Protein Oat, now available in Whole Foods and Sprouts nationwide (MSRP $5.99), is the latest iteration of Übermilk - which launched early last year but failed to gain much traction, in part because consumers weren’t sure what it was – acknowledged CEO Greg Steltenpohl.

“Retailers were really enthusiastic about the concept [higher protein, more nutrition], but everyone agreed the positioning needed to be improved," he told FoodNavigator-USA. "To be honest I think I violated the basic tenet of marketing, which is don’t put anything between your selling and their buying.”

Combining oatmilk, pea protein, and sunflower seeds to deliver all the essential amino acids, Protein Oat has 8g protein per serving, with added calcium (45% DV), vitamin D (25% DV), vitamin E (15% DV) and potassium (10% DV), and “picks up where Übermilk left off,” although there have been some formulation tweaks.

“We’ve modified the type of oats and the processing we do on the oats to try and achieve a lighter and more drinkable product with omegas 3, 6 and 9 [short-chain omega-3 fatty acids from flaxseed and sunflower oil]. We also got feedback that parents want their children to drink it, and children usually don’t like [a thicker] texture and mouthfeel.”

Available in two flavors – Vanilla and Original – Protein Oat “meets the demands of a previously untapped consumer segment, one whose primary barrier has been concern for nutrition, specifically protein,” he added.

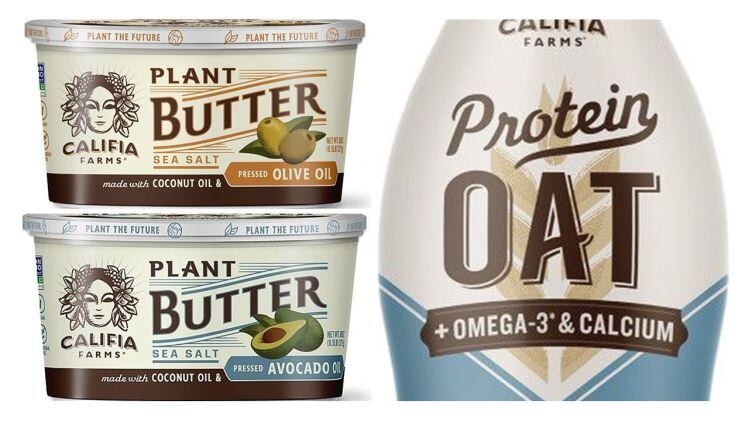

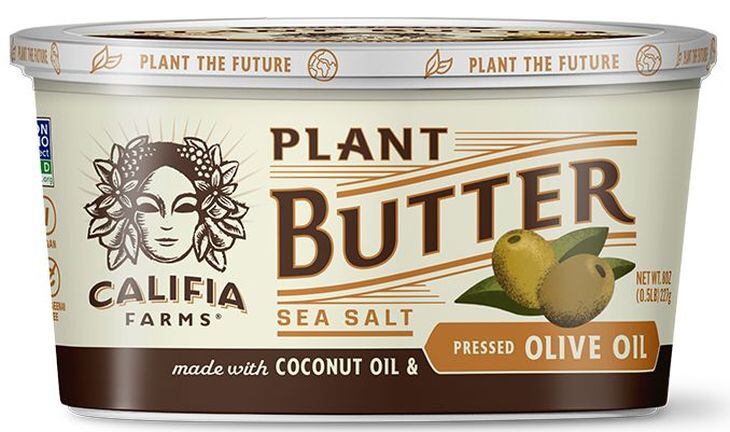

Plant-based ‘butters’

The new plant-based ‘butters’ - which combine coconut oil (a hard fat) with avocado oil or olive oil and add a new twist with the addition of cashews and tigernuts – have just launched in Whole Foods, but have also been accepted by conventional retailers including Kroger, Albertsons and Target, which will start selling them in the fall, he said.

While fellow plant-based brand Miyoko’s Kitchen has encountered some legal issues by using the term ‘butter’ on products without 80% milkfat, albeit with qualifying terms such as ‘plant-based,’ Steltenpohl said he felt confident using the term ‘plant butter’ on labels.

“The question is, is the consumer confused? We’ve got plant in big type all over the label, we’ve got pictures of olives and avocados, so I don’t think there can be any question in consumers’ minds that this is a plant-based product.”

EBITDA positive… A turning point for our company

When it comes to navigating turbulent times, there’s no doubt that bigger brands and firms with more control over their supply chains had an advantage in the early weeks of the pandemic, said Steltenpohl, who has raised $340m+ over four funding rounds to build his plant-based empire over the past five years.

“It’s difficult for unproven younger brands where the big retailers might feel there are financing or operational/performance issues.

“There’s no doubt that retailers want to keep the popular moving products on the shelf, which has worked to our benefit. From a shipping efficiency standpoint warehouse managers were prioritizing full trucks.

“Our grocery sales are close to 50% higher than last year, and our oatmilk sales are even higher; oatmilk and nutritional plant-based foods are doing extremely well. In Kroger, Califia has a much higher repeat rate after trial than other brands.

“We’re also up in the extreme triple digits on e-commerce and we are now EBITDA positive [ie. profitable at an operating level] as we’ve been able to optimize some of our production efficiencies, so this is really a turning point for our company.”

Things that used to matter to people are starting to matter again

As for consumer behavior, meanwhile, Americans are going through phases, he said: “I think families thrown together for extended periods of time took refuge at first in comfort foods, familiar foods and easy foods [which has favored some legacy packaged food brands], so look at cans of Campbell Soup [which were subject to early stockpiling]. But I don’t think that’s going to have a long life.”

Several weeks in, he said, consumers are also recognizing that they can’t seek solace in ice cream and pizza forever, and are now paying more attention to their health and their waistlines: “Things that used to matter to people are starting to matter again. So for us, at first we saw a resurgence of our original and vanilla almondmilk, but now the unsweetened is back on top again.”

What will be interesting is whether some habits formed during these unusual times will stick, he said.

“After you’re cooking more at home, you become more exploratory. You’re also seeing people getting into gardening and baking. The joke is, you can’t find yeast in stores anymore.”

We were able to get first in line with co-packers for larger runs

As for supply chain and manufacturing challenges raised by COVID-19, Califia Farms – which has international investors close to China – was better prepared than it might otherwise have been, and started stockpiling inventories of critical raw materials and core finished goods SKUs before all hell broke loose, said Steltenpohl.

“We were able to get first in line with co-packers for larger runs, we added redundancy to the supply chain, we loaded up on critical ingredients and found domestic suppliers [that could supply key ingredients in case there were problems sourcing from some overseas suppliers] and that paid off big time.”

Foodservice/coffee shop sales

While the foodservice/café/coffee shop side of the business – which represents less than 20% of Califia’s sales – has obviously taken a hit, many companies Califia partners with in this market in Seattle, San Francisco and L.A. have come up with creative ways to get products to consumers, and sales are slowly coming back, he said.

“We’ve seen drive-by windows, delivery services and so on, so we’re seeing some pick up.”

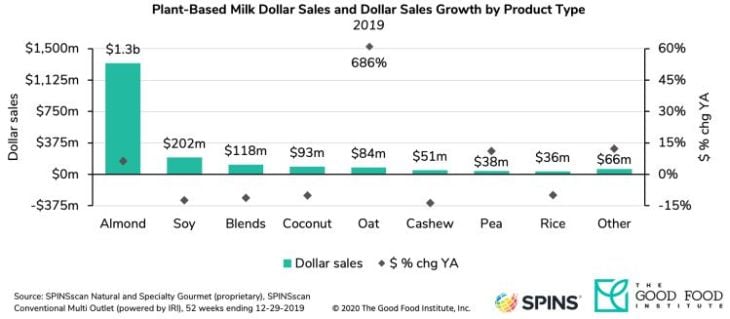

* dollar sales for the 52 weeks to December 29, 2019, SPINS data spanning natural, specialty and conventional retail