BevUSA acquired Texas-based NERD in July 2020. The brand, which is available at approximately 2,000 retailers currently, had built a loyal following of consumers in its home state where it was created by a University of Texas student looking to enhance focus and energy while applying to medical school.

After four years, NERD was generating was generating more than $1m in annual sales, according to Davner, and now under BevUSA’s umbrella the brand is expected to hit between $7m to $10m in revenue by 2022 with expanded retail distribution in Texas, New Jersey, Las Vegas, and Nashville, Tennessee, and online launches on Amazon and Walmart.com, as well as revamped branding, according to Davner.

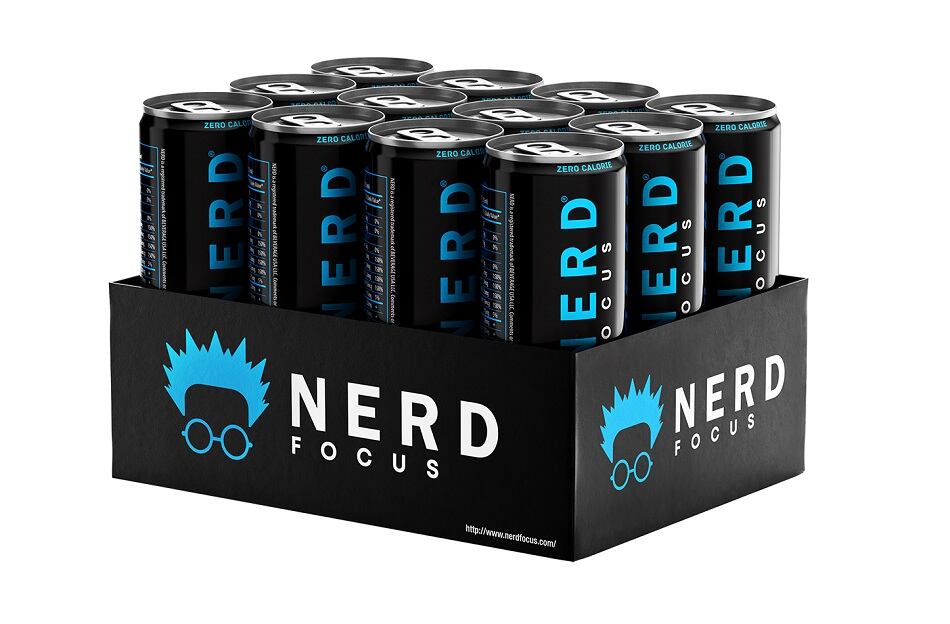

“One of the things that we thought was vital for the brand was to do a rebranding and relaunch it right away,” he said. “The can did not have the visibility that could create a national brand.”

Keeping the same black and bright green color scheme, NERD dropped the brain image on its can and switched to an actual character on the cans that would resonate more strongly with consumers, said Davner.

Available in Green Original and Blue Zero Calorie (zero sugar sweetened with sucralose) 12-fluid-ounce cans, NERD’s national expansion plans will be supported by a national sampling program in which the brand will ship free products to interested consumers.

“We plan to specifically target cities with booming colleges and universities as we continue our expansion. After seeing the brand explode at the University of Texas, we know there is a need for students and other high-demanding professionals to refocus their mental and physical energy,” said Davner.

NERD’s blend of nootropics includes Huperzine-A, Dimethylethanolamine (DMAE), gingko biloba, gamma-Aminobutyric acid (GABA), and Alpha-GPC which the company claims support mental acuity, focus, memory, and clarity.

While the efficacy around nootropics and their ability to boost cognitive performance is still an emerging research area, there is some promising research around Huperzine-A, gingko biloba, and Alpha-GPC.

Nootropics: Size of the prize?

Valued at $2.17bn in 2018 and forecasted to grow at a CAGR of 12.5% through 2025 (according to Grandview Research), the market opportunity for nootropic ingredients (such as gingko biloba, L-theanine, creatine, and others) is growing, especially in the age of coronavirus where work-from-home and e-learning distractions are at an all-time high, noted Davner.

The market for functional beverages that offer enhanced focus and cognitive benefits has expanded beyond highly-caffeinated energy drinks and ready-to-drink cold brew coffees, and into emerging area of nootropics (a group of functional ingredients linked to improved cognitive performance).

While caffeine is the most-widely consumed nootropic according to Lumina Intelligence, consumers are increasingly looking for caffeine alternatives that offer longer-term brain health benefits without the energy crash that often comes with caffeine consumption.

Brands including Koios, Synapse, LIFEAID’s FOCUSAID SKU are all vying for market share with their own varied nootropic formulations.

Beyond gamers: Nootropic brands seek broader audience

Considering most of these brands have initially gone after the same type of consumer audience, (e.g. e-sports competitors, gamers, developers, college and graduate students) the market for nootropic-enhanced beverages is becoming less ‘bleeding edge’ and starting to appeal to a more general consumer base spanning multiple generations, according to Lumina Intelligence.

“Nootropics market research needs to focus on the specific needs of different target groups,” said Lumina Intelligence who identified older consumers as an untapped market opportunity for nootropics brands.

“For older generations, nootropics will become a firm part of the pursuit towards longevity and anti-aging, while for younger audiences, they may serve to help with achieving a particular goal or working through high pressure periods.”