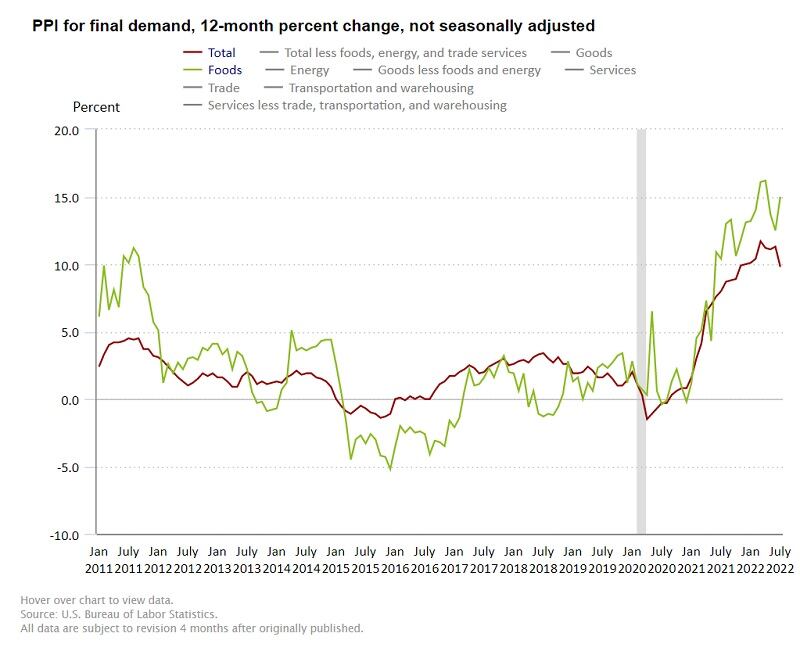

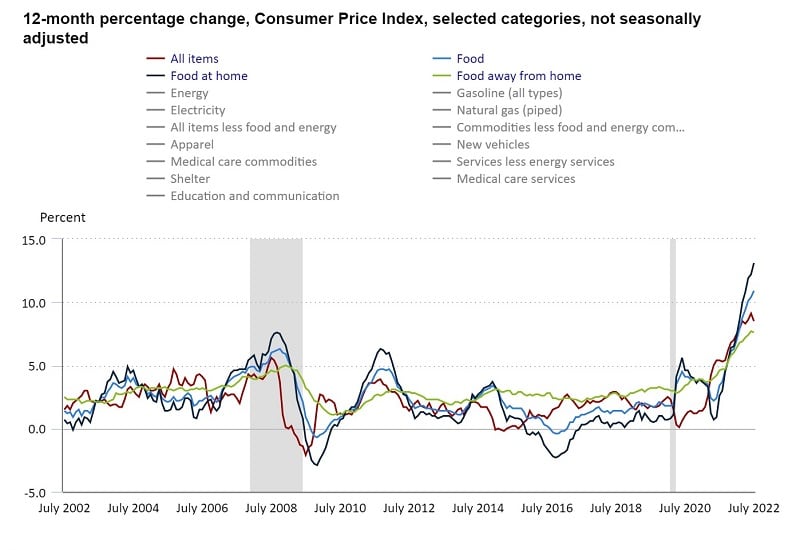

During economic uncertainty like the US is experiencing now, food prices tend to shoot up like rockets, but come down like feathers, Andy Harig, vice president of tax, trade, sustainability and policy development at FMI The Food Industry Association, said during a briefing hosted by the organization last week during which pointed to the most recent Consumer Price Index report for July as an example. Last week, the Labor Department revealed food prices skyrocketed 10.9% year-over-year in July, even as other categories, such as gas, appear to have turned a corner and are falling month-over-month.

He explained that food prices “take time recalibrate” in part because the recent increase in grocery prices is not something that happened overnight or that is entirely pandemic related – rather it is the cumulative effect of significant structural issues that have challenged the food retailer industry since the beginning of the century.

These include volatile fuel and energy costs, labor limitations, transportation challenges and inefficiencies and packaging sourcing constraints, as well as some less obvious factors including climate change and tight margins that make it difficult for retailers and manufacturers to pivot without guaranteed positive results, said Harig and Ricky Volpe, a professor at Cal Poly in San Luis Obispo, Calif., who joined Harig during FMI’s briefing to peer into food inflation’s “black box.”

Lowering prices is expensive

Among these factors the likely least well-known and most difficult to explain to consumers is retailers’ and manufacturers’ hesitancy to rollback prices as costs come down because the process of doing so is expensive and can eat into already thin margins.

Even as food prices have increased dramatically, profit margins for retailers have hovered around 2% thanks in part to additional costs associated with the pandemic and the same inflationary factors that are driving up food prices, Harig said.

He noted that early in the pandemic retailer margins increased slightly to about 3% when consumers were dedicating a disproportionately higher share of their spend to food consumed at home and many were opting for higher value items as they looked to recreate or replace the experience and convenience of eating out with premade options, for example.

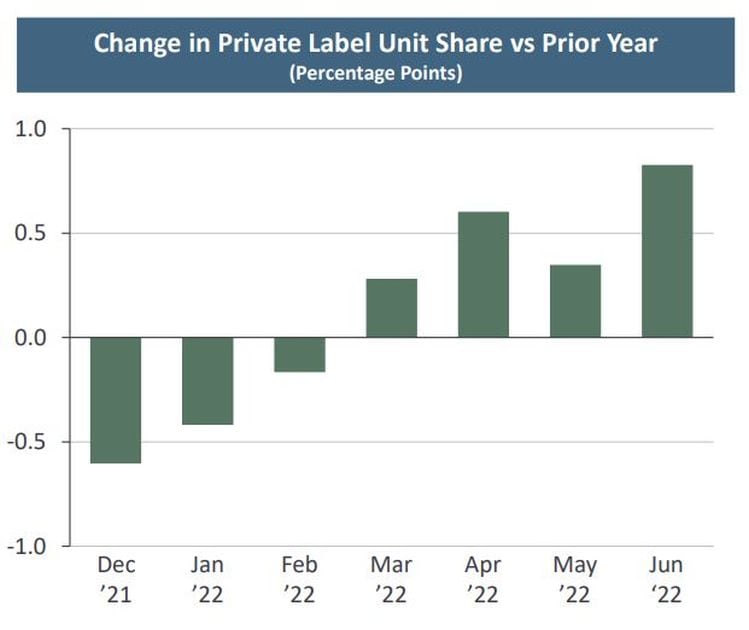

But as food prices have continued to rise, consumers grocery spend has gone down to about $136 per week in August from about $148 per week in February – likely due to consumers redirecting part of their grocery budget to cover higher costs in other categories, such as gas, which are equally nondiscretionary as food.

This pullback is tightening profits so that retailers have less wiggle room and less of an appetite for incurring costs associated with adjusting food prices to reflect incremental and unreliable dips in input costs, argued Volpe.

“Retailers and manufacturers – but especially retailers – are typically reticent to change their prices in either direction, and the main reason for that is due to a phenomenon that we call menu costs, which is an idea born from the restaurant industry … and it is literally the cost of changing prices,” Volpe explained.

“Changing prices for a retailer that carries 35,000 or 45,000 products is expensive and it is a complex undertaking. There’s literally the cost of printing new tags, the cost of the new promotion, the cost of replacing the tags, the cost of making sure that in today’s day and age that all the price information syncs up between what is in store, what’s in the circulars, what’s online – all of those costs can be pretty considerable,” he said.

“So, the calculus is, do we undertake this cost to lower our prices a little bit … knowing that we will then need to incur that cost all over again in a relatively short period of time to adjust to rising pressures? It is a difficult proposition, but helps to explain why we see prices rise higher than they fall, and it is why food prices in the US, especially retail foo prices, are notoriously sticky,” he added.

Bracing for a recession

Retailers and manufacturers likely are further hesitant to lower prices because it is unclear if the US economy will dip into a recession, and if it does how consumers will adjust their spending.

“If we enter into a recession and consumer confidence goes down, people are probably going to move back away from restaurants and food service, which is going to bolster demand for food, retail and grocery,” Volpe said.

But, he added, demand for many of the higher value products on which retailers made higher margins during the pandemic – such as ready-to-eat and -heat options – may also fall during a recession.

Finally, he warned, “a recession is not guarantee that consumer demand for groceries will pull back and therefore ease inflationary pressures. It may, but every recession is a little different.”