Alkaline water: An ‘international growth phenomenon’

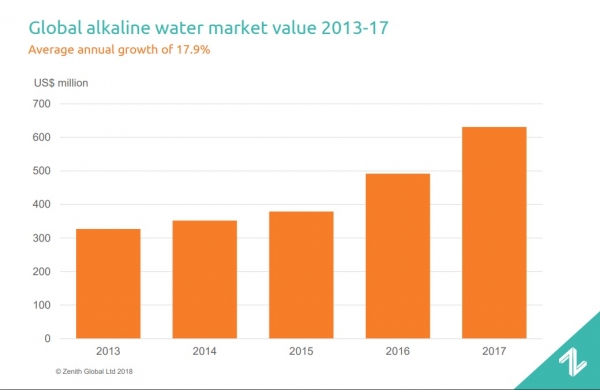

Consumption volumes are estimated at 521 million litres in 2017, with growth of 10% a year since 2013. And this is forecast to accelerate, predicts Zenith Global in its 2018 Alkaline Water Report.

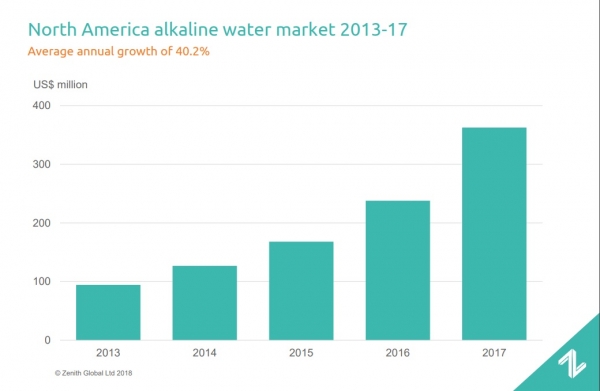

While Asia Pacific is the largest market for alkaline water, North America is the market to watch: where sales have growth by more than 40% a year since 2013.

What is alkaline water?

Alkaline water typically has a pH of between 7 and 10. Products either come from a naturally high pH source, or are enhanced in processing to create an elevated pH.

Most alkaline waters are positioned as premium products for active, healthy lifestyles: often commanding double the price of regular packaged water.

Alkaline waters tap into a number of key consumer trends: as a bottled water it can make the most of the category's overall impressive growth; while as a product with added value it is well positioned to make the most of consumers' desires for premium products.

“Influenced partly by a move away from high sugar carbonated soft drinks, the uptake of alkaline water has been motivated by a range of health and wellness drivers, with a broadening consumer appeal,” says Zenith Global.

Alkaline water: What's the fuss about?

Will alkaline waters follow the trajectory of coconut water? Hear from US ionized alkaline water pioneers Essentia and UK brand Actiph as we explore the topic in this alkaline waters podcast.

In the growing US market, alkaline water brands include Essentia (pH 9.5); Keurig Dr Pepper’s recent acquisition Core Nutrition (pH 7.4); Alkaline88, a brand enhanced with Himalayan pink rock salt (pH 8.8); and new launch smartwater alkaline (pH 9) from Coca-Cola.

Elsewhere, key brands include New Zealand's naturally alkaline water 1907 (pH 7.8-8.2); UK ionised water Actiph (pH 9); and South Australian naturally alkaline water 'pH 8' (pH 8).

Asia Pacific takes largest share: but North America is growing

Asia Pacific is the largest market for alkaline water: but the highest growth rates are seen in Western Europe and North America.

While alkaline waters in Asia Pacific show a growth rate of 3%, in North America the growth rate is 40% and in Western Europe this is 50%.

In North America in particular, the category has been transformed from a niche sector into one with mass appeal thanks to the beverage's functional positioning and drive from key brands such as Essentia and Core.

Coca-Cola's launch into the category with smartwater alkaline (currently available on the West Coast will a nationwide roll-out planned for March 2019) is predicted to add further momentum to the category.