COVID-19 has also sped up the adoption of nontraditional models, with consumer spending on meal kits, online grocers, and prepared food delivery services increasing significantly in April, noted Deloitte in its report.

“Among all product categories, grocery has risen to the forefront as the most desired area for convenience, as 63% of consumers find it very important when it comes to selecting a grocery option,” said Deloitte.

Grocery stores today stock roughly five times as many products as they did in the 1990s, according to Deloitte, resulting in an explosion of choices and ever-expanding range of products, brands, and companies available to the consumer.

“And these products are being purchased via multiple channels, with 73% of consumers using a mix of physical stores, e-commerce, digital apps, social commerce, and marketplace platforms to buy products, adding to the competitive mix and complexity,” said Deloitte.

Rise of private label over brand loyalty

Because of the influx of new products from a plethora of brands, Deloitte noted that retailers are increasingly turning their attention and resources to developing their private label offerings which offer 25% to 30% higher margins than traditional brands.

“Spanning across multiple retail categories and channels, private label products have outpaced the growth of their traditional counterparts by three times since 2015. Within this category, mass-retail private label segment sales have increased by 41% over the past five years—about four times higher than overall private label growth,” said Deloitte.

Consumers' experience with private label products has evolved as well. Once thought to be the cheaper, budget option, retailers have moved toward a premiumization of their private label offerings.

According to Deloitte, discount products still represent the majority of private label sales, but the share of premium private labels continues to rise, having climbed from 15.7% to 19% over the past three years.

Physical retail future

“Much has been written about store closures over the past decade. While there’s certainly been weakness in some retailers and formats, the reality is that brick-and-mortar retail is not dead,” noted Deloitte.

As of 2019, physical stores still accounted for 85% of retail sales. Even during a global health pandemic, sales at brick-and-mortar stores saw healthy growth in some categories as COVID-19 further demonstrated the importance of the physical store.

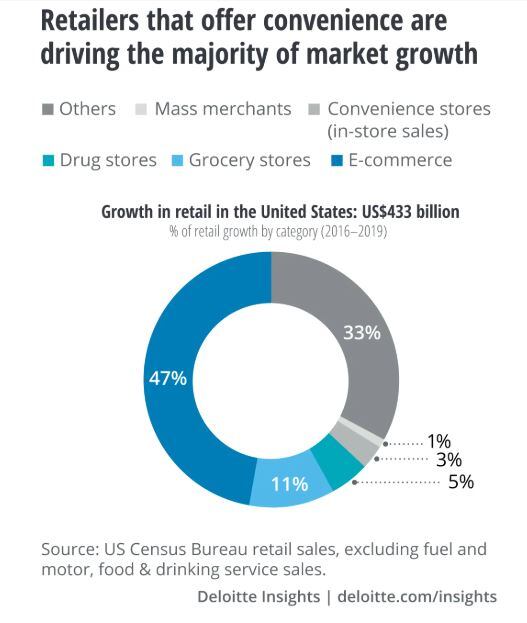

Over the past five years, stores and offerings focused on convenience have led the charge, driving an estimated 67% growth in retail.

“Perhaps surprisingly, e-commerce has helped propel the evolving role of physical stores in bringing inventory closer to the end customer. In-store fulfillment of online sales drove one-third of e-commerce growth between 2015 and 2019 and has quadrupled in the past five years,” added Deloitte.

Convenience store take over?

While the US store count has increased in the past 10 years from 244,000 stores to 270,000 stores (for all sectors), square footage at US retail stores has dropped by 4.4% . The growth of small-format stores such as convenience, drug, and dollar stores has been a driving force in the long-term decline in store sizes.

According to the report, retailers offering the most convenient experience drove most of the market growth from 2016-2019 (see chart below). E-commerce drove 47% of incremental retail growth followed by convenience (33%) and grocery stores (11%).

“In particular, US convenience stores, with 153,000 stores serving 165 million customers daily, saw a 16th straight year of record in-store sales (excluding fuel and gas), growing at 1.8% CAGR to achieve $242bn in sales,” Deloitte said.

"One common trend among these smaller stores is that they’re moving closer—both in terms of location and inventories—to the consumer."