HB 119 – which passed in the House and Senate – defines ‘milk’ as the “lacteal secretion, practically free of colostrum, obtained by the complete milking of a healthy hooved mammal, including any member of the order Cetartiodactyla, including a member of the family (i) Bovidae, including cattle, water buffalo, sheep, goats, and yaks; (ii) Cervidae, including deer, reindeer, and moose; and (iii) Equidae, including horses and donkeys.”

It goes on to instruct the Board of Agriculture and Consumer Services to “ban the sale or offer for sale of any product that violates such prohibition, including any plant-based product that is misbranded as milk.”

The bill will not become effective until six months after the enactment, on or before October 1, 2029, of a similar act in any 11 states listed in the bill.

PBFA: 'HB119 is unnecessary, will only create confusion, and is likely unconstitutional'

In a letter urging Governor Northam to veto the bill, PBFA executive director Michele Simon argued that it would “confound shoppers and retailers” and stressed that PBFA members all use qualifiers such as ‘non-dairy/dairy-free/plant-based/vegan’ to avoid any consumer confusion.

“We believe that HB 119 is unnecessary, will only create confusion, and is likely unconstitutional.”

She also noted that the FDA is completing a formal review into ‘milk’ labeling, which the PBFA supports on the grounds that such labeling issues are “best determined on the federal level, with input from all concerned parties, rather than chaotically on a state-by state basis."

If enacted into law, claimed Simon, "HB 119 would have the effect of setting Virginia apart from the rest of the United States when it comes to how these products are presented to consumers while placing Virginia grocers at a disadvantage.”

Moreover, attempts to impose such restrictions run afoul of First Amendment protections allowing companies to label their foods with clear, non-misleading terms, she added, noting that similar laws in other states (Mississippi and Arkansas) have faced legal challenges on First Amendment grounds.

Asked if the PBFA would consider legal action, PBFA communications chief Michael Robbins said: "Yes, if it takes effect [he noted that in order to go into effect other states must also enact similar bills, and until that time, the PBFA would not have standing to bring a suit]."

GFI: 'This type of bill is clearly a violation of the First Amendment'

“If 11 other states pass similar legislation, consumers could no longer find labels like ‘soy milk,’ ‘almond milk,’ or ‘coconut milk’ on their supermarket shelves," added GFI’s regulatory counsel Nigel Barrella. “Companies would be forced to choose between using opaque and confusing language like ‘coconut beverage’ and ‘almond juice,’ or pull out of the marketplace entirely, under the threat of fines or even jail time.”

“This type of bill is clearly a violation of the First Amendment,” said GFI’s director of policy Jessica Almy. “A federal judge in Arkansas has already halted similar attempts at label censorship in that state.”

Co-sponsor: ‘Last year, Virginia lost up to three dairy farms a week’

While Simon said the move would merely confuse consumers, who have grown familiar with terms such as oatmilk and almondmilk, and “will do nothing to help struggling dairy farmers,” Chris Runion (R-Rockingham) – who co-sponsored HB119 in the House – insisted it was “about giving the consumer correct information and being truthful in advertising.”

In a statement supporting the bill, he added: “Last year, Virginia lost up to three dairy farms a week. Rockingham and Augusta [counties] are two of the three largest dairy producers in the state. This will have a positive impact for our community and this highly regulated industry… I believe it is paramount to protect our dairy farmers from products claiming to be similar in nutritional value but failing to deliver the necessary vitamins and minerals.”

Plant-based ‘milk’ and consumer litigation

Consumer class actions challenging terms such as ‘almondmilk’ and ‘soymilk’ have not made much headway, with judges arguing that the federal standard of identity for ‘milk’ - which limits it to lacteal secretions from cows - does not categorically preclude a company from using names that include the word ‘milk’ (eg. 'soymilk') as long as they use qualifiers such as ‘plant-based’ or ‘dairy-free.’

In an order dismissing one such case* vs brand owner Blue Diamond Growers in 2017, Judge Stephen V. Wilson also gave short shrift to the ‘nutritional equivalence’ argument made by Runion: “A reasonable consumer, indeed even an unsophisticated consumer, would not assume that two distinct products have the same nutritional content.”

In January 2019, the Ninth Circuit court of appeals upheld the dismissal of the above class action and argued that reasonable consumers would not assume from the packaging that it is nutritionally equivalent to dairy milk.

Meanwhile, a federal district court in Arkansas recently determined that a challenge to a state law restricting ‘meaty’ terms on plant-based products was likely to prevail on the merits of its First Amendment claim.

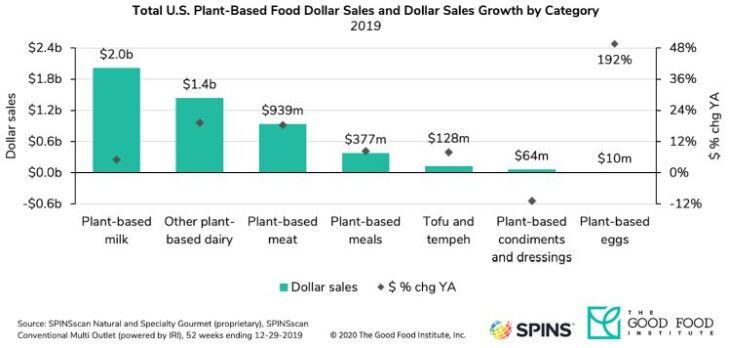

The Good Food Institute and the Plant Based Foods Association has just released a flurry of new data from SPINS* into the plant-based dairy, egg, and meat categories covering the 52 weeks to December 29, 2019.

Within plant-based dairy, plant-based milk is the largest category, with sales up 5% in 2019 to $2.02bn and 41% household penetration; followed by plant-based ice cream and frozen novelties (+5.7% to $335.55m); plant-based creamers (+34.3% to $286.66m); plant-based yogurt (+31.3% to $282.5m); plant-based butter (+8.4% to $198.36m); plant-based cheese (+18.3% to $189.1m); and plant-based dairy spreads, dips, sour cream and sauces (+53.7 to $29.51m).

Plant-based options now account for 14% of the fluid milk market; 4% of the yogurt market; 6% of the butter market; 5% of creamers; 3% of ice cream and frozen novelties; and 1% of the cheese market.

*The data represents retail sales of plant-based foods that directly replace animal products, including meat, seafood, eggs, and dairy, as well as meals that contain animal ingredient replacements. Obtained from the SPINSscan Natural, Specialty Gourmet, and Conventional Multi Outlet (powered by IRI) channels, this data pertains to the 52week periods ending December 29, 2019.