“We’re starting in Whole Foods in August and we’re in the middle of presentations and roll out plans with other retail partners nationwide,” said CEO Rob Leibowitz.

“Butter is a multi-billion-dollar category and the consumer movement is both in premium [dairy] butters like Kerrygold, as well as in the premium plant-based butters that offer variety outside of the traditional soy and canola based products that have been around for so many years,” said Leibowitz, who took the helm at Kite Hill in early 2018.

“However we’ve not seen almondmilk – which is one of our hallmarks - used in plant-based butter yet, and so we developed a product that looks, tastes, and spreads great, and works in recipes, but has a differentiating factor. It’s for people that really enjoy butter but want to have a plant-based option and we think it’s as good if not better than all of the other plant-based butters out there.”

Kite Hill butter alternative: ‘Almondmilk is the #2 ingredient on the ingredient deck’

While many margarine and spreads – which typically combine hard fats such as palm oil with liquid oils such as soybean oil – are already dairy free, a new wave of plant-based brands including Miyoko’s Creamery are developing products positioned as ‘vegan butter,’ ‘butter alternatives’ or ‘plant-based butter’ that claim to replicate the taste and melting properties of butter.

Kite Hill’s new line features a base of sunflower oil (liquid oil) and coconut oil (hard fat). And while Miyoko’s adds cashew nuts, Kite Hill adds almondmilk.

Asked whether almondmilk delivered a meaningful contribution to the formulation (as opposed to something sprinkled into a tub of vegetable fat at fairy dust levels in order to provide a new angle for marketers), Leibowitz said: “There’s a meaningful amount in there. Almondmilk is the #2 ingredient on the ingredient deck.”

Ingredients list, European Style Butter Alternative: High oleic sunflower oil, cultured almondmilk (water, almonds, cultures), coconut oil, natural flavors, cocoa butter, cultured dextrose, sea salt, sunflower lecithin, lactic acid, beta caroten (for color)

‘We’ve experienced massive and expansive growth’

Hayward, CA-based Kite Hill – which said last fall that it expected its business in 2021 will be five times the size it was in 2017 – recently unveiled new branding, a new strapline (‘plant based artisans’), and a revised logo without the almond teardrops deployed in earlier packaging iterations, reflecting the fact that Kite Hill is not tethered exclusively to almonds as its key source material, said Leibowitz.

The brand - which was founded by vegan celebrity chef Tal Ronnen, cheesemaker Monte Casino and acclaimed Stanford biochemist (and Impossible Foods founder) Dr Pat Brown – recently acquired a manufacturing facility in Portland Oregon which makes its yogurts, dips and sour cream (while its Hayward, CA facility makes its almondmilk and cheeses), he said.

“We’ve experienced massive and expansive growth and we’ve had a hard time until recently staying in stock on our cream cheese because demand is so high, and with our yogurt business, we’ve got European style, Greek-style, and new Blissful coconutmilk products and all of them are doing extremely well.

“In the last two years we’ve really improved every product line and become the gold standard for plant-based yogurt in terms of taste, texture and overall aesthetics.”

Asked about dynamics in the plant-based yogurt category, which grew 31% last year, he said: “There are still lots of new entrants coming in, but not every brand has demonstrated the ability to launch products that look great, taste great, and have great consistency and I think you’ll see fallout… as products don’t meet consumer expectations.”

A plant-based lifestyle brand

As for the innovation pipeline, he said: “We see Kite Hill as a plant-based lifestyle brand, which can extend well beyond where you see it today.

“If dairy is an important feature or attribute of a product then we feel we’ve got license to launch into that area with Kite Hill as a dairy alternative, as a main feature or as an ingredient. So we’re going to continue to innovate, but not in areas we feel could be a fad or unsustainable."

What’s the size of the plant-based dairy prize?

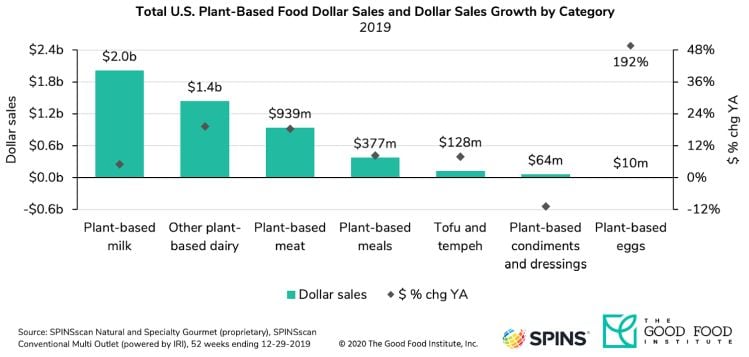

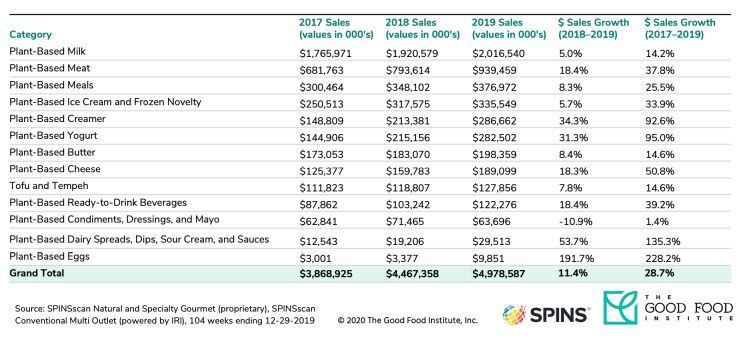

His comments came as the Good Food Institute and the Plant Based Foods Association released a flurry of new data from SPINS* into the plant-based dairy, egg, and meat categories covering the 52 weeks to December 29, 2019.

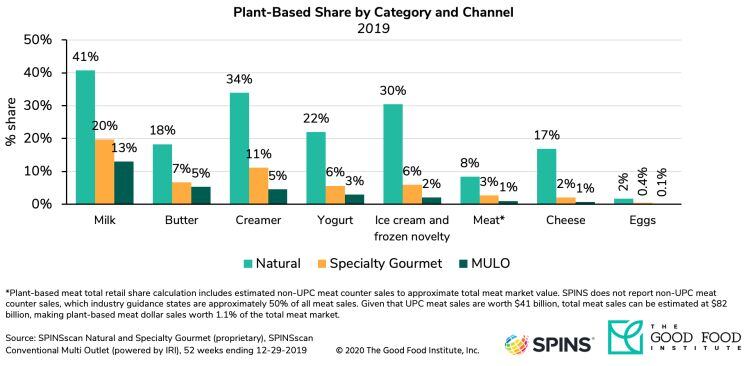

Within plant-based dairy, plant-based milk is the largest category, with sales up 5% in 2019 to $2.02bn and 41% household penetration; followed by plant-based ice cream and frozen novelties (+5.7% to $335.55m); plant-based creamers (+34.3% to $286.66m); plant-based yogurt (+31.3% to $282.5m); plant-based butter (+8.4% to $198.36m); plant-based cheese (+18.3% to $189.1m); and plant-based dairy spreads, dips, sour cream and sauces (+53.7 to $29.51m).

Plant-based options now account for 14% of the fluid milk market; 4% of the yogurt market; 6% of the butter market; 5% of creamers; 3% of ice cream and frozen novelties; and 1% of the cheese market.

*The data represents retail sales of plant-based foods that directly replace animal products, including meat, seafood, eggs, and dairy, as well as meals that contain animal ingredient replacements. Obtained from the SPINSscan Natural, Specialty Gourmet, and Conventional Multi Outlet (powered by IRI) channels, this data pertains to the 52week periods ending December 29, 2019.