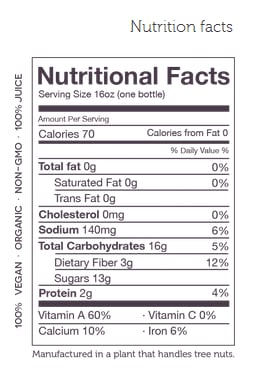

Seattle, Washington-based Vital Juice sources local fruits, vegetables and nuts for regional recipes, also produced locally, and Balassanian tells BeverageDaily.com recipes may differ between, say, Florida and Seattle. The brand's Vital Greens juice and its nutrition facts label are pictured below.

Vital Juice is committed to being non-GMO, using only whole fruit and vegetables and cold pressed (HPP), and he says the brand’s regional model is centered on micro-juiceries in dense metro regions, “so we can bring organic vegetable juice to the store shelf within hours of production – products sourced and distributed locally”.

“So you’re not getting a frozen juice that sat in a warehouse for two weeks, before it thawed out and was stuck on a store shelf,” he adds, noting that, historically, ‘craft’ beverage brands have not been scalable.

“But we feel that with the production techniques we have and the recipes, blending techniques, we can have lots of local SKUs but also scale national scale – really be a local brand at national level,” he says.

Affirming his commitment to plant-based nutrition – Balassanian tells me he thinks animal-based food is unsustainable in the long term and a “massive resource suck” – Vital’s CEO says the premium and functional juice category is growing four times faster than the overall beverage space.

Coke, Pepsi losing youth consumption hold?

It offers real opportunities despite growing from a low base, he adds, since the mainstream consumer is not only aware of their nutritional needs, but is also demanding products that meet them, while the hegemony of Coke and Pepsi is not what it once was as young people choose from a much wider selection of drinks.

“This is very different from when you and I grew up, when Coke and Pepsi were part of the morning, afternoon and evening,” Balassanian says.

Traditionally, he explains, the industrial food production model has been premised on ever-larger facilities, but this brings problems in regard to freshness and preservation.

“Fresh organic produce doesn’t last, but we get our produce delivered in the morning and by the afternoon it’s ready to send out to stores. We put stickers on top of the bottles saying when we made the juice – we want to own this freshness mandate with the consumer,” Balassanian says.

He insists that nutrition, taste and convenience need not be mutually exclusive, and says that Vital Juice used to be a ‘raw juice’ brand before starting to use high pressure processing (HPP).

“Inevitably firms selling raw juice will get somebody sick. We’ve seen that movie before, and we want consumers to have absolute confidence when they grab our product,” Balassanian says, explaining the shift.

To avoid alienating mainstream consumers who want nutrition – he is targeting, kids, youth, moms and dads with a surprising number of SKUs, 18, given the company’s youth – Balassanian insists that Vital Juice is not positioned as a ‘cleanse product’ or a line for ultra-vegans or vegetarians.

A game of chicken in HPP juice...

Prices of $8.99 for a 16oz bottle, $5.99 for a recently released 10oz bottle places the brand at the premium end of the market, but he claims there is a “game of chicken” going on in HPP juice (with brands fearful of losing their ultra-premium consumers) and insists prices for HPP juice will fall within 12-18 months.

“When that happens, we’ll see who’s created a brand that appeals to everybody. $5 and below is a magic price point, it’s still an unconscious purchase by the consumer, something you can buy with your lunch,” he says.

After six months on the market, Balassanian claims that Vital Juice is now the top-selling brand in the Pacific Northwest, going from two slots initially at Whole Foods Market to 20, for instance – success Balassanian attributes to a “tonne of in-store events” that ensure Vital’s immediacy to shoppers and staff alike.

“It’s not just about educating people who are looking for a premium, functional juice. It’s about explaining to people about to grab an Odwalla or a Naked, why that $3 is a waste of money, and you’re better off spending $5 on one of our drinks and getting way more nutrition out of it,” he says.

Vital Juice’s CEO insists the brand has won shelf space at the expense of BluePrint and Suja in the Pacific Northwest, but says he wants to push the brand nationwide this year by opening up the east and west coasts.

“We’d love to get into a bigger market, like San Francisco, LA or New York. By the end of this year, I think you’ll see us competing directly with Suja and BluePrint. We see them as our competition, not the smaller brands you see popping up now,” Balassanian says.

BluePrint has 'lost its way a bit'

That said, he believes that Hain Celestial-owned BluePrint has “lost its way a bit”, although he acknowledges that its marketing dollar is helping to build the ultra-premium, HPP juice category.

“If you look their labels, water is now a very prominent ingredient in a lot of their juices, and is creeping up the ingredients list – we don’t use water in any of our juices,” he says.

“Bigger companies try to squeeze margin, and this is not a margin play right now, but a brand-building exercise, and we feel our brand is sacrosanct,” Balassanian adds.

“We love selling against Blue print and Suja. They’re out there evangelizing nutrition, but we actually walk the walk. There’s only one brand on the shelf focused on nutrition first, that isn’t using fillers, isn’t using processed ingredients like agave or vanilla extracts," he says.

Turning to NPD, Balassanian says a Vital Kids line (the orange carrot beer and almond milk variety is pictured) is designed to ease child acceptance of vegetables by using almond milk, for instance, to take the edge off drinks, and provide “good protein, good fats and lots of superfruits, while using a cucumber base rather than apple juice, to cut sugar”.