US net sales increased 6.8% at constant exchange rates to Euro 11.5bn ($13.3bn), while comparable sales excluding gas grew 2.9%, driven by continued at-home food consumption, said the company.

"Many consumer habits formed during the COVID-19 pandemic favoring food-at-home consumption and a focus on healthier eating are proving resilient, and we continue to make significant investments to address these trends," commented Frans Muller, president and CEO of Ahold Delhaize.

"The pandemic has shown us the importance of maintaining food and product supplies to local communities – a vital role that we remain focused on fulfilling, together with our brands and suppliers."

Omnichannel prioritization

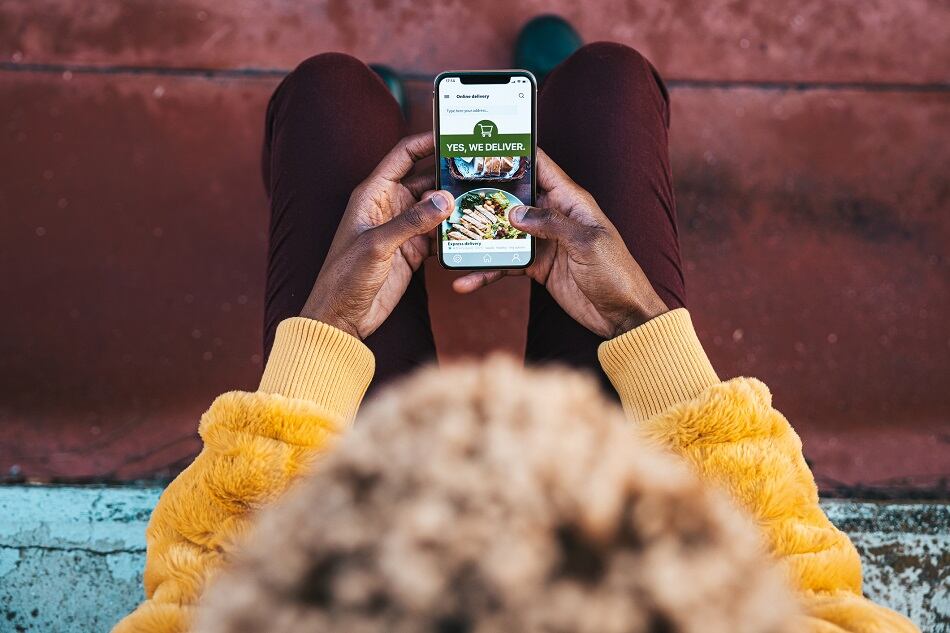

Muller added that the retailer is continuing to invest in its omnichannel capabilities to address evolving consumer needs and shopping habits.

"We continue to solidify our position as an industry-leading local omnichannel retailer by executing our strategy to improve supply chain, advance omnichannel offerings, and enhance omnichannel productivity," he said.

"To improve the efficiency of our supply chain, the US business has now achieved self-distribution for 65% of center store volume, and remains on schedule to transition to a fully self-distributed network in 2023."

Ahold Delhaize noted that its group online sales spiked 29.2% for the most recent quarter, on top of already robust growth from the year prior.

In the US, the company's online sales segment registered 52.9% year-over-year sales growth on top of 114.7% growth in the year prior, driven by expansion of click-and-collect facilities and its acquisition of Northeast online FreshDirect late last year.

Muller shared that Giant Food will soon launch its own online marketplace solution called Ship2me, which will initially offer an additional ~40,000 general merchandise and food items to customers.

"Improving omnichannel productivity remains a high priority, and we are proud of our new e-commerce fulfillment facility in the Philadelphia market at The GIANT Company, which opened this week. The facility is part of our efforts to drive growth and efficiencies in our online operations," said Muller.

Sustainability progress

Ahold Delhaize has also made progress in its sustainability goals, achieving the second highest MSCI ESG rating -- a ranking system designed to measure a company's resilience to long-term, industry material environmental, social, and governance (ESG) risks -- putting the global retailer in the top 25% of all companies measured.

"The ranking reflects our efforts to reduce carbon emissions, mitigate risks, and ensure we have great diverse talent, said Muller.

"Furthermore, we have joined the Science Based Targets initiative (SBTi) Business Ambition for 1.5°C, a global coalition of UN agencies, business and industry leaders, in partnership with the Race to Zero."

Outlook

Looking ahead to the final quarter of 2021, the company has raised guidance for several other areas of its business including operating margins (raised to 4.4% vs. 4.3%), free cash flow (US$1.97bn vs. US$1.85bn), and underlying EPS (earnings per share) guidance which has been raised and is now expected to grow in low- to mid-20s range vs. high-teen growth previously.

"The outlook continues to reflect the effects of over €750m (US$864m) in cost savings largely offsetting cost pressures related to COVID-19, and the negative impact from increased online sales penetration," said the company.

Additionally, capital expenditure is expected to be around US$2.5bn for the full 2021 calendar year, and reflects the company's increased investments in digital and omnichannel capabilities and improvements.