According to a report by the American Frozen Food Institute (AFFI) and the Food Marketing Institute (FMI), the $56.7bn US retail frozen food category notched up +2.6% dollar growth in 2018, outpacing total center store food product sales, with high household penetration (99.4% of shoppers reported buying at least some frozen food last year).

But while household penetration may be high, consumption frequency is relatively low with one-third of shoppers only consuming frozen food once every three weeks, reported FMI and AFFI.

Changing frozen food perception

Similarly, while frozen food has come a long way in terms of product offerings and quality, the category is still seen as second fiddle to fresh produce and perceived as a 'back-up option' when consumers can't make a trip to the grocery store or fresh items have run out, reported FMI.

Eight in 10 shoppers like having frozen food in stock as a backup solution and say it is often their “out-of-time or need-something-quick” answer. Seven in 10 shoppers say frozen food holds them over in between grocery trips when they run out of fresh items.

“In terms of sales, the frozen food category is only a fraction smaller than fresh produce, bigger than all other fresh perimeter departments, bigger than candy and even snacks,” said FMI vice president of industry relations Doug Baker.

Shoppers also tend to buy frozen food with a specific day in mind that they will be preparing it, indicating that frozen food isn't seen as an impulse purchase for most and rather a deliberate element of a planned meal.

In 1998, 1.6% of all in-home meal occasions included a frozen dinner or entree. In 2018, that share rose to 2.7% driven by frozen food's convenience factor and ability to expose consumers to new types of cuisines in an immediate way.

“One could argue that frozen meals are the original meal kit,” said AFFI president and CEO Alison Bodor.

Who are the heaviest buyers?

The individuals most likely to spend more time in the frozen food aisle tended to be parents of kids aged 7 to 12 and older millennials who show higher engagement across all food types.

The top three categories to experience the largest percent of dollar growth within frozen food in 2018 included: soups/sides (+9.8%), appetizers/snack rolls (+5.8%), and breakfast food (+5.7%), according to IRI, MULO+C, for the 52 weeks ending 11/04/2018. In fact, nine out of the top ten major frozen food categories saw sales growth in 2018.

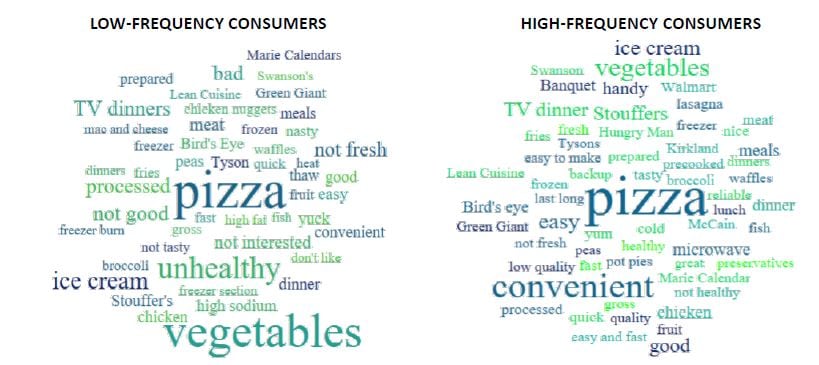

Despite an expanding set of options in frozen food, many consumers still associate the category with 'pizza' and as 'unhealthy', AFFI and FMI's word association research revealed.

"The difference in word associations among no/low versus high-frequency consumers points to an important educational opportunity for the frozen food industry. Word associations among high-frequency consumers may provide communication and marketing angles," the report stated.

Additionally, the food categories that have the highest household penetration among both low- and high-frequency shoppers are fruit, sides, breakfast items, and appetizers/snacks. Meat alternatives and seafood scored the lowest in household penetration, according to the report.

Shoppers are also heavily influenced by sales and promotions of frozen foods, according to FMI.

"Eighty percent of shoppers say sales specials on frozen food can prompt them to stock up on promotional items or buy something they had not planned on buying," noted FMI. "Sales promotions also highly influence brand switching."

Convenience, quality, and taste

Convenience easily took the top spot as the highest purchase driver for frozen foods, ranked as a top three consideration among more than half of consumers. Closely related, 'ease of preparation' was a strong second.

"High-frequency consumers certainly recognize the convenience that frozen food delivers, but they are much more likely to also emphasize the quality/variety of the food itself," FMI and AFFI stated.

"This points to the importance of driving trial to experience the food. The more shoppers pick convenience in combination with quality, variety or taste, the brighter frozen food’s outlook. After all, deli-prepared and restaurants can deliver on convenience just as easily as frozen food."

“The frozen food aisle is in the midst of a strong comeback,” Bodor said.