The move – which follows the launch of plant-based products from fellow meat giants Cargill and Tyson (Raised & Rooted) – was a logical one for JBS, said CEO Darcey Macken, who worked in senior management roles at Kellogg and Noosa Yoghurt before taking the helm at Planterra Foods in October 2019.

“JBS has an innovation council that’s always asking the question: what’s next? And clearly plant-based has been high on the radar for some time, and isn’t going away, but they were smart enough to know that if this was going to work for JBS, it had to be a standalone operation that was completely separate,” she told FoodNavigator-USA.

“You see time and time again that companies try to establish new brands and they get compared to different P&Ls and not run properly, so it had to be independent, but rely on JBS from a support standpoint, so shared services on the back end, SAP, and utilizing procurement from a supplier relationship standpoint. We’ve got 17 people today and only three came from within JBS.”

She added: “It’s been extremely fast and furious, because that decision was made October 1, and we’re launching the products in April. We’ll be producing our first four OZO items at an internal JBS facility, but we are working with two co-packers as well to give us more capacity and flexibility in packaging and product as we want to be able to move quickly.”

INGREDIENTS (OZO burgers): Water, textured pea protein (pea protein, pea fiber), canola oil, wheat gluten, sustainable palm oil, pea and rice protein fermented by shiitake mycelia, methylcellulose, malt extract flavor, natural flavors, yeast extract, ascorbic acid, salt, vegetable and fruit juice (color).

Fewer calories, more protein, less saturated fat

Made with textured pea protein, wheat gluten, and MycoTechnology’s pea and rice protein fermented by Shiitake mycelia (the roots of Shiitake mushrooms), the soy-free OZO product line has less saturated fat and fewer calories than rival offerings, claimed Macken.

To place this in context, each 113g OZO burger contains more protein (22g vs 20g for the Beyond Burger, 19g for the Impossible Burger), a lot less saturated fat (2g vs 5g for the Beyond Burger, 8g for the Impossible Burger) and fewer calories (210 vs 260 for the Beyond Burger and 240 for the Impossible Burger), said Macken, who said the team would be embarking on a nationwide sampling tour this year.

Fermented pea and rice protein

OZO products – which will also enter the foodservice market and club channel this year – deliver a distinct taste and texture that sets them apart in the category, in part dues to the inclusion of MycoTechnology’s PureTaste pea and rice protein fermented by Shiitake mycelia, claimed Macken.

Combining pea and rice proteins creates a balanced amino acid profile, while fermenting them with mushroom mycelium (roots) reduces their off tastes and aromas, improves their solubility (which improves texture, dispersibility, and increases stability in suspension) reduces chalkiness and grittiness, and boosts their oil- and water-holding capacity, enabling firms to create juicier burgers, according to MycoTech.

“We are coming in a little late in the game so we knew we had to bring something different,” said Macken.

“By using this fermented Shiitake blend, it helps with flavor, and it improves the protein digestibility [According to MycoTech CEO Alan Hahn, ‘the mycelium excrete enzymes and metabolites that break down the pea and rice protein strands and make them more bioavailable so your body can digest the amino acids.’].”

As PureTaste has a PDCAAS score of 1.00 - and also contains vitamin B12, which is sought-after by many vegans and vegetarians – its nutritional profile has attracted a lot of interest from companies looking to formulate with plant-based proteins, according to MycoTech.

Pricing and branding

At $5.99 to $7.99 the OZO range is priced in line with the competition, said Macken, with products hitting 1,000+ Kroger stores mid-April with other accounts to follow. "By Q3 I think we'll be in about 40% of stores."

The branding is designed to stand out on shelf, she said: “We wanted to go for color and emphasise positivity and choices, hence the strapline 'taste the good in life,' and with OZO, it tested really well with consumers, it's more of a symbolic name - it doesn't really mean anything.”

Asked about the notion - being propagated in ads by the Center for Consumer Freedom - that plant-based meat is 'ultra-processed' and packed with unpronounceable ingredients such as methyl cellulose (widely used as a binder and emulsifier), Macken said, "Everyone, including us, is using methyl cellulose for a reason, and it's found naturally in plants, but the name does put some people off so everyone is trying to find a way to remove it from formulations."

Further down the road, Planterra Foods will launch additional products, she said: "There's absolutely more in store from OZO and Planterra this year and we're looking at every protein category today in multiple different forms and categories."

Plant-based meat by numbers

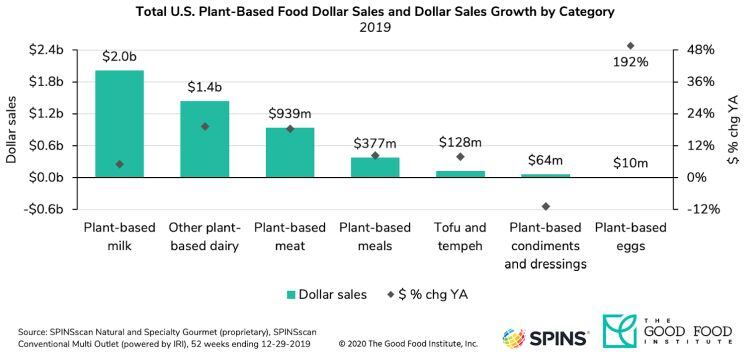

According to SPINS data commissioned by the Good Food Institute (GFI) and the Plant Based Foods Association (PBFA), US retail sales of plant-based meat rose 18% to $939m in 2019 in measured channels, accounting for 2% of retail packaged meat sales, while IRI data suggests that 14% of U.S. households now purchase plant-based meat.

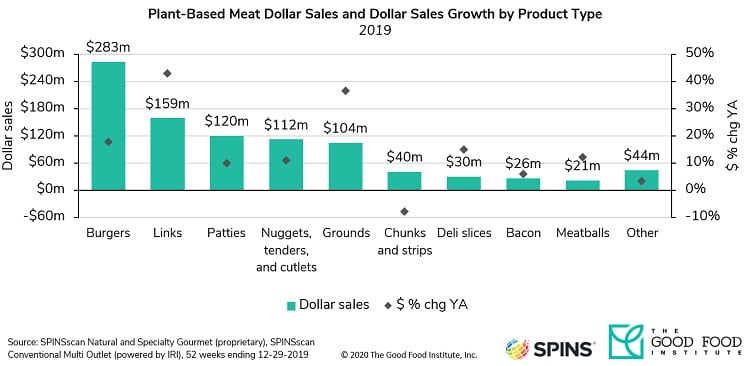

Retail sales of plant-based burgers rose almost 20% to $283; plant-based grounds were up almost 40% to $104m; and plant-based meatballs were up over 10% to $21m, with the bulk of the growth coming from the refrigerated segment, with new plant-based meat products increasingly shelved adjacent to conventional meat.

"This placement helped propel the refrigerated segment’s growth of 63% last year by introducing the category to more consumers shopping for center-of-plate protein options," said the GFI. "Growth of refrigerated plant-based burgers has been especially robust, with sales up 123% and reaching $283m in 2019."

"Few things can accelerate the plant-based protein industry more than investment from the global leaders in meat production, who have the massive distribution channels, economies of scale and marketing expertise to transform this sector from niche to mainstream."

Bruce Friedrich, executive director, The Good Food Institute