Speaking on a video call with reporters after selling 84.4m American depositary shares for $17 a share (at the high end of the expected $15-$17 range) to raise $1.43bn, Petersson said: “The factory is now up and running, and we’ve started to produce finished products already, last week, which is really exciting, and which will enable us to close the gaps of fill rates, but also expand with new partners across retail and foodservice.”

Asked about the potential for other products beyond oatmilk in the US market (Oatly recently launched oatgurt, frozen desserts and soft serve products in the US but they have limited distribution), he said: “We are really excited about that and the frozen items are the best performing in terms of velocity in the US, but it's with very limited distribution so far due to production constraints.

“That is something that this new plant will solve. So, we are really really excited about this year it's going to be a super dynamic and interesting year for us.”

‘It’s growth over profit…’

Quizzed about the path to profitability for Oatly - which posted a net loss of $60m and an operating loss of $47m in 2020 on sales up 106.5% year-on-year to $421.4m - Petersson said the Malmö, Sweden-based company may incur losses for some time as it ramps up production and aggressively expands into new markets.

“We have been building capacity for a long period of time, but also building the organization, our systems and the back office structure across three continents, and I think this is super normal where you are growing as much as we are doing. And going forward on the profit side, we are going to prioritize growth, no matter what.”

He added: “We do have a very ambitious plan, but what we are focused on right now is to see… how can we capture incremental demand?.... This is about conversion, it's about converting people who used to drink cow's milk into Oatly. And the addressable market is just massive… so it’s growth over profit.”

‘The addressable market is just massive’

As to the company’s ability to compete with multinationals in the burgeoning plant-based dairy category, Petersson said: “We’ve been competing with the biggest companies out there for many years, but if you look at the performance data, it's clear that we are beating them greatly in terms of velocity.”

While there are plenty of other players in the plant-based arena – from multinational CPG companies and leading dairy companies to legacy brands and food-tech startups – Oatly’s inhouse creative team has built an especially loyal consumer base, he said.

He added: “We are here to try to make the world better. We're trying to make something that is designed for human beings [Oatly’s marketing has frequently noted that cow’s milk is for cows, not humans] and better for the planet. We're not trying to put a product on shelf just because it's a healthy growing category and it’s a business opportunity.

"Those two things are two different mindsets in how you run a company. And I think that is something consumers can see and feel. So, we know that we beat competition greatly on emotional connection and sustainability credentials, and those parts are equally important to people today when they're making their purchase decisions.”

Oatly generated revenues of $100m in the US in 2020

Four years after entering the US market, Oatly products can now be found in >7,500 retail shops and 10,000 coffee shops in the United States (where it generated revenues of $100m in 2020), and more than 32,000 coffee shops and 60,000 stores across the world (as of Dec. 31, 2020).

In the Chinese market – which it entered in 2018 via the specialty coffee and tea channel, Oatly has been able to scale rapidly via an e-commerce partnership with Alibaba and an exclusive partnership with Starbucks in 4,700+ stores, said the company, which said in its IPO prospectus that it has “a significant opportunity to expand into new international markets.”

Production capacity

Oatly’s New Jersey facility – which opened in May 2019 – has helped the company meet explosive demand in the US market, where oatmilk recently overtook soymilk to become the #2 player in the plant-based milk category behind almondmilk.

The second facility in Ogden Utah (producing oat base and finished products), which was scheduled to open last year, is only now coming online.

Three additional facilities in Singapore, Maanshan (China), and Peterborough (UK), are also under construction or in the planning stages, while expansions are planned for existing factories in Sweden, the Netherlands and new Jersey, said Petersson, who told reporters that the money raised from the IPO would not be used to go on a plant-based buying spree.

"There's really no reason for us to look at M&A. I'm not excluding that completely, but right now we don't see that being part of the plan going forward."

Oatly believes that "plant-based dairy, especially oat-based dairy, will continue to experience significant growth driven by multiple secular tailwinds:

- Sustainability and health as leading factors driving behavioral change and consumer choice

- Current generations increasingly seek out brands that connect with their core values

- Growing consumer demand for oat-based dairy."

Picture credit: Oatly

‘We have cultivated a loyal consumer base that is highly aligned with our ambitions’

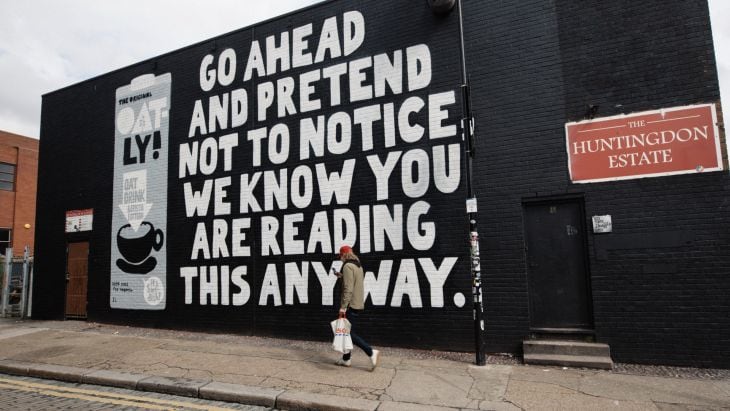

While there are plenty of other players in the plant-based arena – including multinational CPG companies and leading dairy companies – Oatly’s inhouse creative team has built an especially loyal consumer base through engaging and sometimes provocative ads, claims the company.

“We have torn down the conventional corporate approach to brand building and have developed a voice that is human, compelling and honest… Our advertisements are bold and eye-catching, meant to drive conversation among consumers, while challenging norms and outdated industry practices.

“Through the efforts of our authentic and award-winning in-house creative team,” adds Oatly - which generated a lot of buzz with a polarizing Super Bowl commercial featuring its CEO singing 'Wow, No Cow' in a field – “We have cultivated a loyal consumer base that is highly aligned with our ambitions."

Pictured: Oatly ad in the UK. Credit: Oatly

Plant-based milk by numbers, 52 weeks to Jan 24, 2021 (SPINS )

US retail sales of plant-based milk rose 21.9% to $2.542bn in measured channels (natural enhanced, and conventional channels) in the year to Jan. 24, 2021, according to new data shared with FoodNavigator-USA from SPINS.

The key segments are: (figures below exclude included blended products)

- #1 Almondmilk (+16.9% to $1.59bn): Refrigerated +17%, Shelf-stable +15.8%

- #2 Oatmilk (+219.3% to $264.1m): Refrigerated +218.6%, Shelf-stable +85.9%

- #3 Soymilk (-0.9% to $201.4m): Refrigerated -0.2%, Shelf-stable +11.3%

- #4 Coconutmilk (+25.9% to $134.6m): Refrigerated +8.3%, Shelf-stable +68.6%

- #5 Peamilk (+15.8% to $45.2m): Refrigerated +16.4%, Shelf-stable -2.1%

- #6 Ricemilk (+4.2% to $44.68m): Refrigerated -8.5%, Shelf-stable +12.2%

Plant-based cheese and yogurt by numbers, 52 weeks to Feb 21, 2021 (SPINS)

- Plant-based cheese: +43.6% to $233.9m

- Plant-based yogurt: +16.4% to $346.2m