Instacart raises $225m: ‘Millions of people across North America are now relying on Instacart as an essential service'

Led by DST Global and General Catalyst, and supported by existing investor D1 Capital Partners, the round boosted Instacart’s valuation to $13.7bn said the firm in a statement Thursday.

Since the pandemic began, Instacart's order volume has jumped more than 500% year over year, with the average customer basket size growing 35%, said the San Francisco-based company, which has hired about 300,000 new workers since March, and plans to hire an additional 250,000 to meet demand.

“This investment comes as Instacart continues to experience an unprecedented surge in customer demand for grocery delivery and pickup across North America. COVID-19 has changed the rhythm of life for families everywhere and fundamentally reshaped the way people think about on-demand services like Instacart.

"Millions of people across North America are now relying on Instacart as an essential service to get access to the groceries and goods they need."

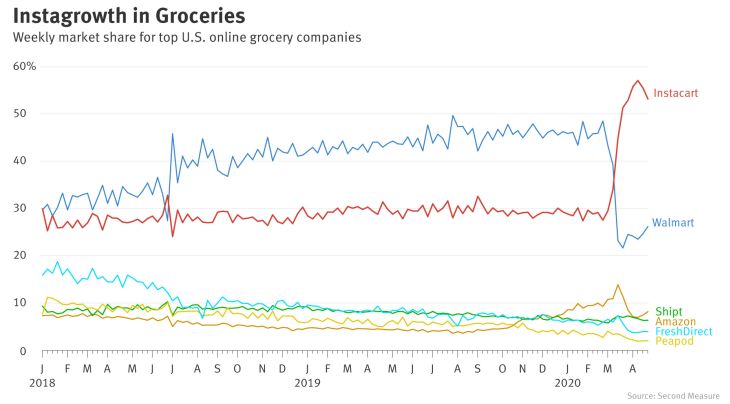

According to Second Measure, which tracks credit card spending, Instacart’s share of grocery pickup and delivery sales rose to 57% in the third week of May, up from about 30% in February, making it the biggest player in the space ahead of Walmart, Shipt, Amazon, FreshDirect, and Peapod.

How does Instacart work?

A high-profile player in the on-demand economy (think Uber and Airbnb), Instacart was founded in 2012 and is now accessible to more than 85% of households in the US across all 50 states, and more than 70% of households in Canada.

The platform enables consumers to order groceries online via a web app from Instacart’s retail partners such as Albertson’s and Sprouts, by activating an army of personal shoppers to pick orders from stores for pickup or home delivery.

Like Uber (which doesn’t own any cabs) Instacart does not buy, build or maintain its own stores, warehouses or trucks, but serves as a conduit between existing stores, consumers, and personal grocery shoppers.

In recent years, Instacart has teamed up with 400+ national, regional and local retailers across 30,000+ stores in the US and Canada.

Consumers pay a delivery fee per transaction (starting at $3.99 - fees can differ based on the time you want your order delivered, how large the order is, and how busy things are) or they can pay an annual membership fee to join Instacart Express and get free deliveries on all 2-hour and scheduled deliveries over $35. A 5% (or $2 minimum) service fee also applies to non-alcohol items for non-Express customers.

As for item pricing, retail partners set the prices of items on the Instacart marketplace. In some cases, a flat percentage is added by the retailer to items to cover the cost of the Instacart service.