At the same time, lower income shoppers increasingly are trading down to less expensive items and private label to help stretch their grocery budgets, according to Walmart executives who reported better than expected earnings during the retailers second quarter thanks in part to these two shifts.

After alarming the investment community last month when it updated its financial guidance out of cycle to reflect a more conservative outlook for the fiscal year, Walmart beat Wall Street expectations during its second quarter with total revenue climbing 8.4% to $152.9b and net sales up 8.2% to $151.4b.

This boost was fueled in part by more consumers, including those with higher incomes than the retailer’s typical shopper, flocking to Walmart for more affordable groceries – driving up same store sales in the US 6.5%.

Walmart reported sales growth in the mid-teens in the US was led increased food sales in the high-teens on a two-year stack. However, food units dipped slightly before evening out in the quarter, suggesting the increase comes from price and that consumers may not be buying as many products as before in order to keep their overall bill in check.

“Our sales were well ahead of plan, with inflation lifting our average transaction size, but we know that the amount and persistence of inflation is negatively affecting many families,” CEO Doug McMillon told investors yesterday during the company’s second quarter earnings call.

While he is troubled by their struggles, he added, “we are pleased to see more families from a variety of income levels choose us as they look for value,” including more mid- to higher income consumers who are coming to Walmart for lower food prices.

The retailer did not provide specifics about its overall market share gains but noted that three-quarters of the gains came from shoppers who making more than $100,000 annually.

Consumers are trading down

The retailer is also tracking “more pronounced consumer shifts and trade-down activity,” as the year progresses, including customers opting for hotdogs and canned tuna and chicken instead of higher priced deli meats, said Walmart CFO John David Rainey.

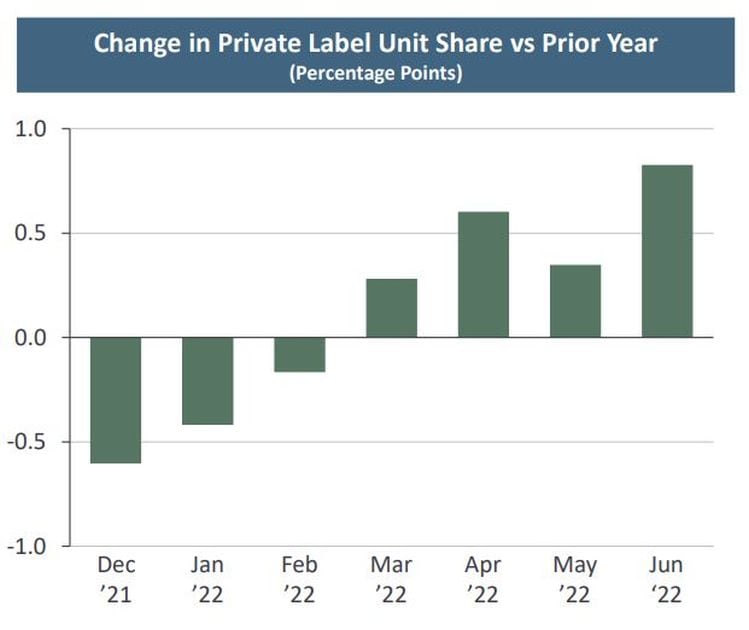

“Private brand penetration has also inflected higher, and in food categories specifically, the private brand growth rate has doubled compared to Q1 levels,” he said.

Recognizing shoppers’ needs, Rainey said, Walmart has intentionally decided to keep prices for some essential prices, including food, as low as possible. So, while it has had to pass some price along to consumers, “what we try to do throughout this entire period is go up as late as possible.”

The retailer also is working to keep down opening price points, offer diverse pack sizes and a broad selection of private label options for consumers who are most price sensitive, said McMillon.

While this strategy has helped Walmart preserve its price gaps and by extension gain market share in grocery, it has also placed additional pressure on the retailer’s margins. Looking forward for the full year, the retailer expects its adjusted operating income to decline 9-11%. Even though this is not idea, it is better than previous expectations of a drop of 11-13%.

The shift in who shops at Walmart and increased demand for less expensive private label and emerging brands comes as food prices in the US continue to climb – reaching a staggering 10.9% year-over-year increase in July and 1.1% increase from June, according to the most recent data from the Bureau of Labor Statistics.

Even though other categories are starting to see inflation slow, food will likely continue to remain high – reflecting increases in key commodities but also a reticence by retailers and manufacturers to incrementally reduce prices until they are assured the overhead of doing so will be covered.