"Just the fact that we were home had this monster effect on eating occasions, because we were a captive audience," said Larry Levin, executive vice president, market and shopper intelligence, IRI, who at a past online industry event identified 33 million new eating occasions created by the pandemic, particularly in the area of permissible indulgence.

"I think in this pandemic we wanted to indulge, and indulgence came in two forms. It came in ice cream, and it came in beverages in general, beer, wine and spirits in particular," he told FoodNavigator-USA.

Calculating Pacesetters

The Pacesetters list, published annually by IRI, tracks the sales of products that hit 30% ACV (all commodity volume) in multi-outlet channels (supermarkets, drugstores, mass market retailers, military commissaries, and select club and dollar retail chains) in the calendar year 2020.

"When a product hits 30% [ACV] in those channels that IRI measures, we turn the clock on, and we track the next 13 quad periods. So imagine an uneven horse race, but every horse gets to run 13 quads," explained Levin.

While some products included in IRI's 2020 Pacesetters list effectively launched in mid-2019 and hit their respective numbers some time in early 2020, meaning they weren't fully exposed to the impact of the COVID-19 pandemic, about 25% of the Pacesetters were launched in fourth quarter of 2019 or January 2020 "and were very much enveloped in the COVID-buying frenzy," said Levin.

So, which products and companies had a breakout year, according to IRI?

Raising a glass to bubbles

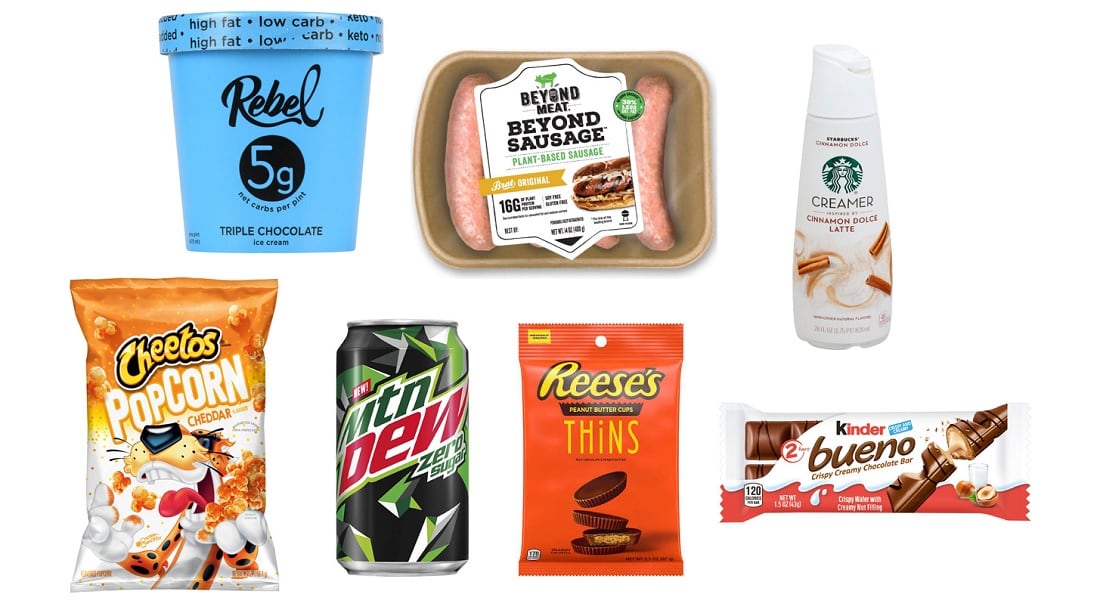

Leading this year's list were several carbonated beverages from Bud Light Seltzer (with $193.7m in revenue for the 2020 calendar year), followed closely by Truly ($191.3m), and Mountain Dew Zero Sugar ($111.2m) in the No. 3 spot.

"We are raising a glass for bubbles, no doubt about it. We saw that happening about a couple of years ago," said Levin, noting the boom of sparkling waters that escalated into other categories including hard seltzer, which in the midst of the pandemic "helped bring the party home" when most restaurants bars were closed.

'A great year for ice cream'

Turning to ice cream, Levin remarked how the category had its strongest showing yet in this year's list.

"It was a great year for ice cream. I don’t remember a time where we had eight ice creams in the top 100," he said. Other Pacesetters include Talenti Gelato Layers at No. 12 and My/Mochi frozen novelties at No. 15.

Leading the pack was Rebel Ice Cream, a small independent keto ice brand, which launched on the crowdfunding site, Kickstarter, and without any direct marketing spend landed in the No. 5 spot with $96.7m.

"Americans have historically made room in their diet for indulgence," said Levin.

According to IRI, nearly half of all boomers try to eat healthy 80% of the time but leave a little room for indulgence in their diets. Meanwhile, more than 40% of millennials say they are equally likely to indulge as they are to eat healthy.

Plant-based meat alternatives

Beyond Meat's Beyond Sausage made the No. 10 spot in Pacesetters with $52.6m in revenue and an impressive repeat trial numbers.

"This is the first time we’ve had a plant-based meat alternative make Pacesetters [top 10 products], and I think that trend is going to continue," said Levin, noting that other sub categories such as plant-based milk alternatives (e.g. almond milk and oat milk) have made the list in previous years.

According to IRI data, Beyond Sausage had 1.6% consumer trial and a 47% repeat trial rate among consumers inching closer to becoming a "repertoire brand," said Levin, who said that a repeat trial rate above 30% is considered "very good" by IRI.

Big or small, who leads the market?

While large CPG companies have typically occupied many of the top 10 spots on IRI's Pacesetters list, there has been a rise in small, cash- and resource-strapped food and beverage companies making the list each year.

"You really have to give credit to these entrepreneurs who are looking at different routes to market that break tradition. This is the second year in a row where we’ve had unique paths to market. Last year, a number of our Pacesetters came out of Shark Tank. I think this is first time, I remember any of our Pacesetters coming out of a Kickstarter campaign (referring to Rebel Ice Cream)," said Levin.

"Small companies, somehow, regularly find their way onto pacesetters. I think it’s because when a consumer goes to buy a product, it’s not about whether it’s a small company or large company. It’s about a product that’s going to meet a need I have, and small companies are as adept as big companies at meeting a need."