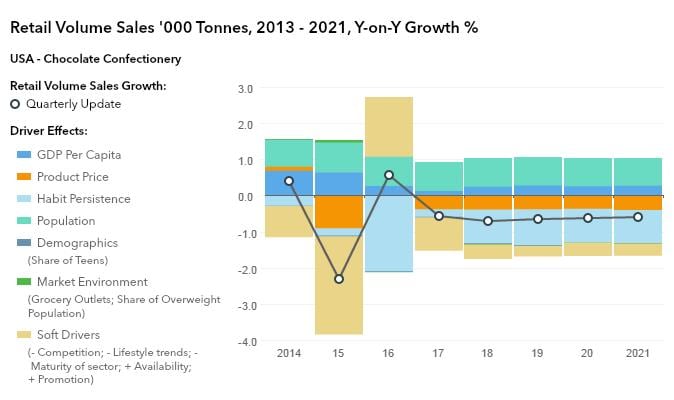

US consumption of cocoa ingredients fell 5,000 metric tons (MT) between 2010 and 2015 and could face further constraints, according to research by Euromonitor International.

It says that chocolate confectionery made up 44% of cocoa use in 2015, but the market has faced competition from the dairy and snack bar sectors as consumers look to reduce sugar consumption.

Volume declines

Euromonitor said cocoa has been the casualty of the war on sugar.

“Chocolate confectionery, and by extension cocoa’s plight, does not look set to improve, with our forecast figures suggesting a volume decline of 1% between 2016 and 2021,” said John George, ingredients analyst at Euromonitor.

The US chocolate market grew retail value sales 3.5% year-on-year in 2016 to reach $18.8bn. The global market grew 4.8% in retail value over the same period, according to Euromonitor.

The market research firm expects the US chocolate market to grow in value sales by 9.9% from 2016 to 2021 – albeit at a slower rate the global market (+12.1%).

Cocoa grind down

The North American cocoa grind – which collates cocoa processed from 17 companies such as Blommer, Mars and Hershey - fell 1.1% to 117,588 MT in the fourth quarter of 2016, reported the National Confectioners Association (NCA) last week.

Full year 2016 grindings in North America were flat (+0.05%) at 485,222 MT.

Hershey performance

US chocolate market leader Hershey reported 1.8% growth in North America sales in Q3 last year to $1.76bn. New products such as Reese’s Pieces Cups, Big Kat and birthday-themed Kisses helped it grow modestly in North America, which accounts for around 88% of the company’s revenues. Hershey will report its Q4 and full year results next week (February 3).

Euromonitor anticipates weaker consumer spending will continue to hinder the chocolate and cocoa market in the US.

“The insecurity associated with the forthcoming Trump presidency has seen GDP per capita revised down for 2017,” said George, adding the chocolate production costs were expected to rise.

‘Pincer movement’

He said that chocolate confectionery was caught in a “pincer movement” between these economic influences and competition from lower sugar alternatives.

“Consumer reticence towards high sugar products is only likely to rise, with the Food and Drug Administration's (FDA’s) 2018 change requiring US products to declare added sugar content likely to further raise awareness of problems associated with high sugar content.”

He advised cocoa ingredients suppliers to look to usage in applications beyond chocolate to “avoid getting caught in the anti-sugar crossfire”.