At SHIFT20, the virtual IFT Show, the International Food Information Council (IFIC) presented its findings from a recent survey of 1,000 US adults, which sought to answer these questions.

Consumer definition of plant-based eating

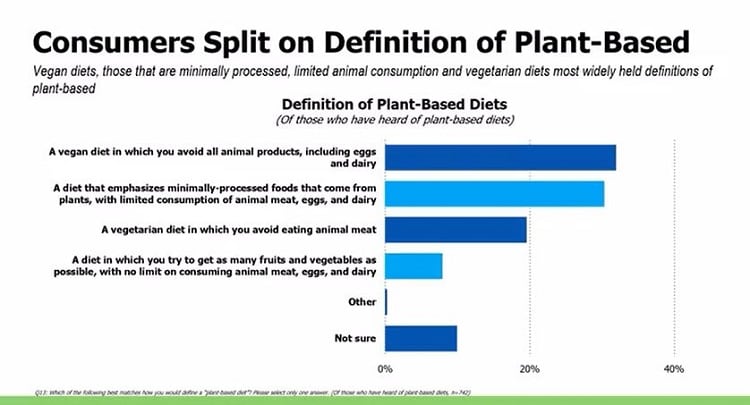

Before diving into consumers' nutritional perceptions of plant-based meat alternatives, IFIC asked respondents to characterize what they believe defines a plant-based diet.

According to survey results, the top response to this question was a plant-based diet is a "vegan diet in which you avoid all animal products, including eggs and dairy." The next top response was "a diet that emphasized minimally-processed foods that comes from plants, with limited consumption of animal meat, eggs, and dairy."

"I found this fascinating because it didn’t necessarily align with what my definition of a plant-based diet is. So, it's always important to consider where the consumer is in terms of understanding or perceptions of certain topics," said Kris Sollid, RD, senior director of nutrition communications, IFIC, during the SHIFT20 virtual presentation.

Who has tried plant-based alternatives? And why?

According to the consumer survey, about half of respondents have eaten a plant-based alternative. When asked what motivated them to try a plant-based meat alternative, the most common answer was curiosity -- 41% of respondents reported "I like to try new foods" and 30% said "I've been hearing about them [plant alternatives to animal meat] and was curious."

"The adventurous eater and the curious eater seem to be driving trial of plant alternatives to animal meat," said Sollid.

When asked what they liked most about plant-based meat alternatives (among the sample that had tried these products), 53% reported liking the taste, 35% said they liked the texture, and 34% said the products taste like meat.

Among the sample of respondents who had not tried plant-based meat alternatives, when asked why, 31% said anticipation of not liking the product was the top reason for not trying plant alternatives.

Health perception

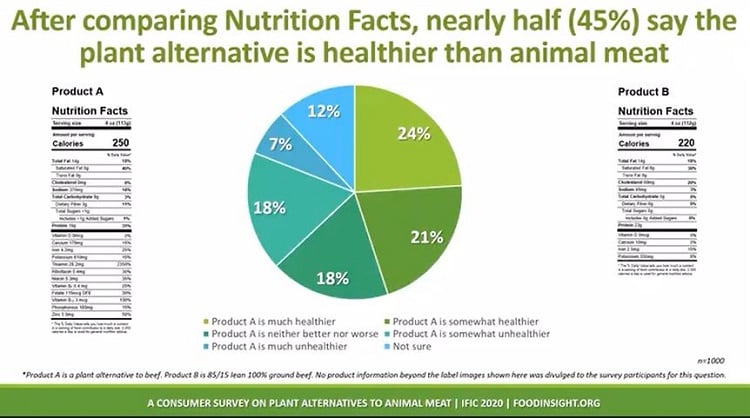

To assess consumer health perceptions of plant-based meat vs animal meat, IFIC performed an exercise in which it presented respondents with two blind nutrition labels: Product A (plant alternative to beef) and Product B (a 100% beef product).

"What we found after comparing nutrition facts is that nearly half of people said that the plant alternative is healthier than animal meat," said Sollid. About a quarter of respondents said Product B (100% beef product) was the healthier product.

Next, IFIC included the product labels with its ingredients (thereby divulging which product was plant-based and which was the 100% animal beef product).

After the ingredients list was divulged, slightly fewer respondents (40%) said Product A was healthier and conversely the number of people that said Product B was healthier grew from 25% to 29%, according to the survey.

"I think I find that most interesting, the effect wasn't as large as we might have assumed it would be after we divulged the ingredients list to our survey takers," said Sollid.

Will the novelty of plant-based alternatives wear off?

"The big question is if these products are here to stay? My personal perception is that they are," said Sollid.

In its survey, IFIC asked consumers about purchasing intent of plant-based meat alternative products.

"What you see is that the responses are a little bit mixed," noted Sollid.

The survey revealed that 18% of consumers said that they have purchased plant alternatives to meat and do not intend to buy them again. At the same time, 27% of respondents said they have purchased these products before and they do intend to buy them again.

"On the reverse side in terms of this question we do see that about half of our sample has not purchased these products," added Sollid.

"I certainly think there's a lot of room to grow for these products, the consumer mindset is there, and I think only time will tell how much they follow through on that," said Sollid.