"We serve less than 20% of US households, but we know that great tasting, natural foods are relevant to a lot more than 20% of the population,” adds Stokes, who joined Mars in June 2019, moved to KIND (as chief growth officer) in spring 2021, and took the helm of its North American business in October 2021.

And while CPG giants haven’t always done a great job of nurturing innovative challenger brands post acquisition, KIND has not been crushed by Mars’ corporate umbrella, observes Stokes.

“[In late 2020] Mars bought a well-established business with a view to nurturing what made it so attractive in the first place.

“They've been really clear they want us to remain totally autonomous. The KIND team sits in the KIND office at #3 Times Square, and other than me and a couple of others, there's no direct connectivity [with Mars], which is very deliberate,” adds Stokes, a Brit who headed across the Atlantic in 2002 to do an MBA at Harvard, and ended up sticking around… for the next 20 years.

“Where Mars helps, I think, is a bit more in the international markets, so in the UK and some other markets, KIND I think is really benefiting from the partnership [with Mars], but the North America business, we really operate autonomously.”

‘On a run rate basis, we’ll hit $1bn in US retail sales in the next couple of months’

This is especially the case when it comes to innovation, he adds: “The innovation model that we use today is the same one that [KIND founder] Daniel [Lubetzky] used when he was running the business directly. In fact, I still work with him on a weekly basis on some of the things that are coming through, and he’s stayed very engaged in the business.

“It's the same kind of small, lean hungry team that you'd associate with an insurgent brand even though we're getting close to a billion dollars retail [in the US] in the not too distant future.

“If you look at the scanner data, you’ll see we're about a billion-dollar retail sales business… on a run rate basis we'll hit that in the next couple of months. We had a great year last year, the brand grew 15% in the US which we were ecstatic about, so really robust growth that's carried nicely into this year as well.”

How successful has KIND been at innovating beyond its core?

So, what kind of success has KIND - which launched in 2004 - had in moving beyond its core fruit and nut bar portfolio in the US market?

Not everything the brand has touched has turned to CPG gold, says Stokes, but there have been considerably more hits than misses.

With the exception of pressed fruit snacks (which have now been discontinued) most new bar variants (breakfast bars, energy, thins, healthy grains, minis, etc) have helped drive incremental growth, although a brief foray into the refrigerated aisle didn’t set the world on fire, he observes.

In the frozen aisle, meanwhile, KIND Pints were not a hit and KIND smoothie bowls have had fairly modest sales, he said. However, the repeat rates for KIND’s new frozen bars suggest they have significant potential, says Stokes, who will be announcing some initiatives designed to encourage trial later this week.

“I really think that this can be transformative, it’s really a delicious product that’s made of ingredients that you can you can see and pronounce.”

‘KIND is the leading granola player in the US market now’

In the cereal aisle, oatmeal and granola have both performed well, he says. “KIND is the leading granola player in the US market now, which makes sense, because breakfast granola is basically a deconstructed KIND snack bar.”

KIND cereal, however, was a tougher nut to crack: “We found in that particular market while we had a great consumer proposition, we couldn't quite make the economics work because that's a big scale business with some very high-quality competitors, so we stepped back.”

Expandable consumption

While Stokes was not at KIND when COVID-19 hit, the brand did not experience the dramatic falloff in sales experienced by some performance nutrition brands in the early months of the pandemic, says Stokes.

“What we saw was that there was still plenty of demand out there, in fact, slightly more even than that in the pre-COVID times, but it shifted to bigger packs. We also found that our product has quite expandable consumption in the sense that if you have it in your pantry or larder, you're going to eat more of it. We’re continuing to see the big packs move, but the nice thing now is we're also seeing growth in the away from home channels again.”

E-commerce: ‘A lot of our focus has been looking at the tactics you can use to draw the best returns from retail media partner programs’

Like many brands, KIND saw a pick-up in e-commerce sales during the pandemic, adds Stokes: “For a long time we were in the single digits in terms of store.com sales [as a percentage of overall sales]. Now that the mobilities back, we're still hovering somewhere in the 12 to 15% range.

“Back in the day, we used to think about retailers and media partners, and now the lines have really blurred as a lot of retailers are our best media partners as well, so we've participated quite enthusiastically in all the [e-commerce] programs. I think that the hard thing is building the muscle, the capability, to get the most out of them.

“So just in my relatively short time here, a lot of our focus has been looking at what are the tactics you can use to draw the best returns from those retail media partner programs. A lot of it is about the pace… being able to experiment, do tests on a daily basis instead of the longer-term tests that some of us grew up with in the old marketing days.”

‘We serve less than 20% of US households, but we know that great tasting, natural foods are relevant to a lot more than 20% of the population’

While KIND has pretty good distribution in the US market (which it had achieved before the Mars acquisition), he adds, there is considerable runway to grow.

“The two areas I get excited about as we look forward are, first, having the right products in the right places, so we're investing a lot of time and effort in bringing insights to our retail partners: ‘This is what happens when we put this set on the shelf together.’

“And then there are still lots of places where we're not today. Think about all of these on the go channels… new retailers, new models, think about the Gopuffs of the world, so I think there's a lot of upside there as well.

“But my umbrella for all of it is thinking about household penetration. How do we bring more households into the brand, because we know that when a consumer tries a dark chocolate, nuts and sea salt KIND bar, they're going to buy another one.”

‘I spent Thanksgiving last year on a bunch of panic-stricken calls’

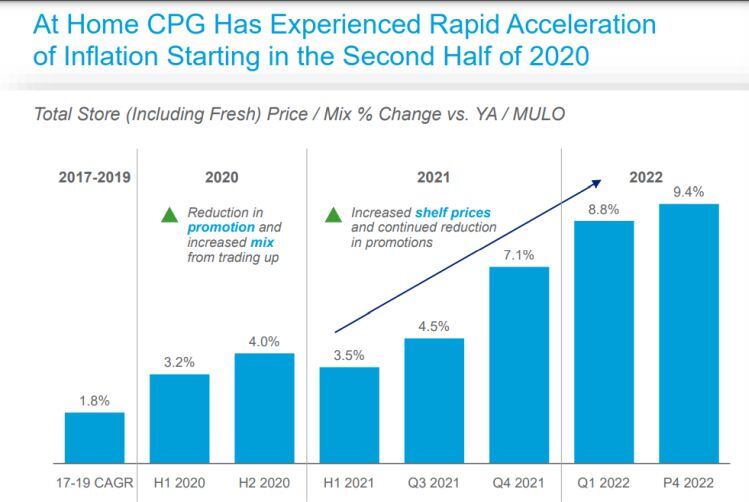

Asked how KIND is dealing with inflationary pressures and supply chain headaches impacting the industry more broadly, Stokes notes that the last few months have been a rollercoaster ride.

“I spent Thanksgiving last year on a bunch of panic-stricken calls when we realized that the oat crop in the US just wasn't sufficient for us and all of our competitors," he recalls. "So we did a lot of scrambling around, because KIND doesn't just source any kind of oats, we source gluten free, super high quality oats, so we're fishing in smaller ponds.”

As for pricing, he says: “We’ve had to work hand in hand with all of our value chain providers to make sure number one, we had enough ingredients to make and sell the product; and number two, that we could drive as much efficiency as we could to offset costs. But like everyone else, we’ve had to pass some of it on, so last year, we took a 5% price increase.”

Back to school promotions

Like many brands, KIND is planning to step up promotional activity later this year, but is being judicious, he says:

“We're trying to build a bit of a season for our business around back to school when we want to put our bars in front of as many American families as possible, as that's a promotion with a clear view to a long-term return. The objective is bringing more households into the current franchise."