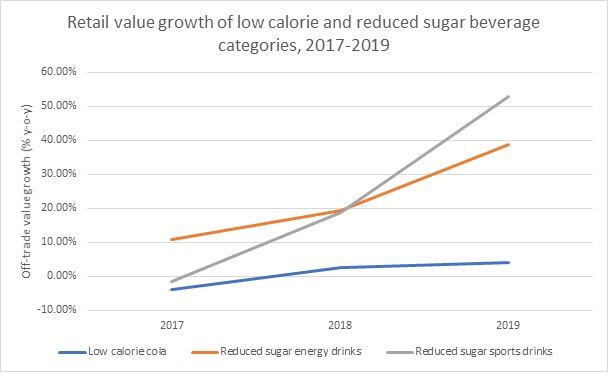

Success of the reduced sugar cola category and Coke Sugar Free in particular, has boosted the reduced sugar segment, while the runaway success of performance energy brands and renewed interest in reduced sugar sports drinks has also contributed to the segment’s recent high growth.

However, it remains uncertain whether the trend will regain its foothold within the soft drinks market or whether history will repeat itself and reduced sugar beverages will begin to decline as consumers move towards naturally sugar-free and low in sugar options.

Coke Zero Sugar continues to succeed within a waning category

Coke Zero Sugar has experienced both volume and value growth, reaching $1.3bn in retail value sales and becoming the main contributor to the low-calorie cola segment’s retail value growth, which stood at 4% in 2019. This is a sizable improvement from its 2014-2019 value CAGR of -1.6%.

The success of the brand speaks to the continuing importance of indulgence within the carbonate d soft drinks carbonates market. While some consumers have moved on from the category, those that are sticking around are increasingly seeking the same classic taste of Coke in more health-oriented ways.

Coke Zero Sugar’s success can be tied to the brand’s closeness to the original taste of classic Coke. In addition to pack size updates which have also helped the brand, mini cans reaffirm the brand’s positioning as a healthier, but still indulgent, alternative to the sugary classic Coke.

Diet Coke has rebranded under a similar strategy with updated slim cans and new flavors, but the brand has been unable to match Coke Zero Sugar’s success. The brand has not innovated far enough to compete with more health-focused beverages and has been left to compete with Coke Zero Sugar as the closest substitute for classic Coke.

Reduced sugar sports and energy drinks succeed by appealing to fitness-minded consumers

Reduced sugar sports drinks have seen success within the last two years, reversing the trend of declining sales.

Until recently, reduced sugar sports drinks had been lagging, facing a -6.4% value CAGR decline between the years 2012 and 2017 as artificial sweeteners within the drinks faced wide consumer skepticism. Reduced sugar sports drinks were also viewed as less effective at hydrating, since electrolytes are produced from salt and sugar.

In 2019, however, the subcategory saw a turnaround in value and volume sales. In 2019, the segment generated retail value sales of $1.3bn and retail volume sales of sales of 996.5 million liters in the US, according to Euromonitor International.

In terms of brand performance, Powerade Zero did well, while the new zero sugar offering from PepsiCo, Gatorade Zero, hit the shelves and proved popular with consumers. The launch of Gatorade Zero, in particular, renewed interest in the subcategory through PepsiCo’s marketing efforts, and the rising popularity of the keto diet drew fitness-focused consumers back towards reduced sugar sports drinks.

The growing fitness trend has also boosted the reduced sugar energy drinks segment, driven in large part by performance energy brands. The subcategory is aimed at health-conscious consumers that are looking for a boost post- and pre-workout as well as during their workout with differentiated nutrients.

These beverages combine aspects of energy drinks, sports drinks and workout supplements, containing creatine, BCAAs, zero sugar, and upwards of 300mg of caffeine — nearly twice the caffeine levels of most energy drinks, which usually sit around 160mg.

While the new subcategory has held a strong undercurrent for several years now, with fitness-focused energy drinks gaining popularity in health stores, only recently did performance energy brands appear on mainstream store shelves. Brands such as Bang and Celsius have been leading the charge, with bigger companies also entering the US market. In April 2019, Monster launched Reign, a direct competitor to Bang.

Energy drinks consumers are clearly seeking less sugar, as growth in low-calorie products suggests, but are first and foremost expecting a lab-engineered, high performance, beverage that delivers on its core functional claim. All other ingredients take a back seat to caffeine.

Source: Euromonitor International

Both reduced-sugar sports drinks and reduced-sugar energy drinks have managed to sidestep consumer concern over artificial sweeteners as two segments have successfully marketed themselves as fitness-forward products that can complement consumer fitness goals and aid in weight loss.

Bottled water remains the most consumed soft drink as other categories move in a sugar-less direction

Despite these pockets of growth, reduced sugar options that utilize artificial sweeteners cannot beat the trend of naturally sugar-free products. Health conscious consumers now have a wide variety of sugar-free beverages from which to choose from that do not use any sweeteners, and the market is only expanding.

The most significant category leading the trend is carbonated and flavored bottled water. Flavored bottled water, in particular has become a direct competitor to carbonates and has experienced sustained high growth, reaching 9% in retail value growth in 2019 with $2.7bn in retail value sales. It is important to note that the Euromonitor International flavored bottled water category includes also all sparkling flavored water brands such as La Croix and Bubly.

Overall, the bottled water category has been outpacing both carbonates and juice in terms of volume growth and retains the highest retail volume sales within soft drinks in the US. More and more consumers are stepping away from sweetened drinks towards water, and despite recent high growth trends for reduced sugar categories, the actual volume growth of bottled water is nearly twice that of actual volume gains of low-calorie carbonates, reduced sugar sports drinks, and reduced sugar energy drinks combined.

Preference for naturally sugar-free and lower-sugar products has also emerged among other beverage categories. Unsweetened packaged ready-to-drink (RTD) teas have gained in popularity and kombucha, which usually contains less than 10g of added sugar, has seen explosive growth.

Within RTD coffee, cold-brew has also seen high growth, and while the segment is still smaller than sweetened coffee, most new product launches within the category have been cold-brew products, leading the category in sugar-free innovation.

Current fitness trends and the continuing importance of indulgence within soft drinks have served to reinvigorate sales of reduced sugar products, but the larger health and wellness trend continues to favor naturally sugar-free products.

Aga Jarzabek is a research analyst at Euromonitor International.