Price rises in key grocery categories 'far exceeding' general inflation rate: NielsenIQ

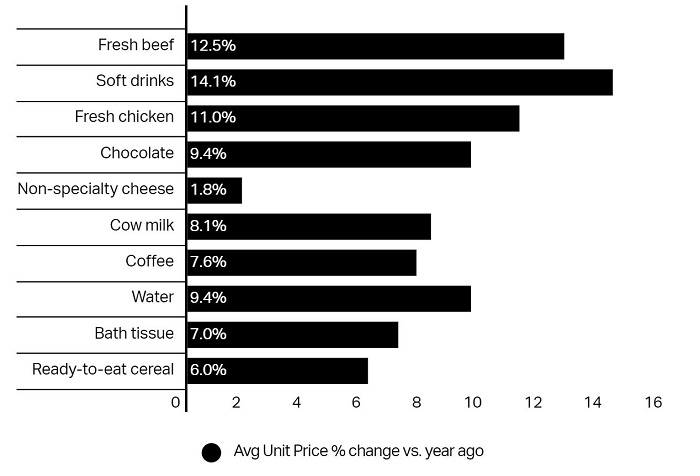

Shoppers are feeling the pressure of inflation on the cost of goods during their grocery trips, noted NielsenIQ, which analyzed pricing trends for the top 10 selling grocery categories.

According to the Bureau of Labor Statistics, the Consumer Price Index (which measures the cost consumers pay for products) was up 0.7% for the month of May 2022 vs April 2022, and up 7.4% vs May 2021, the largest increase since the period ending November 1981.

"At the grocery store, the prices of many staple categories are far exceeding these inflationary measures," said NielsenIQ

The impact is especially acute on frequently purchased items such as fresh beef and fresh chicken which were up 12.5% to $6.77 per unit and 11.0% to $2.98 in average unit price over the last 12 months, respectively, vs. one year ago, reported NielsenIQ.

Fresh pork prices are following a similar trajectory as beef and chicken, up 12.1% to an average unit price of $3.33.

"Meat manufacturers like Tyson Foods attribute soaring costs to a combination of stronger consumer demand, increased fuel and labor costs, and the rising cost of feed for farmed animals," stated NielsenIQ in its analysis.

However, as the overall cost of goods climbs, unit sales of the top-selling grocery categories have posted declines between 2% and 7% (except for chocolate and bath tissue which saw a slight increase in unit sales), reported NielsenIQ.

Meanwhile, in the dairy aisle, average prices per unit of cow's milk are up 8.1% to $3.11 vs. one year ago.

"The price of eggs climbed nearly 20% during the same period thanks in part to the bird flu ravaging the poultry industry," said NielsenIQ.

In beverages, soft drinks posted the highest increased in average unit price of 14.1% to $3.22 while the price of water climbed 9.4% to $2.88. Average unit prices for coffee were also up 7.6% to $8.62 per unit over the last 12 months.

NielsenIQ commented that the rise in prices is leading to some trade down behavior in certain categories and a greater consumer migration towards retailers' private label offerings (41% of consumers are buying more private label products and 77% plan to purchase more private label items in the future, according to FMI).

"Overall, a grocery basket containing these staple items alone could cost consumers nearly $4 more than this time last year. Without relief in sight, we can expect shifts in consumers behavior, from tradeoffs, to increased spend on groceries as consumers decrease their out-of-home spending," noted NielsenIQ.