Speaking at the Good Food Institute’s (GFI’s) Good Food Conference at UC Berkeley last week just before the GFI released data showing that US retail sales of plant-based meat surged 23% in the year to August 11, 2018, Impossible Foods' director of research Celeste Holz-Schietinger, PhD, argued that consumers are attached to meat, not animal slaughter.

By that logic, she said, if you can produce ‘meat’ that is just as good as or better than the real thing without animal suffering and industrialized slaughter, why wouldn’t consumers buy in?

Echoing speakers who predicted that the tipping point for cell-cultured meat will come when it matches conventional meat on taste, convenience, and price, exactly the same applies to plant-based meat, she added: “If it’s convenient, if it tastes great and if it’s affordable, people will follow.

“People don’t eat meat because they like the fact that animals are slaughtered, they eat it in spite of that. No one eats meat because they’re happy an animal was slaughtered.”

Beyond soy and wheat…

Most plant-based meats are still based on soy or wheat protein, with pea protein also gaining traction via brands such as Beyond Meat, said GFI director of science and technology David Welch, PhD.

However, more research is being done on other plant-based protein sources, from chickpeas and lentils to sorghum and millet, while new crop breeding techniques and gene editing technology such as CRISPR could also be utilized to design crops with optimal functional and nutritional properties for meat analogs, he said.

Smarter plant breeding techniques can also eliminate components responsible for off notes, while a greater understanding of how processing steps might introduce flavor issues that weren’t there at the beginning is also helping to tackle taste challenges in plant-based foods, noted Mark Matlock, SVP of food research at ADM: “The easiest way to reduce an off flavor is not to produce it in the first place.”

Flavor houses, meanwhile, are exploring flavor release in plant-based meats, said Scott May, founder of MISTA, a new venture funded by Givaudan: “One of the things that happens with plant-based proteins is that flavor gets bound up in the material and it doesn’t release either at all, or it releases in a strange way.

“So one of the things we’ve developed is a blocker that goes in and sacrifices itself into the protein so that when you add a flavor to it, such as a chicken or a beef flavor, it releases in the right way.”

US retail sales of plant-based meat rose 23% in the year to August 11, 2018

New data* released today by The Good Food Institute (GFI) shows that US retail sales of plant-based food sales grew 17% in the past 12 months to reach $3.7bn (significantly outpacing overall growth rates in food of around 2% over the same period).

Plant-based meat sales were up 23% to $684m led by Morningstar Farms, Gardein, Lightlife, Beyond Meat, and Boca. The fastest growing brand was Beyond Meat with sales up 70%, followed by Field Roast (+68%), Gardein (+51%), Dr. Praeger’s (+44%), and Quorn (+31%).

“12% of US households now purchase plant-based meat," said GFI director of corporate engagement Alison Rabschnuk. "That’s an estimated 14.7m households, which is a significant increase from last year, and I expect we’ll see that trend continue.”

“The plant-based meat category today is reminiscent of the plant-based milk category about 10 years ago, when growth began to really take off,” said Caroline Bushnell, senior marketing manager at GFI. ”As it follows that trajectory, reaching share of market parity with plant-based milk would make the retail plant-based meat category worth almost $10bn.“

Plant-based milk is now sold in 89% of all retail outlets and commands 13% of total retail milk sales nationally. The fastest growing plant-based products are 'other dairy alternatives,' including creamers, with sales up 62% followed by yogurt (+54%), cheese (+41%), and ice-cream (+40%).

“People don’t eat meat because they like the fact that animals are slaughtered, they eat it in spite of that. No one eats meat because they’re happy an animal was slaughtered.”

Celeste Holz-Schietinger, PhD, director of research, Impossible Foods

GFI: We’re barely scratching the surface with plant-based meat

Welch added: “Biochemistry is really transforming the plant-based meat industry. We’re identifying novel ingredients that can reproduce a specific taste or aroma that consumers associate with meat; we’re creating new technologies to encapsulate plant-based fats to provide better textures and tastes and we’re also improving the nutrition of these products.

“We’ve really just scratched the surface in terms of what we can do with plants and turning them into animal meat analogs. In the next few years we’ll see more and more plant-based meat products that are really indistinguishable from the animal meat products they are trying to mimic.”

Is a perfect meat analog really the Holy Grail?

While Beyond Meat and Impossible Foods are utilizing their technological know-how to create products that precisely replicate beef, not every company in the field sees this as the Holy Grail for the industry, however, noted Brian Plattner at extrusion specialist Wenger Manufacturing.

“Not all consumers of these products want a meaty texture or flavor.”

Indeed, it would be unfortunate if a maniacal focus on creating a ‘meaty’ plant beef burger or chicken strip diverted attention from the development of entirely new plant-based products with novel flavors and textures, said successive speakers.

“Some people like the textures of nuts and seeds and simple ingredients,” added Nigel Hughes, SVP global R&D at Kellogg, while Sergio Eleuterio, general manager of Springboard Brands at Kraft Heinz, noted that there are lots of protein-packed plant-based foods such as BOCA’s falafel bites (made from chickpeas) that don’t attempt to mimic meat.

That said, with double-digit growth in the category, and a new sense of possibility created in part by the more embracing descriptor of ‘plant-based’ (instead of ‘vegan’ or ‘vegetarian’) and growing interest in protein, it feels like the market “is about to tip,” said Eleuturio.

From a shopper marketing perspective, meanwhile, “One of the reasons plant-based meat hasn’t developed too much yet is because it still feels complicated and clinical,” added Eleuterio, who said colorful new packaging at meat-free brand BOCA was designed to make the products look simple, fun, and delicious.

Make it delicious, and they will come

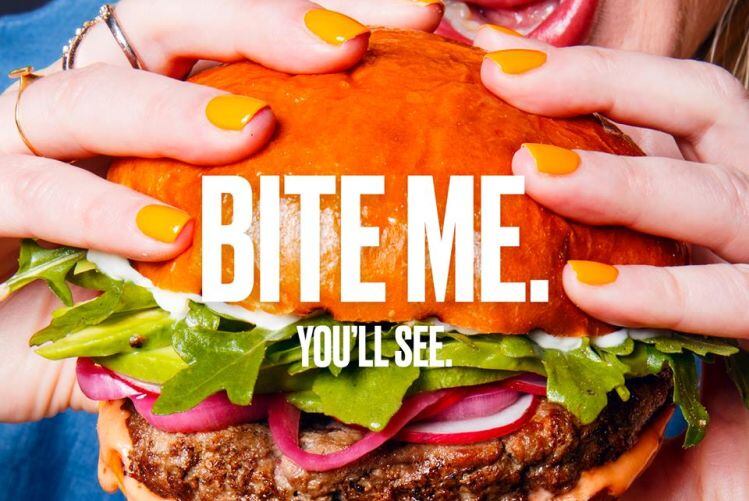

As for marketing plant-based meats, the success of the Beyond Burger and the Impossible Burger demonstrates that pleasure tends to trump improving human or planetary health when you’re in the mood for a juicy burger (regardless of what consumers tell you in surveys), added GFI director of corporate engagement, Alison Rabschnuk.

“We should position plant-based meats as indulgent, not restrictive, and flavor is key. Nielsen data shows that the fastest growing brands are the ones that focus on flavor.”

Menus that emphasis plant protein also encourage trial, she said: “Some consumers assume that plant-based foods aren’t going to be full of protein.”

‘Vegan’ vs ‘plant-based’

And while the terms ‘vegan’ and ‘plant-based’ might appear to be interchangeable (they both involve avoiding animal products), consumers do not view them in the same way, noted Barb Stuckey, president at food development specialist Mattson, who said consumers tend to see ‘plant-based’ as a positive dietary choice, whereas following a vegan diet is seen as a lifestyle associated with serious commitment, deprivation, and allegiance to a ‘cause’ that defines you (animal rights, environmental activism).

“Simply by changing the conversation you can make food taste better.”