While out of stocks and practical considerations (queues, revised opening hours) are still impacting the data (eg. consumers are buying brand B because brand A is not available, but may return to brand A when it is), some trends are starting to emerge following the initial wave of panic buying, according to the latest in a series of consumer trends reports from IRI and BCG.

For example, 12% of 1,094 primary grocery shoppers surveyed by IRI April 10-12 said they were buying larger pack sizes (in part due to buying more groceries at club stores, in part to save cash, and in part because they are not consuming as many food/beverages on the go or for immediate consumption), while 7% said they were buying fewer single-serve foods/beverages.

More consumers are also returning to their preferred retailer, said IRI and BCG: “When faced with out of stocks at the onset of COVID-19, consumers went to other stores looking for those items. As consumers become accustomed to the new normal, they are returning to their retailers despite out of stocks.”

Self-care: Vitamin C, elderberry, melatonin, zinc

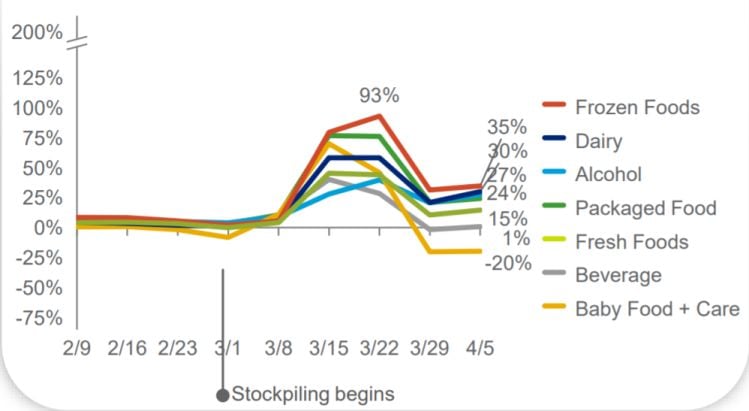

While things have calmed down since mid-March, sales of most edible products are still well above pre-COVID-19 levels, with strong growth in frozen (+35%), dairy (+30%), alcohol (+27%), packaged food (+24%), and fresh foods (+15%) in the week ending April 5 (YoY) according to IRI data.

Meanwhile, sales of nutritional supplements "grew more during the pandemic than in the entire previous year,” with growth peaking in the week ending March 15 at +88% and slowing to +21.7% in the week ending April 5, said Kristin Hornberger (IRI principal, healthcare) during a webinar hosted by the Council for Responsible Nutrition and Natural Products Insider on April 17.

Immunity, stress, anxiety

Dollar sales of vitamins rose +44% year on year in the six weeks ending April 5, added Hornberger, noting that particular areas of growth within supplements include vitamin C, adult multivitamins, elderberry, children’s multivitamins, vitamin D, melatonin, and zinc.

“Consumers are searching for supplements to not only boost immunity, but reduce severity of symptoms and even manage stress and anxiety.

“Immunity-focused brands such as Emergen-C and Airborne made significant share gains, attracting new buyers and driving stock-up; private label struggled to add new buyers... An influx of new buyers is driving product growth. This is an opportunity for manufacturers to win consumers over for the long-term.”

While all age groups have been buying more supplements since early March, Millennials and Gen Z shoppers have upped spending the most, added Steve French, managing partner at the Natural Marketing Institute, who also presented at the event.

According to SPINS data shared during the webinar, sales of yogurt, cottage cheese, refrigerated kombucha, refrigerated juice and functional beverages, and refrigerated pickled and marinated veg also outperformed other refrigerated foods as shoppers look for “products with functional benefits.”

'Consumers will resort to behaviors exhibited during previous recessions'

In an adjacent report (click HERE) attempting to predict where shoppers are heading in the coming weeks, IRI argued that “Recessionary behaviors are just starting to take hold,” and predicts that:

- “As the impact of the economic shut-down hits personal finances, consumers will resort to behaviors exhibited during previous recessions, including purchasing more private label and multi-use packages.

- “Consumers will continue to social distance, shifting grocery trips to weekdays and making fewer visits, and buying more when they do shop.”

- “Retailers and manufacturers will continue to limit depth of assortment to larger, multi-use sizes, as well as smaller, lower-priced packs for economically pinched consumers. Single-serve packages will continue to be challenged as small-format stores suffer traffic declines.”

- “Private label and value brands will become increasingly important to product mix. Large manufacturers that can quickly make at scale and deliver to retail shelves will continue to gain share, reversing years of gains by small manufacturers.”

- “E-commerce will continue to gain share of wallet as shoppers get used to ordering online and omnichannel retailers invest in infrastructure needed to support the demand for additional services.”

- “Marketers will need to defend their shelf space as retailer's reallocate space for high-demand, high-margin categories.”

- “As consumers and retailers adjust to limited assortment, marketers will face greater hurdles getting new items and new varieties into stores.”

It also notes that 43% of the 65% of consumers* who report eating at home more often during the pandemic say they will "wait a few extra weeks after restrictions end before returning to restaurants."

Meanwhile, 55% of the 33% of shoppers who report cooking more from scratch during the pandemic say they will continue to do so after shelter-at-home orders lift; and 66% of the 27% that report making more coffee at home during the pandemic say they plan to continue this trend after stay-at-home restrictions end.

That said, any consumer survey data collected during this crisis should be viewed with caution, warned Dr James Richardson, principal at CPG consultancy Premium Growth Solutions, who told his linkedin followers this week:

"Don't read, download or look at any 'research' based on asking consumers directly about their likely future spending behavior post-COVID... there is no epistemological support for doing research of this kind.

"Consumers can only tell you what they did yesterday. End of story."

*1,094 primary adult grocery shoppers surveyed by IRI April 10-12

Visit IRI’s COVID-19 portal for more data and insights HERE.