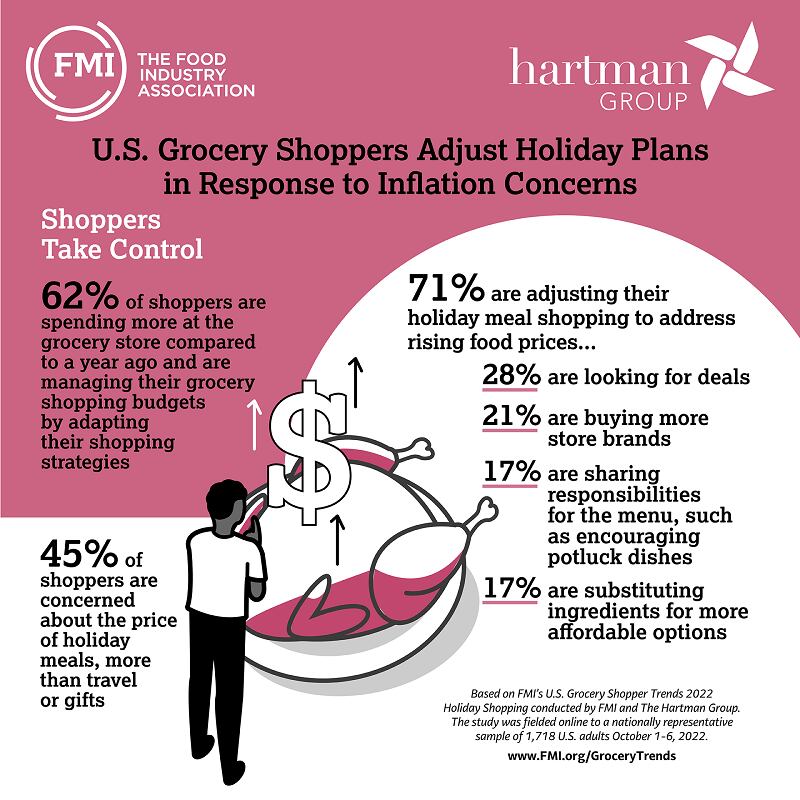

In the sixth and final installment of FMI’s US Grocery Shopping Trends 2022 research series published Oct. 20, the trade association in partnership with the Hartman Group found consumer concerns about inflation are “exacerbating typical holiday stress” and spurring some adjustments to both everyday and holiday meal shopping.

More than two-thirds (70%) of the 1,718 US adults surveyed from Oct. 1 to Oct. 6 reported being very or extremely concerned about rising food prices, which continue to hover at 40-year highs even as inflation in other categories eases.

“As inflationary pressures have evolved, a greater number of shoppers [65% versus 60% in August] are reporting that they are spending more on groceries because prices have gone up on all items,” but most noticeably within fresh meat and seafood (as cited by 56% of respondents), fresh produce (53%), refrigerated dairy foods (51%) and non-dairy milk (50%), according to FMI.

To maintain their level of food purchases despite rising prices, FMI found 57% of respondents are eating out less, 55% are buying new clothes less often, 47% are cutting back on gifts for family, 45% are driving less and 45% are pulling back on holiday celebrations.

Subtle shifts in grocery purchases to keep costs down

Shoppers are also adjusting what goes into their grocery carts with 41% buying fewer items, up 4 percentage points from August – an increase that could portend additional pullback in the coming months as consumers make space in their budget for seasonal spending and traveling.

In addition, more consumers are opting for frozen meat and seafood (a 3 percentage point increase from August to 14%), more store brands (a 3 percentage point increase from August to 44%) or generally switching brands they buy (up 5 percentage points from August to 30% of respondents), according to FMI.

To further manage their grocery bills, 28% of consumers report using store loyalty programs – a 6 percentage point increase from August – and 11% report changing where they buy food. The main benefits they seek from these programs are overall deals (noted by 59% of respondents), personalized coupons (41% of respondents) and gas discounts (40% of shoppers).

In-store vs online

As fears of contracting COVID-19 ease, more consumers (18%) also are returning to in-store shopping to manage their budgets with 58% saying they can more easily make adjustments at shelf and 52% noting savings on shipping and delivery fees as primary benefits of in-store shopping, according to FMI.

The research also notes budget benefits of shopping online, with 51% of consumer saying they can more easily monitor their basket size and save on gas by shopping online and 41% called out ease of using coupons with ecommerce. Still, only 9% of shoppers are leveraging ecommerce to save money, a 4 percentage point drop from August, according to FMI.

A more subdued holiday season?

Finance concerns also could dampen enthusiasm for the holidays with FMI finding 45% of shoppers worried about rising prices for holiday meals and celebrations.

To manage holiday cost concerns, FMI found consumers will leverage many of the same strategies they are employing to manage their day-to-day grocery budget, including looking for deals and sales (28%), buying more store brands (21%), preparing more dishes at home (20%), substitute more affordable options (17%), make fewer dishes (17%) and make smaller portions (13%).

For a deeper dive into how rising prices will influence consumers’ approach to the different holidays this season, check out the full report and other installments in the series from FMI HERE.