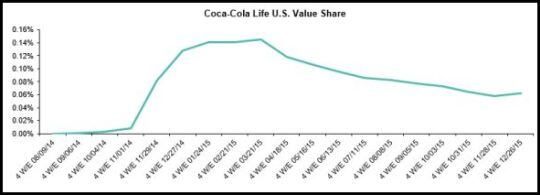

Sales of Coca-Cola Life - which was launched in upmarket chain The Fresh Market in August in August 2014 and rolled out nationally across the US in October 2014 - peaked in spring 2015, when it achieved a value share of 0.14% of the carbonated flavored drinks market in the four weeks to March 21, according to Bernstein data.

However, they have been declining ever since, with its value share dropping to just 0.06% in the four weeks to December 26, 2015.

The data was released following press reports indicating “a trajectory of decline” for Coca-Cola Life in the UK - where the product is being reformulated to further reduce sugar - although Coca-Cola Great Britain general manager Jon Woods said it had generated £35m in retail sales since its Sept 2014 launch and elicited a "really positive reaction".

Trends in the US have been disappointing…

As for the US, however, it’s hard to put much of a positive spin on the figures, Bernstein senior analyst Ali Dibadj told FoodNavigator-USA: “Trends in the US have been disappointing…so they have now lapped their nationwide launch, and since then, share only managed to peak at about 0.14% before sequentially declining now to under 0.1%.

“Coca-Cola Life’s novelty has likely warn off. However, we would see the product as only the first version of such products, and continue to expect more innovation in the natural and calorie free sweeteners space.”

Tom Vierhile: Mid-calorie colas are like the Bermuda Triangle of carbonated soft drink marketing

Market researchers we contacted said they were not surprised by the lukewarm figures, meanwhile, with Tom Vierhile, innovation insights director at Canadean, telling FoodNavigator-USA that, “Mid-calorie colas are like the Bermuda Triangle of carbonated soft drink marketing: They don’t appeal strongly to any one group and launches seeking this elusive niche tend to disappear.”

The beverage aisles are littered with the corpses of high-profile failures in this segment, he noted: “I remember reporting a product called Jake’s Diet cola from Pepsi way back in 1987 that had a blend of NutraSweet brand aspartame and high-fructose corn syrup. It didn’t last long. After that, we had similar launches like Pepsi Edge, Coke C2 and Pepsi Next. None of these products are still around. That should tell us something.”

He added: “Soft drink companies kept coming up with these products because they wanted the so-called “dual user” of full-calorie soft drinks and diet soft drinks. So they split the difference, creating a product that didn’t appeal strongly to full-calorie soft drink consumers or diet soft drink consumers. It didn’t work. And it doesn’t work.

“It’s hard to describe who a mid-calorie soft drink is going to appeal to in the first place. There are just so many other choices already available to the consumer including ready-to-drink teas, flavored bottled waters, low-calorie carbonated juices, newer types of beverages like kombucha and so on that may be able to ride this taste and calorie tightrope better than a mid-calorie soft drink would.”

The US version of Coca-Cola Life - which has 60 calories per 8-oz glass bottle (vs 93 cals for 8oz of regular Coke) - was first launched in The Fresh Market stores in Georgia, North Carolina, South Carolina, and Florida in later summer 2014 ahead of a national roll-out in a variety of packaging formats in October 2014.

Speaking to analysts in February 2015, Coca-Cola CEO Muhtar Kent said Coca-Cola Life had "shown great promise in recruiting new and lapsed consumers into the sparkling category".

However, many market watchers and competitors remained skeptical about its potential, with Zevia CEO Paddy Spence arguing that Coca-Cola Life and rival product Pepsi True were “not really pleasing anyone".

He added: "Full calorie drinkers say, 'Gosh this doesn’t taste like my full calorie soda'; zero calorie drinkers are saying: 'Why would I ever want 60, 80, 100 calories a can?'"

Graph: Courtesy of Bernstein

Low-calorie cola has been one of the weakest performing categories in the US

Howard Telford, senior analyst at Euromonitor International, said he too struggled to see the appeal of Coca-Cola Life: “To be honest, this aligns with what I’ve been hearing about the launch so far. In addition to the US/UK, momentum also seems to have stopped in Latin America (Argentina) as well.

“Low-calorie cola has been one of the weakest performing categories in the US, and consumers are moving into waters and non-cola options.”

Having said that, he observed, “It is also possible that consumer awareness and education when it comes to the product (what stevia actually is, the “natural” sweetener angle) isn’t yet where it needs to be in order for the product to be successful.”

With this in mind, Coca-Cola’s new unified marketing approach around all of its cola brands (click HERE) might help alert consumers to the unique attributes of Coca-Cola Life, added Telford, noting that the brand has already featured in some of Coca-Cola’s new 'Taste the Feeling' images as part of this campaign.

PepsiCo has not said much in recent earnings calls about the progress of its stevia-sweetened mid-calorie cola Pepsi True, which has 60 calories per 7.5oz can, compared with 100 calories for the equivalent amount of regular Pepsi

I don’t have any sense that Coca-Cola is backing away from Life just yet

So what does all this mean for the long-term future of the brand?

It’s probably a little early to say, said Telford: “I don’t have any sense that Coca-Cola is backing away from Life just yet, but it’s very much a work in progress.”

FoodNavigator-USA has asked Coca-Cola for a comment on Coca-Cola Life, and will update this article accordingly should we receive one.

Interested in the mid-calorie trend? Both Vierhile and Telford will be participating in our trendwatching panel at FoodNavigator-USA''s LIVE online beverage innovation summit on Feb 18, and Coca-Cola Life is sure to come up... Register HERE for free...