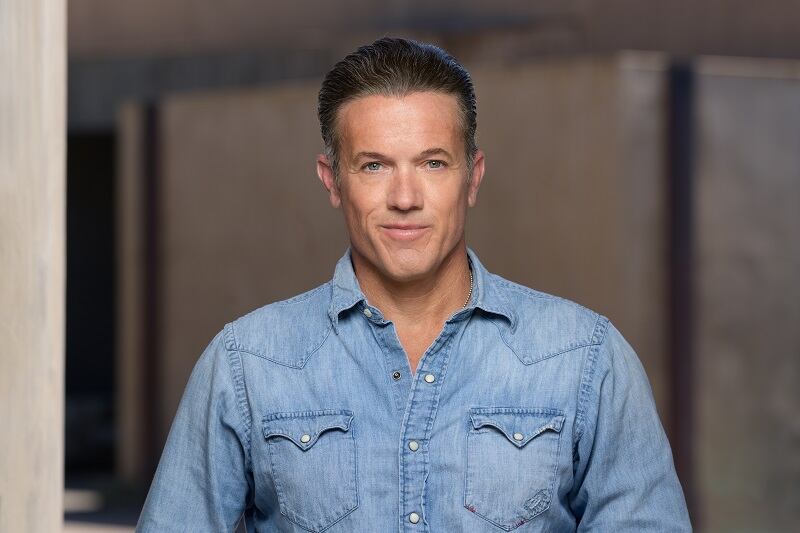

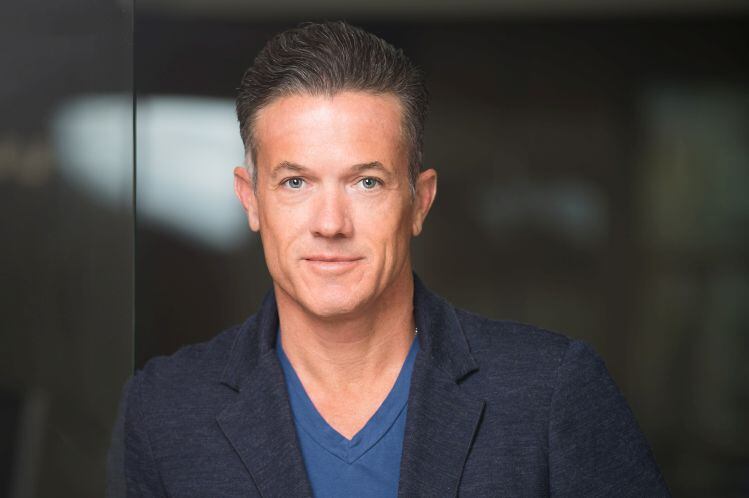

Just two months after buying KRAVE back from Hershey in May, Jon Sebastiani announced today that his private equity firm and incubator Sonoma Brands has acquired Chef’s Cut Real Jerky Co. for an undisclosed amount with the goal of “approaching of a one plus one equals three strategy.”

He explained to FoodNavigator-USA that by joining the two brands in one portfolio he hopes to once again reposition the premium side of meat snacks by stemming an ongoing promotions war in the space that threatens the success of all players.

“The original thesis of KRAVE was to reintroduce meat snacks to America in a more qualitative, functional, flavor or culinary-forward manner. And the deeper strategy was to usher in a new wave of health and wellness and fitness-oriented consumers,” including women who previously were overlooked by legacy brands that narrowly focused on men, Sebastiani said.

The strategy was so success that “the category 100% followed,” but then quickly became so crowded and fragmented with new brands that “classic businesses issues erupted” and a price war began.

“Price wars are never good. You have excessive promotional activity, you have excessive slotting fees being paid. You have significant channels like club where brands are willing to sell product at a negative margin and really aggressive behavior all to build market share. And those strategies never end well. Usually those that survive are the ones that have the deepest pockets or have the same vertical integration, have manufacturing at a point where their margins are superior to others,” he said.

Compounding the negative effects of the price war has been the impact of the coronavirus pandemic, which has hit the meat snack space a bit harder than other sectors as people are no longer on-the-go or working in offices.

This has created “a perfect storm for a very crowded, fragmented area of premium meat snacks,” and “we believe that right now is an opportune time to roll-up multiple brands that live in the premium segment of this space,” Sebastiani said. By bringing brands together, he added, he believes they “can collaborate with one another, can promote more strategically alongside each other and can deliver a more efficient strategy to retailers by representing multiple brands in the premium space.”

With Sebastiani’s strong track-record for success, he said, several brands already have responded to his stake in the ground.

“As we continue this roll-up strategy, certainly, we’re aware of other brands and understand that some brands are stronger than others. But we have been fielding inbound calls with and from other founders or other investors at these brands, and … just know that our thesis in a roll-up strategy may or may not be done, yet,” Sebastiani said.

The appeal of Chef’s Cut

After the initial move to buy back KRAVE, which Sebastiani said was not sentimental for him or Sonoma Brands but was “made with a deep though and deep consideration into our strategy,” Sebastiani said that acquiring Chef’s Cut was a logical second step.

“The Chef’s Cut brand is a very premium brand that has performed well in the space,” and shares many of the fundamental principles on which KRAVE was founded, including a goal to create the best tasting, highest quality, real jerky, Sebastiani explained.

The acquisition also gives Sonoma Brands a toe-hold in every significant vertical of the meat snacks space. While KRAVE focused solely on jerky, Chef’s Cut brings a zero-sugar option, biltong and sticks.

The deal also brings new distribution points, “the lion’s share of which, when you study KRAVE versus Chef’s Cut, is not duplicative,” Sebastiani said. “We feel that one brand can leverage the other to gain more distribution each.”

‘Millennials and now Gen Z … have shown a willingness to pay premium prices for a better product’

The timing of Sebastiani’s strategy to expand in premium may sound risky given the current economic downturn related to the pandemic and consumers’s shrinking budget and discretionary spending. However, Sebastiani says he is confident that the value proposition of KRAVE and Chef’s Cut will tip the scales in their favor.

“We are constantly trying to understand consumer behavior, and one thing we know is that pre-COVID or during COVID, recessionary time ore expansionary time, the current trends largely are driven by Millennials and now Gen Z who have shown a willingness to pay premium prices for a better product,” he said.

“A better product can be defined by a healthier product. That can be a more eco-friendly product. That can be a better supply or sourcing story. There are a lot of different product attributes that are triggering a willingness to pay more for today’s consumer,” he said, adding that even during COVID-19, consumers have demonstrated a willingness to pay upwards of 20-30% for premium meat snacks over existing legacy brands if they deliver on that expectation.

Even with consumers paying more, Sebastiani acknowledged that a significant challenge in the premium meat snack space are tight margins.

But, he emphasized, “we believe by aggregating brands together and building a portfolio … where we can retain each brands’ specific personality but also centralize and leverage manufacturing so that we can generate better margins as well as promote better” we can overcome this challenge.

Beyond meat snacks

Even as Sonoma Brands consolidates players in the meat snack space, Sebastiani said that it is looking for flexibility to enter additional snack segments with its KRAVE brand.

“We’re not in the very near-term planning to launch outside of our core lead products, but we will be building a brand portfolio that can support extensions into other areas of the store … with different non-meat SKUs,” he said.

Indeed, KRAVE has already pointed its nose in this direction with the launch earlier this year of its plant-based jerky. The development done under Hershey’s ownership of KRAVE was lost in the hub-bub of the pandemic’s early days, but Sebastiani sees this as a new opportunity rather than a missed one.

“KRAVE right now is in early development of a plant-based jerky. We’re taking that very seriously and in our opinion it is a giant step forward in terms of delivering the consumer a jerky experience using plant-based ingredients. But we want to perfect it from a manufacturing and qualitative standpoint, and we have a high degree of confidence that over time the plant-based meat snack space has a lot of runway, and we plan to leverage additional fruits and vegetables into our products in the future as well,” he explained.

Recognizing that these plans – and the overall strategy to roll-up brands in the premium meat snack segment – are ambitious for any moment in time, but especially during the ongoing pandemic, Sebastiani added that he is grateful for a strong team who will all work collaboratively to push each other – and the category as a whole – forward.