Reimagining base brands, cultivating the M&A pipeline, and developing new innovation models

Can ‘big food’ still innovate in-house? ‘It’s a strategic imperative,’ says Nestlé USA exec

Not surprisingly, Nestlé USA director of new business ventures Doug Munk reckons the world's largest food company can still come up with some pretty cool stuff, and has no time for industry navel gazers who worry that big food has “lost its way” as consumers reject the brands their parents grew up with and embrace smaller, sexier startups with brands and missions they believe in.

“Of course I believe big companies like us should still innovate in house,” Munk told FoodNavigator-USA at the Natural Products Expo West show earlier this month. “It’s a strategic imperative for us to do this.”

The key – when you are the size of Nestlé USA - is to ensure that you have the structures in place that can empower people to develop ideas and run with them, he said.

Reimagining base brands, cultivating the M&A pipeline, and developing new innovation models

When it comes to innovation, said Munk, Nestlé USA has a three-pronged growth strategy:

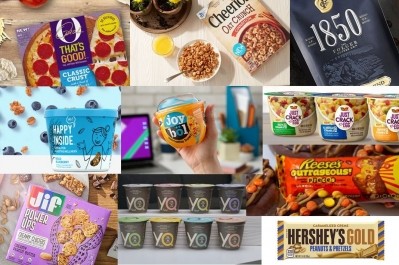

“One part is about reimagining our base brands, so a large part of why a lot of our marketing and cross functional groups come to a show like Expo West is to see what are the trends, and how do they translate to their brands. So, for example, our Coffee Mate Natural Bliss brand is launching an oatmilk creamer, which has incredible texture vs some of the nut based products consumers say are not meeting their quality or taste standards.

“The second part of the strategy is around cultivating our M&A pipeline, so we’ve acquired or made investments in brands such as Chameleon Cold Brew, Blue Bottle, Sweet Earth, and Garden of Life.

“The third part is developing new innovation models, so I like to say we’re innovating innovation.”

Collaboration, courage, driving with speed, and being extremely agile

So what do these new innovation models look like?

In the first instance, Nestlé USA has started working with the Terra accelerator, which was founded by co-working company RocketSpace and Rabobank to connect disruptive emerging brands with large players to create “win wins,” he said.

“A lot of the ways of winning for these entrepreneurs are now bleeding into the CPG world. It’s about collaboration, courage, driving with speed, and being extremely agile. So through Terra we’ve been working with startups such as Jackson’s Honest, Here, and Miyoko’s Kitchen and finding where they can leverage our capabilities, but also where we can learn from them about how to innovate.”

A key to this is that we empower our people to make decisions at lower levels

But what can the world's largest food company learn from start-ups about how to innovate? And even if the likes of Miyoko Schinner can teach an old dog like Nestlé new tricks, is a company the size of Nestlé capable of deploying the same strategies and moving with the same agility, or injecting the kind of passion into projects that a founder does?

Yes, insisted Munk, who said Nestlé USA has just launched two new brands in-house via an internal incubator that is separate from the main business units to allow team members to go from concept to launch in a fraction of the usual time.

The first two concepts to emerge are the refrigerated probiotic yogurt bar GoodBe, and the chocolate snack goodnight, which is laced with functional ingredients designed to help the body relax and prepare for sleep.

“A key to this is that we empower our people to make decisions at lower levels. In the old days my manager would have to get approval from her boss, me, my boss, the CEO... and now she is empowered to make all the decisions at her level, so that enables us to move with speed and agility,” he said.

Launch, learn, adapt, and then scale

But he cautioned: “You have to have a deliberate strategy. It’s not just a case of ‘Oh, this is trending at Expo West, let’s try that.’ We’ve defined a very tight growth agenda to ask where should we play outside of the categories in which we’re currently playing?

“So we’re focused on healthy snacking and plant-based eating, for example. And we’re using lean methodologies, rapid prototyping, getting in front of consumers, not validating as much, and launching small, say solely in Wegmans, as there is just a lower risk level associated with that.

“Let’s launch, learn, adapt, and then scale.”

Rapid prototyping, small-scale launch

So what consumer insights led to GoodBe (which has launched at the same time as a new refrigerated probiotic bar developed by Danone North America under the new Cultured Snacking Co brand)?

“We did a ton of deep dive research into consumers in the bar category to see what they were missing,” explained Munk.

“We found different opportunities for functional snacking, and we ideated a number of ideas and then went to a co-manufacturer who could rapidly prototype for us, went to Wegmans as a key retail partner that could work with us, and we launched. Clearly the fresh snacking space is growing and retailers are making more space for it.”

Crowdsourcing innovation from 23,000 employees

Another recent initiative is a “crowdsourcing platform where we reached out to all 23,000 employees in Nestlé USA to ask them to submit ideas for what the next new food or beverage should be that doesn’t currently exist in the marketplace,” said Munk.

“We had over 550 ideas in about three weeks, we selected six to pitch to our executive leadership team, and those six are moving on to really launch their babies as I call them, with the speed and agility of an entrepreneur, but the capabilities and resources of Nestlé.”

What does food and beverage look like in 20 years’ time?

Stepping back of course, Nestlé is also engaged in big picture, blue-sky innovation that could ultimately impact multiple parts of the business, helping to refresh legacy brands or give rise to completely new food and beverage concepts, he said.

“Our R&D is north of $2bn globally, and is a core competitive advantage for us. We’ve got people in R&D centers all over the world asking what will food and beverage look like not just two years or five years from now, but 20 years from now.”

What trends is Nestlé USA tracking?

Key areas Munk is watching are:

- Food as medicine

- The continued evolution of plant-based

- The trend towards cleaner labels and allergen-friendly products

“And then of course we are tracking trends such as keto, as we see a lot of growth and consumer interest in that space.”

While many nutritionists have queried the merits – and practicality - of diet in which 70% of your energy comes from fat, 25% from protein, and just 5% from carbs, he acknowledged, the keto craze is “tapping into two larger trends that are definitely here to stay: healthy fats, and low sugar.”

As for CBD, he said: “There is a really growing interest in this space, so much so that one of the companies that we’ve acquired, Garden of Life, launched a hemp extract that contains CBD at the show and we’re very much following that trend to see where it goes.”

Asked about meal kits and prepared meal delivery, he said: “So we invested in [subscription-based prepared meal delivery firm] Freshly, and we’re learning a lot from that. I think that understanding your consumers though that model really enables you to personalize meals in a way that’s very difficult to do via a retail model when you’re driving scale, so absolutely we think there are opportunities in that space.”