‘Alternative’ proteins could account for 11% of global protein market by 2035, predicts report

VIDEO: Courtesy of Boston Consulting Group and Blue Horizon Corporation.

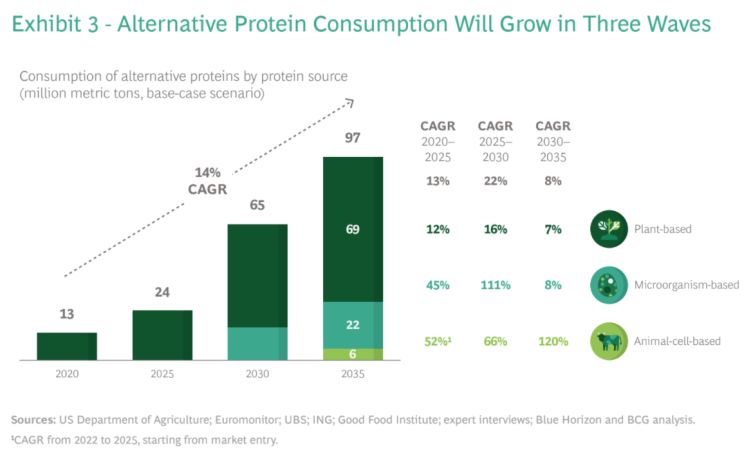

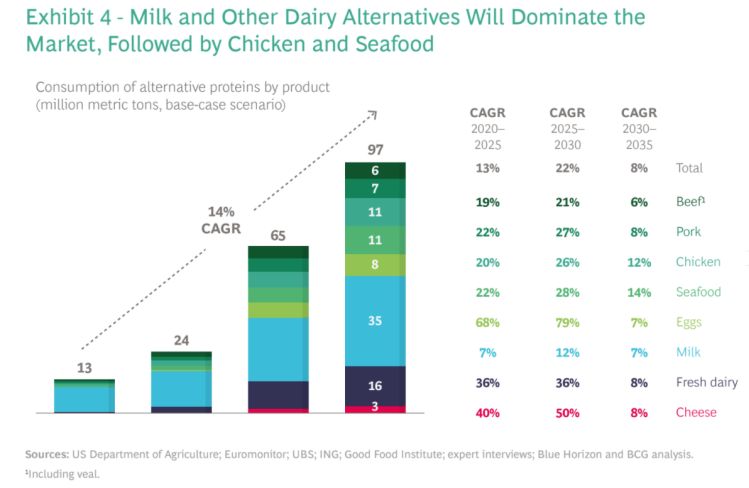

'Base case' scenario: Alt proteins (plant-based proteins, microbial, cell-cultured) get 11% share by 2035:

In the core, 'base-case' scenario, two metaphorical dominoes will need tipping over, say the authors of Food for Thought: The Protein Transformation, which has been praised by some, but dismissed by others as wishful thinking given consumers' attachment to animal proteins and the nascency of some of the technologies in question.

Domino #1 is consumer and investor interest in sustainability, which they argue is "already falling;" while domino #2 is achieving parity with animal proteins on taste, texture, and price (clearly no mean feat, but something they insist is plausible in 14 years).

This base case scenario - which would see plant-based proteins reaching price parity by 2023, proteins from microbial fermentation by 2025, and proteins from cell-culture by 2032 - still assumes a modest increase in animal production by 2035 as the overall protein market continues to grow. It also requires - among other things - $30bn in investment capital for bioreactors for microorganisms and animal cells, along with a cool $11bn in new extrusion capacity for plant-based meat.

'Upside 1' scenario: Alt proteins get 16% share by 2035:

Should we tip over domino #3 – achieving step changes in technology – then price, taste, and textural parity could come earlier, leading to a 16% market share by 2035, predict the authors.

'Upside 2' scenario: Alt proteins get 22% share by 2035:

If we tip over domino #4 – securing regulatory support to speed up a transition from animal agriculture to alternative-protein inputs, something some commentators believe will be critical if the food system is to fundamentally shift its focus – then alt proteins could reach a massive 22% share by 2035, some way off Dr Pat Brown’s prediction of the wholesale collapse of animal agriculture, but still an enormous change in an incredibly short period.

“At that rate, Europe and North America would reach ‘peak meat’ by 2025, and then the consumption of animal protein in those markets would actually begin to decline,” says the report.

Technical barriers to overcome

So what kind of technological barriers need to be overcome in order to improve the viability of alternative proteins?

Plant-based proteins: More work is needed to optimize protein crops for alt meat/eggs/dairy (higher protein content, fewer off-colors and off-flavors, etc), and find higher-value markets for side-streams from starches to fibers, say the authors. Protein extraction methods also need to be improved and scaled up.

Microbial fermentation: More work is needed to increase the efficiency with which microorganisms convert feedstock into protein through strain optimization, adjusting growing conditions, and finding carbon feedstocks that are less expensive than the glycerol and glucose commonly used today. In precision fermentation, using more efficient filtration membranes [to separate the target proteins from the growth media] requiring less maintenance and less water, for example, “can substantially reduce production costs,” they argue.

To quote former Quorn CEO Kevin Brennan: "It took us six weeks to find the right microorganism and 20 years to get the process to work reliably at scale."

Cell-cultured meat: More work is needed to achieve higher-density cell cultures, more efficient use of food-grade media, food-grade equipment in facilities, and large cost reductions in recombinant protein and growth factor production (read more HERE).

Getting high on your own supply?

To those inherently suspicious of an analysis based largely on interviews with firms with a vested interest in alt proteins, the authors point out that leading CPG brands from Nestle to Unilever; leading meat companies from Tyson to JBS; the world’s biggest foodservice brands from McDonald’s, Burger King and KFC to Pizza Hut, Starbucks and Dominos; to leading retailers such as Kroger and Tesco; have all placed pretty big bets on alternative proteins.

And while we don’t yet know if these bets will all pay off, they note, the rapid market uptake of plant-based meat, dairy and eggs just over the past 12-18 months shows that the appetite for change is there, even if significant challenges remain:

“The first domino is already falling: public concern for the climate—and, more broadly, sustainability—is rife. In addition, fully 85% of investors now incorporate environmental, social, and corporate governance (ESG) criteria into their investment strategies.

“We predict that, taken together, these concerns will generate enough consumer demand and investor interest to tip over the second domino: refinement and scaling of existing technologies to unlock parity.”

NMPF: This isn't research, it's a marketing document'

So, should we take predictions like this with a pinch of salt given the number of known unknowns (and potentially unknown unknowns) in this space, particularly in the nascent field of cell-cultured meat and dairy, which for many players in the space has not yet moved from the laboratory to the real world?

Alan Bjerga, SVP communications at the National Milk Producers Federation, told FoodNavigator-USA: “This isn’t research. It’s a marketing document."

He added: "It’s only logical that we should be wary of any ‘analysis’ that’s based largely in interviews with firms that have an interest in the scenario it outlines coming to pass, especially ones that specifically urge potential investors to buy now.

"Consumers tend to be very skeptical of highly processed, artificial foods; these types of reports often understate factors that hinder their funders’ interests and overstate those that aid them... Add it to the ever-growing pile.”

Jack Bobo: 'The more often CEOs like Pat Brown talk about making plant-based proteins cheaper than hamburgers, the harder it gets to convince people that these are quality products they should want'

Jack Bobo, who spent 13 years in the State Department working on global food policy and now runs Futurity, a consultancy at the intersection of food and technology, which has advised companies in dairy and alt protein sectors, noted that there "does not appear to be any consideration of how the new alt proteins will cannibalize the plant protein market.

"The alt dairy market provides some lessons here. Just as the growth of almond took a bite out of soy milk and oat milk is taking a bite out of almond milk, we can expect a similar infighting among alt protein producers."

As for pricing, while it's logical to assume that lower prices will increase consumption (assuming taste and texture also improve), he said, a race to the bottom could have some interesting effects on consumer psychology: "The day these products become cheaper than [conventional beef] hamburgers is the day that hamburgers become a premium product.

"The more often CEOs like [Impossible Foods CEO] Pat Brown talk about making plant-based proteins cheaper than hamburgers, the harder it gets to convince people that these are quality products they should want. Nobody wants cheap food. It would be much better to speak in terms of affordability.

"People who were happy to pay $20 for an Impossible burger at Founding Farmers raised concerns about the ultra-processed nature of the burgers when regular consumers could buy them at 18,000 restaurants."

‘It’s hard to judge how fast alternative proteins will grow. Most judgments we make now will be wrong. My hunch is that alternative proteins will grow faster than we think...’ Vipul Chawla, president, Pizza Hut International

Nick Cooney: 'The higher figures to me seem very unlikely'

So what do investors in alt proteins think?

Lever VC managing partner Nick Cooney, who co-founded the Good Food Institute and the New Crop Capital venture capital trust, has been working in the alternative protein space for over 15 years.

He told us: “To me it seems certainly possible that in major western countries a figure approaching 11% could be alternative protein by 2035. I'd guess lower, but I think 11% is possible. The higher figures to me seem very unlikely. Even to get to 11%, you need a much faster CAGR on the plant-based meat side than you have now.

“And if these numbers are global, you'd need an incredibly fast surge in Asia as a whole, whereas I think it will take longer to develop. (Strong CAGR there, but starting from a very low base and with low penetration in most countries today, other than China).”

Tom Mastrobuoni: 'The alternative protein ecosystem needs to include the corporates truly getting behind the innovators'

Tom Mastrobuoni, chief investment officer at Big Idea Ventures, which is immersed in the alt protein space, added: "Predicting the future size of the alternative protein market is impossible. I get asked this question all the time and my answer is, ‘I don't know.’ No one does.

“But here's what I do know. Consumers are driving demand at an expanding CAGR and companies of all stages and sizes are responding. FMCGs are developing products and messaging to satisfy consumers making purchasing decisions based on a mix of personal health, animal welfare or sustainability motivations.

“The global protein market is worth trillions of dollars and whether alternative proteins command an 11% share or a 22% share, to me is not the point. It takes an ecosystem to drive an industry and the alternative protein ecosystem needs to include the corporates truly getting behind the innovators and the governments that have a multi-year plan to engage with the same innovators to establish a food system that will scale with the challenges ahead.

"Big Idea Ventures is committed to being a part of that ecosystem, working with the leaders to build a food system that is robust, scalable and truly sustainable.”

Dan Altschuler Malek: 'Alternative proteins are poised to play a significant part in how the world feeds itself'

Dan Altschuler Malek, managing partner at Unovis Partners’ New Crop Capital venture fund – which has invested in companies in plant-based, cell-cultured or ‘cultivated’ meat, and proteins produced via microbial fermentation – added that the report "confirms our long-held views that alternative proteins are poised to play a significant part in how the world feeds itself.

"Our expectations are for the market share of alternative meats, seafood, and dairy to reach parity with plant-based milk within the next 10 years and continue expanding.

"This expected growth comes on the supply side from technical innovation and the increased attention of the ecosystem's stakeholders (investors, food manufacturers, farmers, and governments) driven by exponential consumer demand led by increased interest in health, global environmental challenges, sustainability, and animal welfare."

![Quorn USA president: ‘We want to be the kings of [meat-free] chicken’](/var/wrbm_gb_food_pharma/storage/images/_aliases/wrbm_medium/publications/food-beverage-nutrition/foodnavigator-usa.com/article/2021/09/09/quorn-usa-president-we-want-to-be-the-kings-of-meat-free-chicken/12805899-1-eng-GB/Quorn-USA-president-We-want-to-be-the-kings-of-meat-free-chicken.jpg)