induced pluripotent stem cells, which they claim can now be developed without using what would be classified as genetic engineering, Future Meat is using fibroblasts, connective tissue cells, that naturally grow in "very simple culture medium," Prof. Nahmias explained.

"The current cost of such medium is under $28 per liter and we see a clear path to $4 per liter. In addition, the cells grow extremely fast and reach very high densities, about 10-times the industrial standard.

"Finally, fibroblasts undergo a process called spontaneous immortalization, enabling the cells to replicate in perpetuity without genetic manipulation. This means that our product is by-definition GMO-free."

This process truly set up apart in industry

Future Meat’s cells can also grow in suspension, without carrier beads [to attach to], he said: "Our cells grow in high density suspension without carrier beads. They are uniquely resistant to high shear rates allowing us to grow them in stainless steel tanks which are the industrial standard. This process truly set up apart in industry as it allows our cultures to reach densities 5- to 35-times higher than others."

Asked whether Future Meat would grow muscle, fat and connective tissue cells together in one reactor, or in separate reactors, he said: "The process is far more efficient when the cell types are grown separately."

‘There’s a path to reality, it’s not just something on a Power Point presentation’

Walker from S2G Ventures added: “We see a path to reality here, it’s not just something on a Power Point presentation. We’ve also tasted the meat – and it’s delicious.”

Asked about IP, he said: “There are fundamental elements of this technology that we believe are unique to Future Meat and are protectable by Future Meat and they relate to the Non GMO process of creating cell lines that grow indefinitely.

“Other patentable things are multiple dimensions of the growing process, so growing at higher yields, and the way they can use the growth media [in a so-called ‘rejuvenating’ bioreactor] in a way that mimics nature [significantly reducing the volume of feed media required]. They are able to ‘clean’ the fluid – wash out waste products - without using additional fluid, if that makes sense, and this provides real differentiation on the cost side.

“A lot of the others rely on a growing methodology that’s limited in its yield capability. Future Meat has broken free of those limitations, so it can use less steel, less fluid, and far less expensive fluid, and that means you’re going to shave orders of magnitude off the price, as they are doing now.”

Prof Nahmias explained: "Mechanisms that recycle growth medium are commonly used in industry. Our technology is based on specific removal of waste products, like ammonia, from the bioreactor, enabling the cells to grow in the same growth media for longer."

He added: "Our intellectual property is built around using fibroblasts in cultured meat as well as a process that allows the cells to grow in extremely high densities."

The business model

Asked about the business model at Future Meat, which has talked in the past about developing a ‘distributed’ production model whereby meat is produced by a network of partners closer to the end markets, Walker said: “Where appropriate they can and should work with partners to bring these products to market.”

- WATCH: Higher Steaks talks cell-cultured (a.k.a. ‘cultivated’) meat at FoodBytes! Chicago

- ‘Cultivated’ meat could be the most-consumer-friendly term for cell-cultured meat, suggests Mattson/GFI research

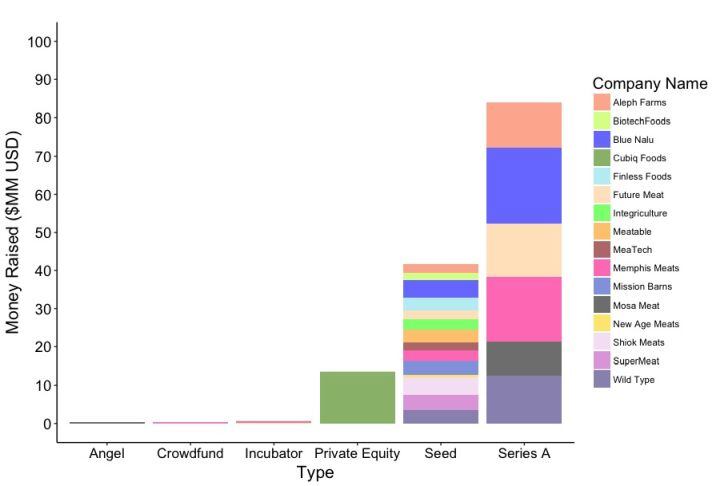

By some estimates there are now as many as 40 startups in the cell-cultured (a.k.a. 'cultivated') meat space, which you could say 'officially' launched when Memphis Meats emerged from stealth mode in late 2015 (although others had been working on the technology prior to that).

However, the overall amount of cash pumped into these firms (less than $140m in private capital*) pales in comparison to the millions pumped into plant-based meat over the same period.

Most firms are at the seed funding stage, with only a handful thus far in Series A territory, including Wild Type (US), BlueNalu (US), Memphis Meats (US), Future Meat Technologies (Israel), Aleph Farms (Israel), and Mosa Meat (The Netherlands).

* Good Food Institute (GFI) senior scientist Elliot Swartz - who put the above chart together - notes that it only includes publicly visible funding announcements and thus excludes companies such as JUST Inc, and "stealth startups that have raised undisclosed capital."

- Read more HERE about research grants available to companies in the plant-based and cell-cultured meat industries from the GFI, a global nonprofit accelerating plant-based and cultivated meat technologies.