The 79-page report - commissioned by the Cattlemen’s Beef Promotion and Research Board and written by Glynn Tonsor and Ted Schroeder at Kansas State University and Jayson Lusk at Purdue University - surveyed 3,000 US adults in September 2020.

Just over two thirds (68%) indicated they regularly consumed meat, while the rest described themselves as flexitarian, vegetarians, vegans, or none of the above.

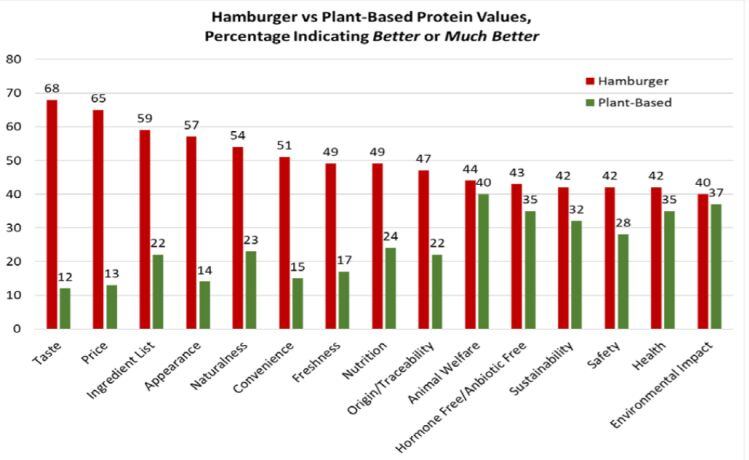

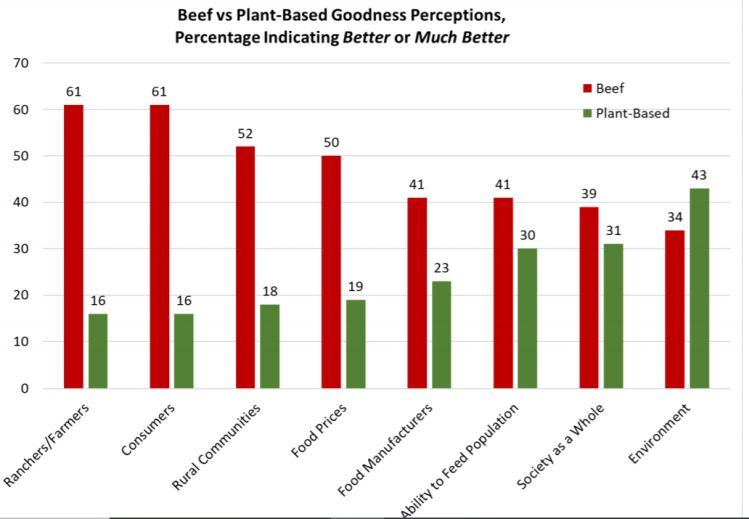

Overall, note the authors, “Beef has a good image. Consumers’ perceptions of taste, appearance, price, and naturalness of beef greatly exceed that for plant-based proteins.”

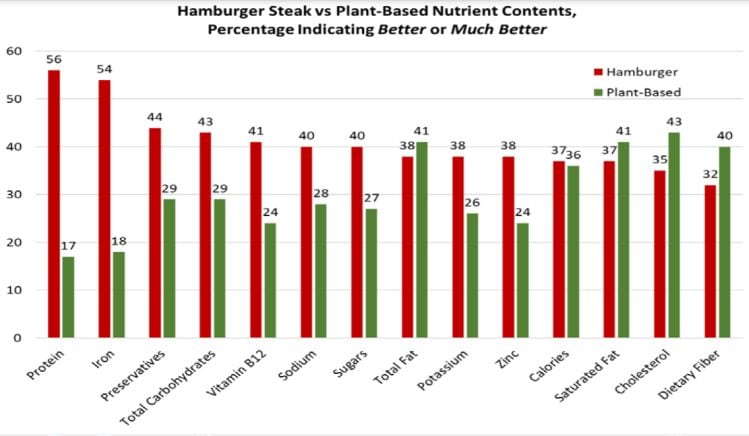

Beef burgers perceived more favorably on protein, iron, vitamin B12

While plant-based proteins score highest on animal welfare, health, and environmental concerns, “on average these are still slightly lower scores than beef for the same attributes,” say the authors.

Drilling down into nutritional attributes, beef burgers were perceived more favorably by consumers on iron and vitamin B12 (which some plant-based brands such as Impossible Foods add to their burgers). They also scored significantly higher on protein, although the survey did not drill into whether consumers were thinking about protein quantity or quality.

Meanwhile, the ‘natural’ and ‘unprocessed’ attributes of animal protein were seen as “key competitive advantages,” add the authors, observing that many survey respondents who didn’t consume plant-based protein over the previous month expressed a preference for ‘real’ meat.

‘Consumers who select plant-based proteins place greater importance on environmental and animal welfare concerns’

As for demographics, “Consumers most likely to select plant-based proteins include younger [people], those with children under the age of 12, having higher household income, residing in a Western state, and affiliating with the Democratic party,” says the report.

“Conversely, regular meat consumers are more likely to reside in the Midwest region, be married and be affiliated with the Republican party.”

Consumers who select plant-based proteins “place greater importance on environmental and animal welfare concerns when making food choices than consumers predicted to choose traditional animal proteins,” adds the report.

Beef and price elasticity

When it comes to price, the assumption from many stakeholders in the plant-based industry has been that as plant-based meat approaches price parity with conventional meat, it will aggressively gain market share and ultimately even displace animal-based products [assuming all other things are equal, which right now, they are not].

But the data does not necessarily support this hypothesis, says the report: “Changes in the price of beef have a much larger impact on consumer decisions to buy beef than the impact of changes in the price of plant-based offerings. This means plant-based burgers are relatively weak substitutes for beef.

“In food service, a 1% increase in beef burger meal price reduces overall probability of selecting beef by 2.5%; by contrast, a 1% decrease in Beyond Meat burger meal price reduces the probability of selecting beef by only 0.21%.

In a retail grocery setting, a 1% increase in store brand 80% lean ground beef prices reduces overall probability of selecting the same product by 1.73%; by contrast, a 1% decrease in Beyond Beef prices reduces the probability of choosing 80% lean ground beef by only 0.18%.”

Author Glynn Tonsor told FoodNavigator-USA: "Considering the full set of all consumers, each 1% decrease in the retail price of Impossible Burger is projected to increase Impossible selections by 3.26%, decrease Beyond Beef selections by 0.35%, decrease Laura’s Lean natural ground beef selections by 0.22%, and decline store-brand 80% lean ground beef selections by 0.14%. The order of impact being Beyond>Laura’s Lean>Store-Brand GB is consistent with our expectations.

"Furthermore, the inner-adjustments between two plant-based offerings being greater than between plant-based and beef is to be expected."

Taste and health

So what does all this mean for stakeholders trying to predict the market potential for plant-based beef?

Noting that conventional beef significantly outperformed plant-based beef on taste perception in the survey, the “extent to which plant-based alternatives significantly affect beef demand depends on the extent to which they come to be seen as tasty and healthy alternatives, and the extent to which consumers’ preferences for issues such as animal welfare and the environment shift,” argue the authors.

Despite the rapid growth in plant-based meat (US retail sales grew 45.1%YoY in the latest 52 weeks, according to Nielsen data*), the notion that animal agriculture could all but disappear in 15-20 years seems wildly optimistic, they argue.

“Virtually all the production innovation that has entered the market has focused on ground products, but of course consumers also enjoy many whole muscle cuts from T-bones to briskets – products currently uniquely sourced from cattle [although new players such as Atlast Foods and Meati Foods are making whole cuts from fungi].

“While lab-based cellular products have the potential to replicate whole muscle cut products, it will likely be many years before products will hit the market, and it remains to be seen whether the science will advance to a point that these products will truly replicate the eating experience of animal-based products.”

According to a new report from the USDA's economic research service (ERS), the increase in sales of plant-based milks over 2013 to 2017 is one-fifth the size of the decrease in Americans’ purchases of cow’s milk.

"Therefore, sales of plant-based milk alternatives are contributing to—but not a primary driver of—declining sales of cow’s milk."

Are plant-based meats displacing conventional meat or just providing incremental growth to the overall protein category?

While plant-based meat sales are growing strongly, meanwhile, sales of regular meat (a far larger, more mature market) have also grown strongly this year.* So are plant-based meats displacing conventional meat or just providing incremental growth to the overall protein category?

“It is important to note strong growth rates could occur for plant-based items yet a smaller market share resulting,” say the authors. “In fact, early in the COVID-19 pandemic this occurred as retail sales of plant-based items jumped; but so did many other protein items [Nielsen data shows that sales of conventional meat – a huge and mature market – grew 18.7% YoY in the latest 52 weeks].

“Accordingly, plant-based item retail market share declined despite growth of overall sales – an observation that conveys caution on using market-share measures.”

Tonsor told FoodNavigator-USA: "First, we conclude that currently plant-based items are weak substitutes for beef, and illustrate how changes in prices of plant-based items correspond to small reductions in beef selections. Second... we provide words of caution over heavy focus on market shares. In fact... early in the pandemic retail sales of plant-based items jumped yet plant-based retail market share declined (because other protein items increased also)."

That said, the report concludes that, “Our estimates suggest we will likely continue to witness significant growth in the plant-based alternative market even if all that changes is increased availability, and prices remain fixed at the status quo and consumer preferences and beliefs remain unchanged.”

*According to Nielsen data shared with FoodNavigator-USA this week, US retail sales of plant-based meat (frozen and fresh) rose 45.1% to $932.9m in the 52 weeks to January 16, 2021; whereas sales of conventional meat (which dwarfs plant-based meat in scale) surged 18.7% to $72.9bn.