Avocado consumption climbs with plenty of headroom for growth ahead, says Rabobank

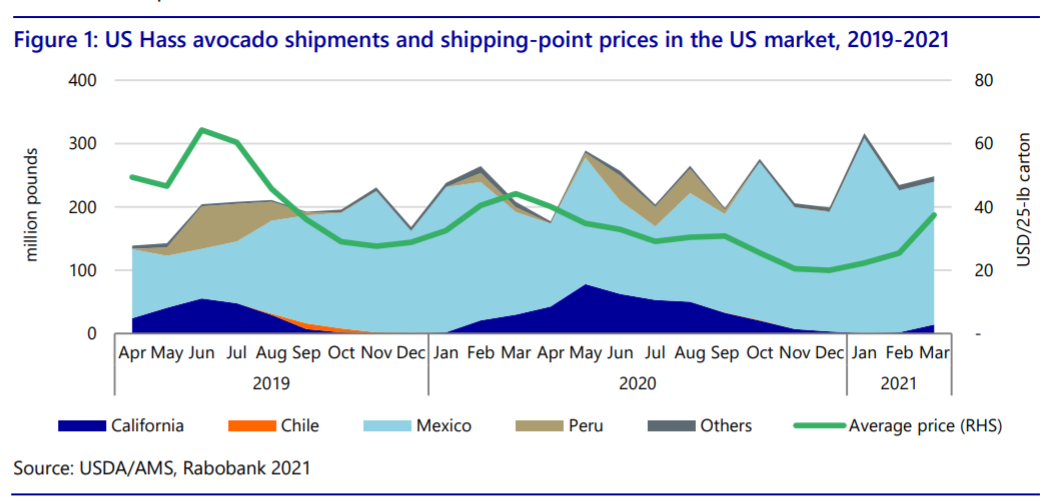

Monthly avocado shipments to the US market hit record highs in January 2021, registering 33% volume growth compared to the same month a year prior, according to Rabobank.

In March 2021, volume shipments declined slightly but remained elevated at 20% more shipments than 12 months prior.

“Both shipments and wholesale prices increased month-on-month during March, suggesting stronger demand for avocados as the US economy rapidly recovers, consumers visit grocery stores more frequently, foodservice activities increase, and pandemic-related restrictions lift,” writes David Magaña, senior analyst, fresh produce and tree nuts, Rabobank in a report.

Growing appeal of avocados

While demand for avocados typically peaks during specific events and holidays (e.g. Super Bowl weekend), there is expanding consumer demand for avocado beyond guacamole and avocado toast, says Magaña.

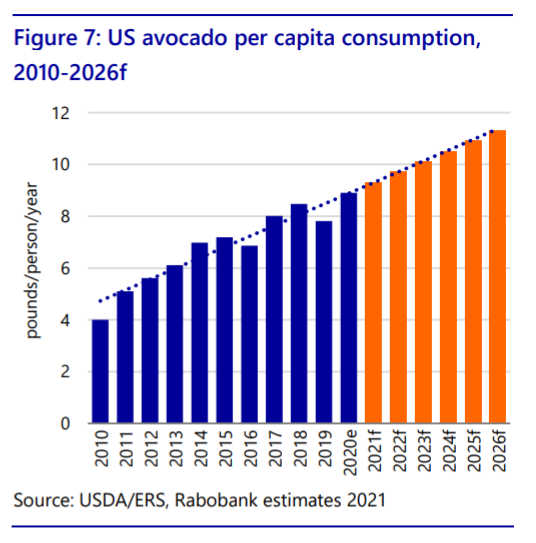

Per capita consumption of avocado has grown at a CAGR of 8% of the past decade – in 2010, per capita consumption of avocados in the US was roughly 4 lbs., in 2018 it was close to 8.5 lbs. and Rabobank estimates that the number could exceed 11 lbs per person by 2026.

Household penetrations of avocados in the past 12 months was about 40%, still a lower rate than other fruit such as apples and bananas which registered a nearly 66% household penetration, according to Rabobank which cited recent industry surveys.

Shifting generational food preferences are also driving the trend towards increased avocado consumption, said Magaña.

“In the US, Generation Z is more racially and ethnically diverse than previous generations."

According to Magaña, about 25% of Gen Zers are Hispanic, compared to about 17% of Millennials, and 12% in Gen X.

“Hispanic consumers in the US tend to consume more avocados than the average US consumer. As a reference, per capita avocado consumption in Mexico is about 18 pounds, which shows the headroom that remains in less mature markets,” he said.

‘Environmental sustainability and social responsibility will become relevant differentiators’

Magaña predicts that as consumption of avocados continues to grow, consumers will seek out product attributes beyond health and eating experience.

“While transparency and food safety continue to be imperative, factors such as environmental sustainability and social responsibility will become relevant differentiators… Investors, retailers, consumers, and other industry players are expected to continue to pay more attention to these aspects,” said Magaña.

“The avocado industry will need to continue to work proactively in terms of environmental sustainability to gain or maintain market access, profitability, and visibility.”

Investing in and implementing a sustainable supply chain that reduces environmental impact will improve brand/product perception.

“Continued investment and innovation in logistics and ripening facilities will enable a reduction in food waste, another important sustainability goal. Adopting genetics and technologies that increase input efficiency and post-harvest services/products that extend shelf life will surely become increasingly important,” said Magaña.

Avocado forecast for remainder of 2021/early 2022

Rabobank estimates that overall shipments for the 2021/2022 period will be up about 12% compared to the 2018-2020 three-year average. Shipments from Mexico – the largest exporter of avocados to the US, followed by Peru – has remained strong during the 2020/2021 season, according to Rabobank.

However, an anticipated seasonal decline due to unfavorable weather conditions of the past winter will affect harvest volumes in Mexico.

“Hence avocado availability may be tighter and closer to the three-year historical average between week 34 and week 40 [late August – early October 2021]. Once the new harvest season ramps up in Mexico after week 40, shipments may stabilize,” noted Magaña.

“Unsurprisingly, the highest shipment levels are expected in the first weeks of 2022, just in time for the Super Bowl demand pull.”

Using shipment estimates, demand-side seasonality/variables, and relevant trends, Magaña said average avocado prices are likely to remain elevated for the rest of 2021, however not as high as they were in 2019.