The recent figures have caused “concern, although not panic” in some quarters of the trade, according to one source, while others are predicting a shakeout as retailers weed out poor performers, and report a “market correction” as valuations come down to a more realistic place.

Recent survey data from The Brightfield Group also suggests that 'plant forward' or flexitarian consumers, who eat meat, but are open to plant-based options, and represent a significantly larger addressable market than vegans and vegetarians, have been pulling back from the category as inflation has started to bite, and report eating more (conventional) meat over the past three months.

According to trade association the Plant Based Foods Association (PBFA) – which will report new data on how consumers are shopping the category later this month – the devil, as always, is in the detail, when it comes to interpreting figures.

“Obviously I can’t name names,” senior director Julie Emmett told FoodNavigator-USA, “but many of the large retailers are saying that their plant-based meat sales are very healthy and continuing to grow; something else to consider is that oftentimes when numbers are reported, private label is not reported.

“Retailers have been very open when they speak to our membership that they are looking for partnership opportunities to create private label products, which will support scale in the industry.”

PBFA: ‘The retail partners we're working with are genuinely committed to growing plant-based foods. They're not walking away from it’

As for space allocation, she said, retailers are not contracting their sets, even if the velocities for plant-based meat in the fresh meat case are not optimal.

“I can tell you that the retail partners we're working with are genuinely committed to growing plant-based foods. They're not walking away from it. They're dedicating more time and effort to understand it because they know that this is a valuable consumer that they don't want to lose.”

She added: “Sets have not contracted, if anything they've expanded, and signage has been expanding everywhere. Kroger just placed clings [signage that sticks to frozen and refrigerated doors] all over their stores, Hannaford has implemented signage throughout the store, Safeway has great signage, and there is a direct correlation between strong merchandising and signage and positive sales.” (Click HERE to see some case studies from the PBFA about the benefits of integrated merchandising in the cheese and meat categories.)

When it comes to merchandising, she said, however retailers decide they are going to position meat alternatives, “the goal is consistency, to make it easier for shoppers to find the products, to use all the levers that are available: signage, store-wide integrated marketing programs and so on.”

‘I’m seeing a strong desire to coalesce around a common message’

So what about messaging? Has the industry done a “lousy job” of getting its messages across, as Impossible Foods’ new CEO Peter McGuinness suggested last week?

PBFA members all have their own strategies, but there is a broad consensus that taste, health and convenience are the primary consumer drivers followed by sustainability and animal welfare, said Emmett, who noted that “animal based meat is aggressively taking up ad space” while meat alternatives are being “picked apart” without a similar level of scrutiny into the realities of industrial animal agriculture.

“I’m seeing a strong desire to coalesce around a common message so it doesn't get lost.”

As for pricing, she said, “If it's healthy and it tastes good, we know consumers are willing to pay a little bit more. But the gap is definitely closing [between conventional and plant-based meat] because of increased meat prices, and that's particularly the case with chicken right now.”

Meat alternatives are not just plant-based anymore

As to the broader question of what the meat alternatives category actually looks like in five years' time, and whether the messaging will become more complicated - and confusing - as more fermentation-based ingredients arrive on the scene (that are not technically plant-based) coupled with hybrid products containing combinations of cell-cultured meat or fats and plant-based ingredients, there will need to be clear segmentation, she said.

“As we work with retailers and data providers, they see a definite distinction between the two [plant-based and cell-cultured]."

Shoppers looking for 100% plant-based products meanwhile, can look for the PBFA’s ‘certified plant-based’ stamp on packaging, she added, noting that 1,100+ products now feature the logo.

McDonald's US: Analysts 'increasingly concerned that no national launch may be coming'

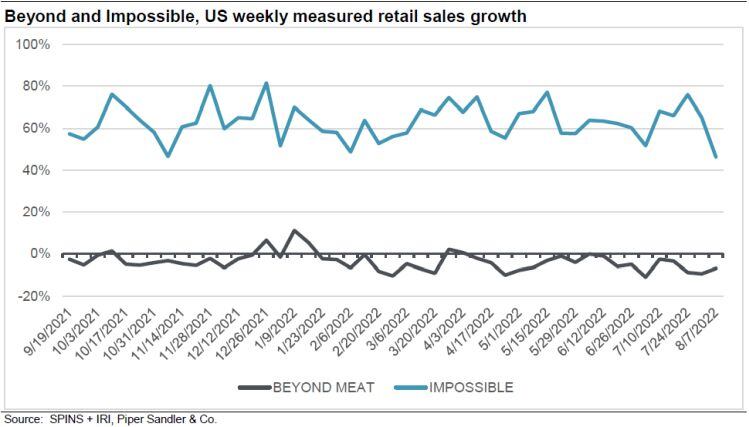

“McDonald’s McPlant test ended on April 24, and there has been no news since (crickets!)… we are increasingly concerned that no national launch may be coming,” said analysts at Piper Sandler in an August 23 note to investors.

“The McPlant had strong early sales in its initial operational test, with our channel checks pointing to sales of perhaps 70 per day, though this was likely fueled by consumer curiosity and outsized levels of marketing.

“Each operational test location was also surrounded by locations without the product, which drove ‘artificial stimulation’ of concentrating sales in an area into one location. In the larger California and Texas tests, sales rate appears to have fallen off considerably, per our channel checks over the course of the test."

Yum! Brands: Broad roll-outs in Singapore, Guatemala and El Salvador

However, there was positive news this morning for Beyond Meat, which said Pizza Hut is introducing new Beyond Meat options as permanent menu items across several markets in Asia and Latin America.

Pizza Hut Singapore is launching the Cheesy 7 Beyond Supreme to its permanent menu nationwide, while Pizza Hut restaurants across Guatemala and El Salvador are introducing a new Beyond Meat-dedicated menu, which features nine Beyond Meat dishes across breakfast, lunch and dinner.

Products include: Omelet Beyond, Croissant Beyond, Cheese & Meat Share Beyond Breadsticks, Italian Style Beyond Pizza, 3 Quesos 3 Carnes Beyond Pizza, Chipotle Bomb Beyond Pizza, Cavatini Bolognesa Beyond Pasta, Cavatini Alfredo Beyond Pasta, and Rotini Chipotle Beyond Pasta.

GFI: There’s no ‘Got Milk’ for plant-based meat

Caroline Bushnell, who leads the corporate engagement team at the Good Food Institute, meanwhile, told us that consumer survey data suggests that the demand is there, but the products are not universally meeting people’s sensory expectations, and in many cases, are still too expensive, even though the price gap is narrowing.

This is also reflected in the Brightfield data, that shows that among early adopters and highly engaged shoppers, consumption is going up, but capturing the larger opportunity - meat eaters that are open to alternatives, but only if they hit the trifecta of taste, price and convenience - is proving more challenging.

“But it's still really early days for this category and significant innovations are happening across the sector to address the sensory opportunity and to scale this relatively nascent industry to be able to compete on price.”

As for messaging, she said, “The meat alternatives industry doesn't have a checkoff program and there's a very significant opportunity for a category-level campaign for more plant-based meat and the plant-based sector more broadly."

Paul Shapiro, The Better Meat Co: ‘The problem for us is supply, not demand’

Paul Shapiro, co-founder and CEO of The Better Meat Co, which makes a wide range of fungi-based meat alternatives, is currently raising money to build a larger fermentation facility.

Shapiro, who is trialing his fungi-fueled foie gras and lunchmeat slices at the Linkedin HQ in the San Francisco Bay Area for a couple of weeks through a partnership with Bon Appetit management company, said: “We are selling everything that we produce from our Sacramento fermentation facility so the problem for us is supply not demand.

“In order for us to start selling millions of pounds, we need to build a much larger facility, but the company is in a strong fiscal position at this time, and while many companies in our space have been doing layoffs, we've continued to grow our team.

“We’re also working with partners such as Hormel so we can show the world what they can do with our ingredients, because most of these companies have never used mycoprotein before as there's been no such thing as a commercialized b2b mycoprotein ingredients provider.

“What’s exciting is how versatile it is, you can create everything from sliced meats to steak and chicken breasts because the filaments are very long, so depending on how you process them, you can cause those fibers to interlock, before or after rehydration.”

‘Deals are still being done but on lower valuations’

Asked how investors are viewing the meat alternatives space given the softening sales at US retail, he said: “After 40% growth through the pandemic, it may have been too optimistic to expect that to continue, and you might see something that is more normal types of growth.

“At the same time. I do think that as meat prices continue to rise there will be an even greater pressure to move away.

“As for the investment climate, my experience is that capital is still flowing but there are potentially lower valuations. So deals are still being done but on lower valuations.”

‘If you want to raise money in this market, you're probably going to take more dilution than you would have taken, 12 or 18 months ago’

He added: “I always say that companies don't go out of business because their founders get diluted. They go out of business because they run out of money. Every founder wants to prevent as much dilution as possible, but if you want to raise money in this market, you're probably going to take more dilution than you would have taken, 12 or 18 months ago, and that's just a fact.

“But we intend to raise money and go out and create a full-scale fermentation plant that will create a river of mycoprotein to flow through the industry.”

David Benzaquen: ‘Building a food company is not like going live on an app’

David Benzaquen, founder Mission Plant, a holding company advancing the plant-based and alternative protein industry with strategic investments and consulting services, said: “Valuations have corrected and the opportunity is all upside now. But it has to be patient capital. I think people have to understand that these are still pretty nascent markets and that building a food company is not like going live on an app.”

But he added: “That said, the long-term trajectory is a very good one, because Gen Z’s buying patterns and consumption patterns show the future is clearly going in this direction.”

But where does this leave companies trying to raise money right now?

“The question is do you have the margins that allow you to invest in what's needed?” said Benzaquen. “If you do, I think the demand is there. Some of the companies that are struggling the most right now are companies whose numbers are actually extremely solid, but they're at an infancy stage where they still need to raise capital to continue to grow and aren't finding access to capital.

“I've seen companies that are growing 3x month over month in repeat succession and are not able to raise money. And that's a travesty.”

*Stay tuned for further insights on FoodNavigator-USA in the coming days from Conagra Brands (Gardein), Quorn, and early investors in the space.

MAPLE LEAF FOODS: “We used to believe in a transformational category outcome” for meat alternatives, said Maple Leaf Foods’ CEO Michael McCain on his firm’s Q2 earnings call earlier this month after the plant protein business posted an -18.4% decline in sales to $40.8m. “This did not materialize… and we no longer believe that it will materialize.”

This doesn’t mean the category is a dud, just that all those hockey-stick growth charts were way too ambitious, he said: “We feel along with others… that it will settle into a long-term growth rate of 10-15% particularly if supported by a robust innovation agenda.”

KELLOGG: Speaking on Kellogg’s Q2 earnings call this month, CEO Steve Cahillane said the firm’s plant-based brand Morningstar Farms was “uncharacteristically down in net sales and consumption through the first half” reflecting short-term “supply chain challenges, principally with a co-manufacturer, which led us to reducing our commercial activities,” he said.

“Nevertheless…. this is a business that remains in good condition from the standpoint of brand equity, marketing and innovation pipeline as well as profitability.”

Further reading:

Plant-based meat by numbers in US retail: A tale of two temperature states