Things have changed significantly following the May 2019 opening of Oatly’s production facility in New Jersey, which makes the oat base used in all of its US products, with a second facility scheduled to open in Utah mid to late summer that will make more oat base and some finished products (although Oatly will still work with a network of co-packers), North America president Mike Messersmith told FoodNavigator-USA.

“We still have partners that would love to order more and we’re working every single month to make as much as we possibly can, but broad scale out of stocks and sustained capacity challenges are largely behind us.”

‘We’re trying to be really thoughtful about our growth’

However, the company is still being judicious about what it takes on, he said: “We’re certainly not at the same level as where we were 12-18 months ago where we were in a completely capacity constrained environment.

“The New Jersey facility removed a key bottleneck in our supply chain and since then we’ve increased production output by a factor of six, eight times on a monthly basis, and our partner manufacturers [that make Oatly’s finished oatmilk and frozen dessert products] rode that wave with us.

‘But at this point we’re trying to be really thoughtful about our growth. It goes beyond, ‘Can you make this much?’ to questions of organizational bandwidth, so we’re trying not to take the spigot and turn it all the way wide open, as you can overwhelm the organization and end up frustrating your team and your partners and it becomes counterproductive.”

Managing demand

Right now, Oatly is seeing strong demand both at grocery retail, and in the on-premise channel (spanning coffee chains, hotels, hospitality/chain dining, and college campuses), with consumers frequently discovering the brand in a coffee shop or university, and then seeking it out at the grocery store, said Messersmith.

It has also stepped up online sales of shelf-stable products (which are the same as the chilled ones, but sold in aseptic packaging), recently re-opening its direct to consumer business at us.oatly.com (which was put on ice when the brand was very suppy constrained), and launching on Amazon.com.

“We only arrived in the US in 2017 in on-premise and retail in early 2018 so we feel like we’re still barely scratching the surface," he said. "Our first retail partner was Fresh Direct here in New York City [where Oatly US is based] and then from there we had partners like Wegmans, Whole Foods, Target and ShopRite, and as the business has grown, they have grown with us.

“We’ve held off on pursuing the kind of full US ACV footprint out of deference to those partners that believed in us early on and a handful of others such as Publix that came on after, as it would be a disservice to them to add on 5,000 or 6,000 more doors [with other retailers] when we still haven’t found a steady run rate with those initial partners, which is incredible after two years, but demand just continues to surge."

He added: "Currently we are available in roughly 6000 retail locations in the US and hope to grow to close to 10,000 by the end of 2020."

Results from a trial of Oatly in 1,300+ Starbucks locations are also encouraging, he said.

‘We’re barely scratching the surface’

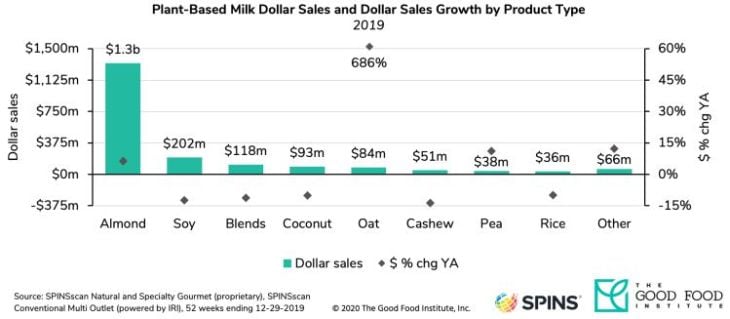

While oatmilk only accounts for a small percentage of US retail sales of plant-based milk, and is still dwarfed by almondmilk, said Messersmith, it’s “the segment that’s really driving the growth and the innovation in the category right now [although in dollar terms, almondmilk – which is still growing steadily – is clearly still a major contributor to growth given the size of the segment].

"Over the last 52 weeks, the Oatmilk segment has grown over 500% in US retail (Nielsen thru 2/22). When we launched in US retail in January 2018, oatmilk accounted for less than 0.1% of the total plant based category and now acounts for 8.7%, and Oatly is the fastest growing, largest growth contributor and #1 market share brand within oatmilk."

While oatmilk pairs particularly well with coffee, usage occasions for all plant-milks are not that different, said Messersmith, speculating that selections were more likely based on taste/nutrition preferences of household members than for specific usage occasions, with basket analysis showing many households now have multiple ‘milks’ in their fridges including dairy and plant-based options.

Within plant-based dairy, plant-based milk is the largest category according to new data from SPINS, with sales up 5% in 2019 to $2.02bn and 41% household penetration; followed by plant-based ice cream and frozen novelties (+5.7% to $335.55m); plant-based creamers (+34.3% to $286.66m); plant-based yogurt (+31.3% to $282.5m); plant-based butter (+8.4% to $198.36m); plant-based cheese (+18.3% to $189.1m); and plant-based dairy spreads, dips, sour cream and sauces (+53.7 to $29.51m).

Plant-based options now account for 14% of the fluid milk market; 4% of the yogurt market; 6% of the butter market; 5% of creamers; 3% of ice cream and frozen novelties; and 1% of the cheese market.

Ditching sanitized corporate BS and trusting the inhouse creative team

Although the oatmilk category has become significantly more crowded as multiple players have piled in over the past year (some with more success than others), Oatly has a singular focus (it only does oats) and a very distinct brand voice, said Messersmith, who notes that consumers “hate sanitized corporate BS because they can smell it a mile off” and have embraced Oatly’s brand personality, which is created in-house.

Unlike some other brands which have an ‘internal agency’ approach where a team is briefed and comes up with ideas to pitch to the management team for approval, Oatly’s creative team is embedded within the business and immersed in commercial, operational and product development decisions.

Put another way, it comes up with its own ideas and implements them, said Messersmith, who has worked at other CPG brands including Chobani, Frito-Lay, and Nature’s Bounty, but said he'd never seen anything like this.

“We do it very differently; you don’t get the diluting effects you get with a lot of branding efforts and it’s really special. I’ve never seen it work like this anywhere else and it keeps the brand fresh, straightforward and human. That can sometimes come across as sarcastic, even challenging, without that kind of sanitized brand safety that so many companies revert to, and people really like that.”

Similarly, when it comes to allocating marketing resources, Oatly has also taken an unusual approach, investing little in digital and social media and focusing on billboards, podcasts and print ads, which allow its brand voice to shine through, he said.

Additional Oatly products will hit the US market in the second half of the year

As for new products, there are multiple Oatly products on the market in Europe that could work well in the US, said Messersmith, who launched frozen desserts here last summer and has been “super encouraged by the turns and velocity – we’re basically doubling that business every month.”

Moving forward, he said, additional Oatly products will hit the US market in the second half of the year.

Added sugar confusion

While Oatly doesn’t add any sugar to its original product, it is required by law to list its 7g of sugar (from the oats) as added sugar on the new-look Nutrition Facts label as the FDA says the process of breaking down oat starch via enzymatic hydrolysis creates added sugar.

While most oatmilk brands produce their oat base using enzymatic hydrolysis and have therefore also had to update their labels, it can be confusing to consumers, who look at the ingredients list and don’t see any sugar, and then wonder where the 7g of added sugar on the Nutrition Facts label is coming from, said Messersmith.

“They are trying to reconcile the ingredients label and the Nutrition Facts panel, but we have always been really transparent about our process.”

*Nielsen data shows US retail sales of oatmilk were up 435% year on year in the 12 weeks to February 29; while SPINS data shows retail sales were up 686% in calendar year 2019 vs 2018.