Conagra Brands' organic net sales rose 21.5% in the latest quarter (Q4, ending May 31, 2020) and 5.6% in the full year, driven by substantial growth in staples (+46.3%), frozen foods (+26.2%), and snacks (+20.1%).*

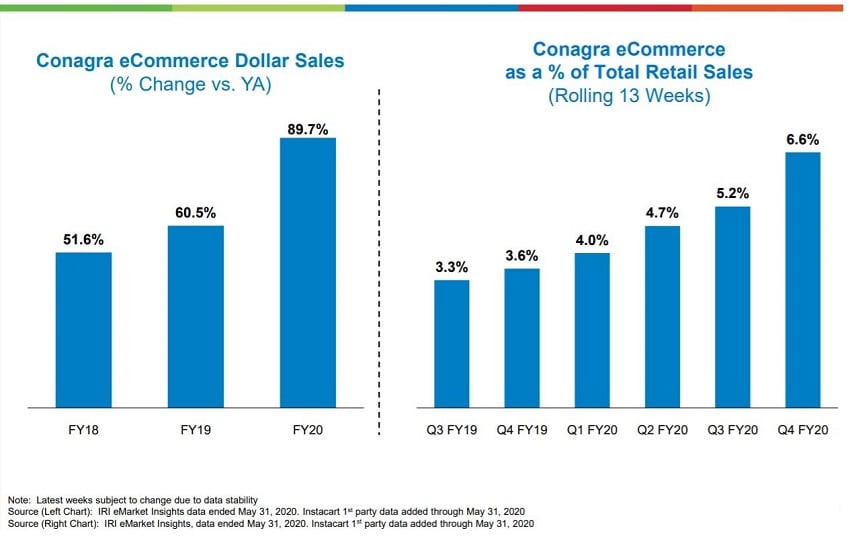

The company's e-commerce business experienced elevated demand as online sales accounted for 6.6% of its total retail sales in the latest quarter, an increase from 5.2% compared with the same quarter in 2019.

"Our business clearly benefited from increased at-home eating in the fourth quarter, as the elevated retail demand outweighed the reduced foodservice demand. In retail, many consumers tried our modernized products for the first time and then returned for more,” said Sean Connolly, president and CEO of Conagra Brands.

According to the company, 38% of new buyers (whose first purchase was in March 2020) repeated their purchase in May this year.

The company’s foodservice segment decreased 27.9% to $193m in Q420. However, several of its retail brands offset this decline, experiencing strong double-digit organic sales growth in the fourth quarter, including Chef Boyardee, Hunt's, Libby's, Armour, Duncan Hines, Orville Redenbacher's, Snack Pack, and Slim Jim.

Within the snacks segment, consumers gravitated towards popcorn brands (Orville Redenbacher's, Act II, and Boom Chicka Pop), which experienced a 42.2% sales increase, and 'sweet treats' products (Duncan Hines, Snack Pack, and Swiss Miss), which saw a 39.7% sales increase for the quarter.

At-home food consumption also drove double-digit sales gains for Conagra's frozen meal solution brands including Birds Eye, Marie Callender’s, Banquet, Healthy Choice, and P.F. Chang’s Home Menu.

Within its frozen food portfolio, frozen multi-serve meals and frozen plant-based meat alternatives grew 31.1% and 52.1% for the quarter, respectively.

“We have effectively responded to elevated demand, continued to make good progress on improving the overall business, kept our synergy capture on-track, and begun to launch our fiscal 2021 innovation slate," said Connolly.

“While we are optimistic about the long-term implications of recent consumer behavior shifts, given COVID-19 uncertainties, we are only providing guidance for the first quarter of fiscal 2021. We intend to provide an update on our fiscal 2021 outlook next quarter."

In its earnings call, the company said it expected elevated demand for Conagra products and brands to continue, but the timing and degree of change in demand was uncertain.

FY21 innovation pipeline success

Despite disruption to the entire food retail landscape, Conagra moved forward with a number of new launches in the latest quarter, including the introduction of its Gardein Ultimate Plant-Based Burger, legacy brand Marie Callender’s plant-based bowls, Duncan Hines single-serve ‘Keto’ cakes, Evol paleo frozen meals, and more.

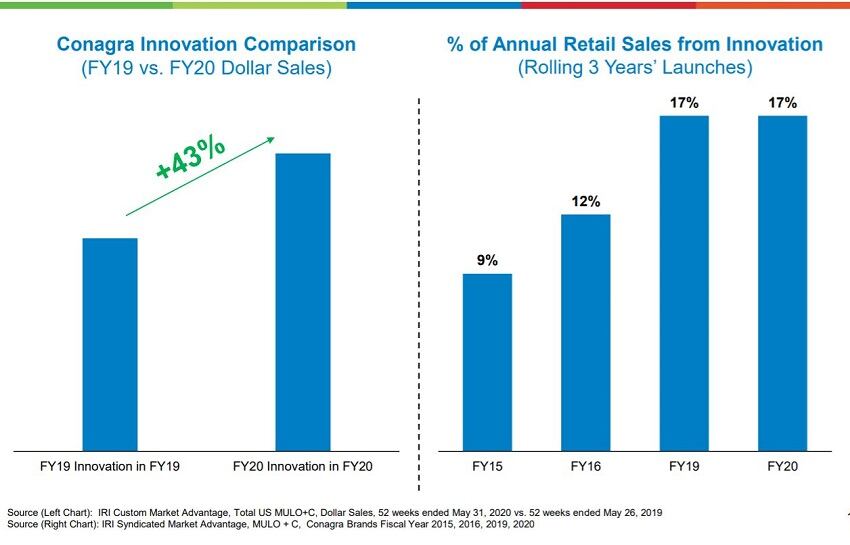

Dollar sales of its new launches increased 43% in FY20 compared to FY19, accounting for 17% of the company’s annual retail sales for the year.

Conagra’s focus on innovation will continue throughout FY21 as the company said it would “continue to infuse new innovation across the portfolio” while ensuring physical supply of its new product launches.

* IRI Syndicated Market Advantage, Total US MULO+C, 14 weeks ended May 31, 2020