Speaking to FoodNavigator-USA at FOOD VISION USA in Chicago, director of cellular agriculture Eitan Fischer said growing interest in clean meat (made by culturing cells without raising or slaughtering animals) and plant-based meat, egg and dairy alternatives stems from a desire to find kinder and more sustainable alternatives to industrial animal farming.

But is this a bold move into a logical adjacency for a company looking to disrupt the food system and take on industrialized animal food production, or an expensive distraction for a business that has been dogged by reports of boardroom power struggles and disputes over the strategic direction of the business?

It's entirely logical for a plant-based food company to go into cultured meat, said Fischer, who joined Hampton Creek in 2016: “I think animal agriculture… is a relatively inefficient way to create the foods that we want.

“So if we have more efficient means, whether it’s plants converting sunlight directly into the food we eat, or whether through cellular agriculture bypassing all the waste products and the inefficiencies of the meat industry, I see this ultimately as a more efficient way that will replace the less efficient ways of doing things.”

While clean meat requires a highly-specialized new skillset, Hampton Creek is not going into this entirely cold, and has capabilities that standalone clean meat companies do not have, he added.

“Hampton Creek is a slightly larger company than some of these [other clean-meat] start-ups. We have 60 R&D members that have worked for over five years in bringing products from research to the market, and that expertise is definitely coming into play… “

While only a fraction of those R&D employees have expertise in the embryonic clean-meat field, he acknowledged, “We have process engineering, culinary development, biochemists, food scientists and many of those disciplines are very applicable to the development of clean meat… And we did bring in additional expertise in the fields of stem cell biology, bio-process engineering, and tissue engineering …"

“From a meat scientist’s perspective, this is a dream. You have so much control over this process, the ability to define your product precisely... and you don't have to valorize all these lower grade side-streams... I am talking to people from the meat industry almost every day and they want a foot in this door..."

Dr Liz Specht, senior scientist, Good Food Institute

In August, Hampton Creek CEO Josh Tetrick told FoodNavigator-USA that he had identified a partner to work with on the initial clean meat launch, and had “bought in” some IP, although he could not share any more details: “We completed an acquisition to own foundational global IP around clean meat, and are developing additional IP around the media, cell line development and scaling up.

"We have a handful of cell lines fairly close to the point where we could put them in a commercial facility and create products at a cost within 30% of a more premium product in the avian family,” he added, but stressed that the first move into the market would be small scale:

“There won’t be clean blue fin tuna in every Walmart next year.”

The business model: ‘First we do it ourselves…’

Asked about the business model, Fischer said: “Our business strategy is that first we do it ourselves, likely a ‘just’ branded clean meat product sold by Hampton Creek [other products in the ‘Just…’ plant-based portfolio include vegan mayo, liquid egg alternatives that 'scramble,' cookie dough, cookies, and dressings].

"After we do that ourselves, or concurrently, we partner with some of the largest players in the industry… if we are going to revolutionize the meat industry there is no way to do that unless we partner with the world’s largest actors in this space…

“The meat processors have expertise in the large scale manufacturing, distribution and marketing of meat products, and it has been surprising the extent to which they have been open to this technology.”

The route the market

Foodservice and retail both present opportunities for Hampton Creek’s first wave of clean meat products, which will likely be “in the poultry segment,” said Fischer: “We have a partnership with the world’s largest foodservice provider Compass, but we also have strong retail partnerships with Walmart, Safeway and Whole foods, all of which would be very interesting places to launch.”

The hurdles

That said, significant hurdles remain, conceded Fischer, notably developing a cost-effective plant-based alternative to fetal bovine serum as a growth medium for cell cultured meat: “There is still a lot more work for us to do to bring the cost of the media down to where we need it to be in order to make a cost competitive product with commodity meat today.”

He also acknowledged that “3D vascularized tissue [eg. beef steak or chicken breast] is a more difficult technical challenge than the ground meats [burgers, nuggets etc], but certainly we’re working on both…”

Asked whether Hampton Creek is using genetic engineering to ‘immortalize’ cell lines that can proliferate indefinitely and differentiate into multiple cell types (muscle, fat, connective tissue), he said:

“There are a number of different approaches in the clean meat space… and not every clean meat embodiment will require immortalized cell lines … … we are trying any number of approaches ... whatever will get us to a cost competitive scalable process.”

The best known names in the clean meat space are mosameat in the Netherlands, Future Meat Technologies and SuperMeat in Israel, Memphis Meats, Finless Foods and Hampton Creek in the US and Integriculture in Japan. (New Jersey-based Modern Meadow has pivoted from food to other applications such as animal-free leather.)

Speaking at FOOD VISION USA, however, Good Food Institute senior scientist Dr Liz Specht said there has been a flurry of new players entering the space over the past couple of years, some of which are in “stealth mode, and not publicly disclosed yet,” while others “are so new they don’t even have logos yet.”

WHAT ARE THE BENEFITS OF CLEAN MEAT?

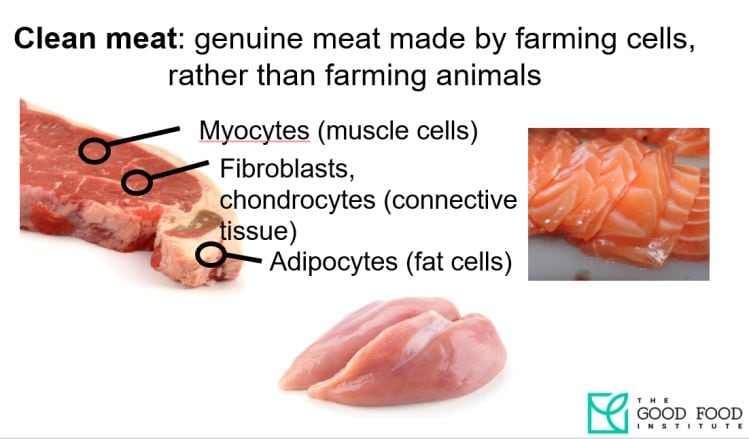

According to the Good Food Institute (GFI), cell cultured ('clean') meat offers several advantages over traditional meat in that it does not contain bacterial pathogens that pose food safety risks; it has a longer shelf life; it would not suffer from price/supply volatility risks from animal infectious diseases (avian flu, porcine epidemic diarrheal virus); requires fewer inputs for a given quantity of meat, and is "more controllable and tunable," enabling production of only high-grade meats in quantities dictated by consumer demand, rather than by the biology of the animal.

Speaking at FOOD VISION USA, senior scientist Dr Liz Specht said life cycle analyses indicated that clean meat would require >90% less water and land than conventional meat, and would reduce greenhouse gas emissions significantly, including eliminating methane emissions.

Moreover, clean meat “does not contribute to the development of antibiotic-resistant bacteria or zoonotic disease outbreaks that emerge from intensive animal agriculture operations,” she added.

Finally, “clean meat does not present the animal welfare concerns of conventional meat, which are increasingly important to consumers,” she said.

WILL CONSUMERS BUY IT?

However, several food marketers at FOOD VISION USA predicted that selling cultured meat to consumers - despite its animal welfare and sustainability credentials - could prove challenging, given the strong trend towards more ‘natural,’ minimally processed foods using traditional processing techniques.

THE PATH TO COMMERCIALIZATION

In a mapping document penned by the GFI, the authors predicted that clean meat would likely come to market in phases, with the first products perhaps hybrids combining clean meat and plant-based meat; followed by ground meat products (nuggets, burgers); and finally those mimicking steaks or chicken breasts, which present significantly greater technical challenges.

“The first products that come to market may be hybrid products wherein clean meat is included as a part of plant-based products that essentially require only cell lines, media, and proliferative bioreactors to come to fruition.”

They add: “The next commercial products will likely be ground meat mimics, where scaffolding can be minimal; more complex structures requiring vascularization or perfusion bioreactors are not necessarily required.

“Finally, more structured tissues – like those mimicking steaks or chicken breasts – will require research and development in all of the areas outlined above. Thus, a consideration of target product(s) should drive the R&D focus.”

* The latest funding round – for an undisclosed sum – is led by Radicle Impact and Blue Horizon, and “other mission-driven investors,” said Hampton Creek.

** Just Scramble is currently available at Floré, an historic Castro neighborhood cafe in San Francisco, said communications head Andrew Noyes. “We’ll be launching in additional cities and locations in 2018.”

The price of Just Scramble “is comparable to premium egg products used by foodservice operators,” he added. “Currently [we are targeting the] foodservice [with a] liquid [product] but we also have a baked patty version. We’ll have a retail offering as well.”

Asked to share the ingredients list, he said: “For intellectual property purposes, we are not sharing the full ingredient list at this time.”