According to the RFG annual study (which surveyed 1,200 shoppers), while the majority of respondents said they are on the lookout for sales and promotions, many are not satisfied with the 'value for money spent' at traditional supermarkets.

Measured on a 5-point satisfaction scale, consumers ranked the 'value for money spent' at traditional supermarkets at 4.17. Private label retailer ALDI, on the other hand, achieved a 4.51 score and shoppers are more likely to recommend the store to others with a 'Net Promoter Score' of 44.7 compared to supermarkets (40.7) and Walmart (27.1).

In addition, 42% of those who shopped at ALDI say they plan to shop there more in the next 12 months, versus 22% for supermarket shoppers, and 28% for Walmart shoppers.

The rise of ALDI in the US

The private label discount grocery chain promising 'no hidden costs' in its products was founded in Germany in 1946. The retailer now operates more than 1,800 stores across 35 US states reaching over 40 million shoppers. Last year, ALDI announced that it is investing more than $5.3bn to remodel and expand its store count to 2,500 by the end of 2022.

"ALDI continues to make inroads in competing against supermarkets with strong value for money spent and likelihood to recommend scores, as well as perceived improvement in quality, coupled with the highest OSAT (overall satisfaction) scores during the peak traffic period of 3 p.m. – 7 p.m.," said Doug Madenberg, RFG principal.

"As ALDI continues to remodel stores and expand into new locations, supermarkets need to step up their game in areas like staff availability and helpfulness, maintain leading scores in quality and variety, as well as focus operationally on improving satisfaction during high traffic time periods."

Where supermarkets are doing well

Despite ALDI's growing presence in US market, supermarkets maintained the highest overall satisfaction score of 4.31 compared to ALDI (4.27) and Walmart (3.93).

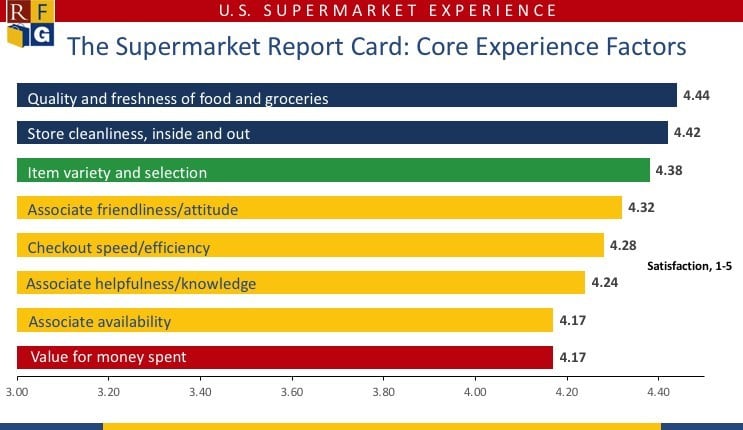

Supermarket shoppers rated quality/freshness of the food and groceries (4.44), cleanliness of the store (4.42) and item variety and selection (4.38) as the strongest core experience factors. Associate friendliness, while the highest service rating, received a more moderate score of 4.32, followed by checkout speed/efficiency (4.28), associate helpfulness/knowledge (4.24) and the lowest scoring service area - associate availability - (4.17). Service is a critical factor given that overall satisfaction is significantly higher when service attributes receive stronger scores.

Of the 1,200 consumers surveyed, Baby Boomers ranked supermarkets more favorably than Gen X and Millennials except for 'value for money spent' which scored similarly across all three generations, noted RFG.

"Value still remains a very important consideration for supermarket retailers with more than seven out of ten shoppers referring to sales vehicles before or during the visit to the store," Brian Numainville, RFG principal, noted.

While digital circulars continue to grow, the printed circular is still more popular

However, there are some effective pricing and sales strategies that could help supermarkets increase consumers' value satisfaction rating, according to Numainville.

"While supermarkets receive the lowest scores on value for money spent, the good news is that advertised specials register as the strongest scoring pricing factor for supermarkets. While digital circulars (30%) continue to grow, the printed circular is still more popular today (51%), more so with Boomers (62%) as compared to Millennials (40%). However, digital coupons (33%) have now surpassed clipped coupons (29%) and are used across all age groups," he said.

"Retailers need to remain attentive to the trends in their local markets to ensure they are communicating value using the vehicles most relevant to their shoppers."