Cox Enterprises has invested more than $1bn in sustainable businesses and technologies including taking a majority stake in BrightFarms in 2018 as part of its growing 'cleantech' investment portfolio.

Steve Bradley, vice president of cleantech for Cox, said the indoor farming segment has been an area of focus for its team for several years as the market exploded with investment and steadily growing consumer adoption.

"We were right about all these macro tailwinds, the only thing we missed is how fast the acceleration was going to happen," Bradley told FoodNavigator-USA.

According to a report from S2G Ventures, there has been approximately $1.8bn publicly invested into controlled environment agriculture companies in North America and Europe between 2013 - 2020. Last October, BrightFarms raised $100m in Series E funding to fuel its business.

'I can very clearly see us being able to build a $1bn+ revenue business in this space'

With the support from Cox, BrightFarms is poised to become even more of a leader in the hydroponic indoor farming segment, according to Bradley.

"It’s time to go now, it’s time to put the full weight of Cox behind this and go accelerate growth and meet our customers' and consumers' needs," said Bradley.

"I can very clearly see us being able to build a $1bn+ revenue business in this space. It’s not that hard to imagine us getting to that level and still meet a small percentage of the demand out there," he added.

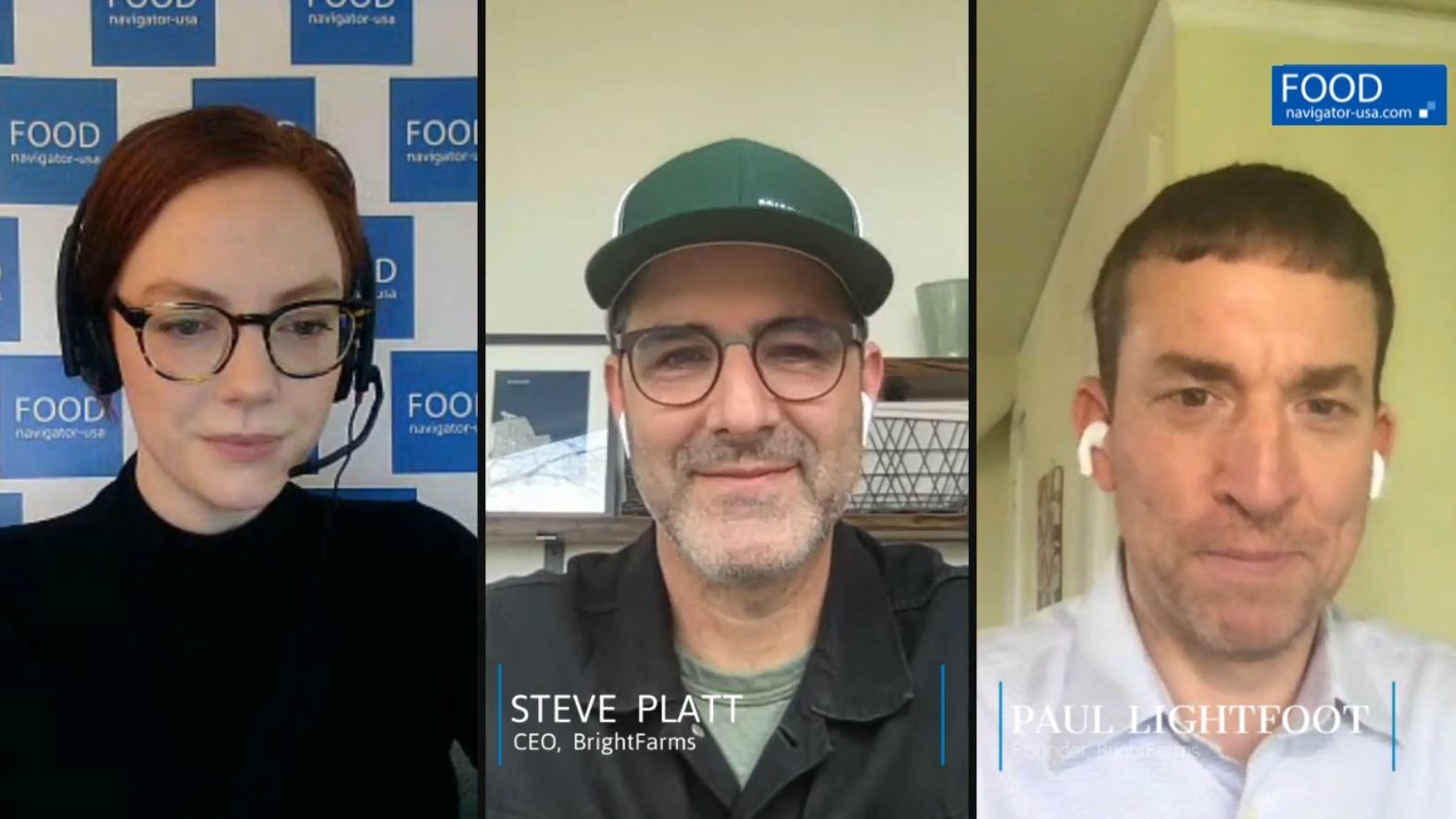

"With Cox behind us, we don’t need to go out and do fundraising anymore, we have a company that’s been around for 100 years who shares our values and our vision for the future... Things will move a lot faster," BrightFarms CEO Steve Platt told FoodNavigator-USA.

With the direct access to capital under the Cox umbrella, BrightFarms plans to construct a national network of new high-tech farms that will accelerate the salad industry’s transition to indoor farming.

The company will also increase investment in talent and research and innovation as it expands its product portfolio within the salad category and other segments, said BrightFarms.

BrightFarms' hydroponic indoor farms yield 10 times more leafy greens per acre than growing in a field, and use 80% less water, 90% less land, and 95% less shipping fuel than long-distance field grown produce, according to the company.

'...in 10 years, 50% of leafy greens will be grown indoors'

Over the course of the next four to five years, BrightFarms' goal is to reach two-thirds of US consumers through its growing network of indoor farms.

BrightFarms currently operates five farms in Virginia, Ohio, Pennsylvania, North Carolina, and Illinois. Last month, BrightFarms acquired New Hampshire-based lēf Farms -- and its sixth indoor growing facility -- expanding its presence in the New England market.

The company plans to expand lēf’s facility into a 14-acre indoor growing hub for New England supermarkets.

With the access to additional capital through Cox, Platt added that BrightFarms' goal is to build five 30-acre farms in the next four to five years.

"We want to grow leafy greens that are accessible to as many people as possible," said Platt, adding that a single product of BrightFarms lettuce is comparable in price to organic lettuce grown in California, but that its products offer key advantages (i.e. being more fresh as the lettuce can reach store shelves within 24 hours of harvest rather than travel thousands of miles cross-country to reach a consumer's local supermarket).

Speaking about how long it might take for leafy greens grown in indoor farms to reach a majority market share, Platt said, "I don’t see any reason why in 10 years, 50% of leafy greens won't be grown indoors."

Platt told FoodNavigator-USA that he sees indoor-grown leafy greens following a similar market path as tomatoes. In the 90s, less than 10% of the tomato supply was grown indoors, according to Platt.

"Now 75% of tomatoes are grown indoors (mostly in massive indoor greenhouses located in Canada and Mexico," Platt noted.

"We think that salad greens will be different in that we can build the infrastructure in a local way."