In its Q4 2022 financial earnings report, Costco's net sales for the quarter increased 15.2% to $70.76bn compared to $61.44bn in Q4 2021. In the US, sales were up 9.6% (excluding gas inflation) for the quarter compared to the same period last year.

Costco reported a 5.2% (7.2% worldwide) increase in shopper traffic for the quarter compared to Q4 2021. In addition, the average transaction amount was up 10% in the quarter in the US (up 6% worldwide).

Speaking on the company's Q4 2022 earnings call, Costco CFO Richard Galanti said that consumers are increasingly recognizing the value mass and club stores can offer during times of economic uncertainty.

"That’s the one thing I think we’re good at, is figuring out how to drive people into the door with hot items, and that’s helped us as well," said Galanti.

Light at the end of the tunnel?

Costco Grocery sales were up 20% for the quarter compared to the same period last year with the best-performing categories being candy, frozen, and bakery and deli, noted Galanti.

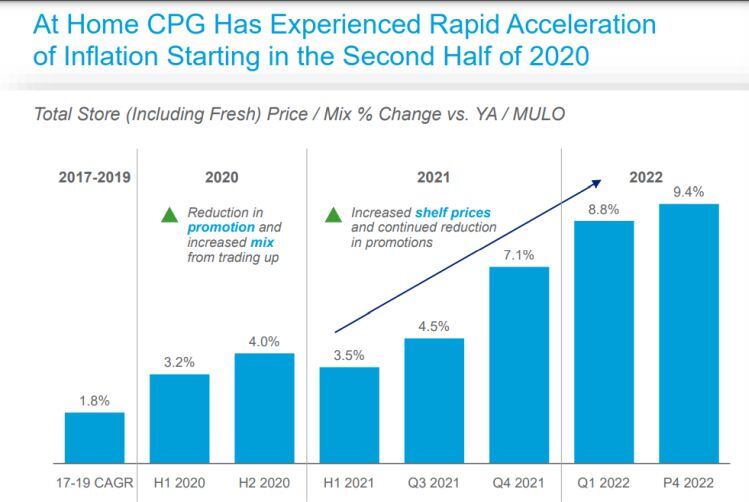

While the latest Consumer Price Index (CPI) for food at home was up 13.5% on a year-on-year basis in August 2022 vs. August 2021, Costco has managed to keep the cost of its products somewhat tame, according to Galanti.

"For the fourth quarter and talking with our merchants, the estimated price inflation overall was about 8%," he said, adding that the company is seeing commodity pricing for key commodities come down slightly signaling "some beginnings of some light at the end of that tunnel."

Kirkland Signature

So how are consumers shopping at Costco? And is the retailer noticing trade-down behavior from shoppers looking for the best possible deal?

Answering analysts' questions about shifts in shopping behavior, Galanti said, "Many of you have asked about private label with the recent inflationary environment and what’s happening, are people trading down? And of course, our first response, of course, is they’re not trading down. They’re trading up or certainly trading the same."

For Costco's main private label offering, Kirkland Signature, which cuts across several categories from fresh foods and frozen to floral and personal care, penetration is up 28% year-over-year and increasing slowly and steadily.

In its broader food offering including fresh, frozen, bakery, and other merchandise, the retailer is in good shape in terms of inventory levels which struggled last year due to high consumer demand combined with supply chain disruptions, said Galanti.

"In all, despite current inflation levels, we believe we continue to remain competitive versus others and able to raise prices as cost increases, hopefully, of course, a little less than others with whom we compete," he said.

'There are no specific plans regarding a fee increase at this time'

Costco, which requires a paid annual membership to shop in its stores, saw an increase in the membership fee income, up 7.5% to $93m. Excluding the impact of the foreign exchange market, gains would have been +10% or $29.8m higher, noted Galanti.

In terms of membership renewal rates, the company hit all-time highs in Q4 2022 with 92.6% of Costco members renewing their annual membership. Worldwide, renewal rates were 90.4% for the quarter.

By the end of Q4, Costco reported 65.8 million paid household members and 118.9m Costco cardholders, an increase of 6.5% compared to the same quarter last year.

More paying members

Executive members, the highest paid membership tier, now represent over 44% of members and just under 72% of our worldwide sales, according to Galanti.

"During these last several years, we’ve continued to get better at talking you into signing up -- selling you on the value of that executive member upfront. So, we’ve seen increased penetration there too," he said.

Galanti also commented that the retailer has no plans to increase the price of its three different membership offerings: Gold Star ($60 annual fee), Business Membership ($60), and Executive Membership ($120).

"In terms of membership fees and a possible increase, there are no specific plans regarding a fee increase at this time. We’re pleased with our growth in both, top line sales and membership households over the last several quarters, and member loyalty is reflected in increasing member renewal rates. We’ll let you know when something is about to happen," said Galanti.

Another thing that won't be changing is the retailer's $1.50 price for its hot dog and soda combo at its store food courts, said Galanti.

"At the end of the day... I don’t think we necessarily look to find places where we can harvest margin," he shared.

"It’s all about driving volume. If we can incrementally get another percentage point of comp sales, that does more than any kind of harvesting we would ever want to do, which we don’t do."