Annual sales of "pumpkin" flavored products reached $488.8m in the 52 weeks ended Aug. 25, 2018, representing 15.5% growth from 2017 numbers and an all-time high for the past five year, Nielsen noted.

In the week ending Aug. 25, 2018, sales of products with pumpkin flavorings hit $6.9m, a 10% jump in dollar growth from the same time last year, according to Nielsen data.

“For the past several years, pumpkin flavoring has swept through stores each fall,” Nielsen noted.

“And brands continue to jump on the autumnal bandwagon, bringing to market new pumpkin-flavored offerings across categories. These new offerings are benefiting from this popular fall flavor.”

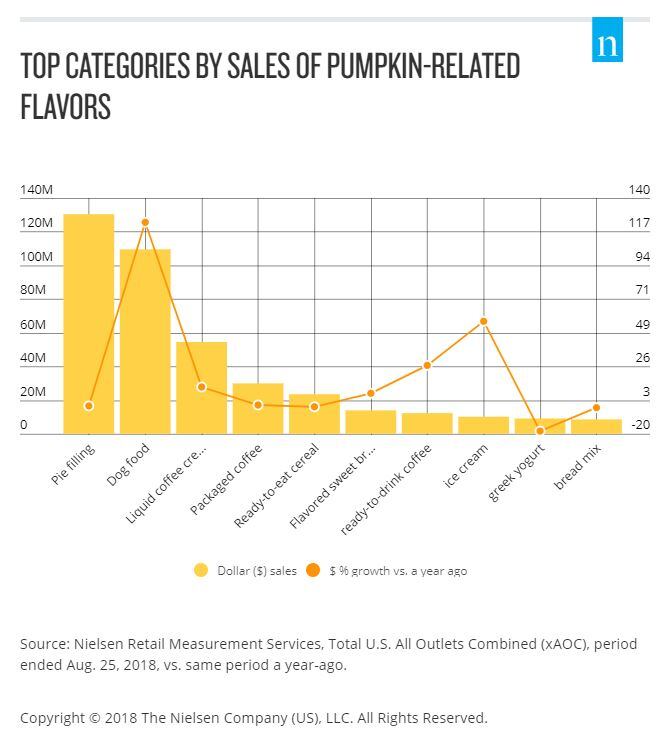

Popularity of pumpkin products vary by category and perennial staples such as canned pumpkin pie filling (available year-round) haven’t fared as well as other offerings. Pumpkin pie filling recorded a 1% drop in sales for the 12 months ending Aug. 25, 2018, compared to the same period last year, but still represents the largest share of the pumpkin market with more than a $130m in sales.

Steeper declines were seen in ready-eat-cereal (-1.8%), bread mix (-2.5%), and Greek yogurt (-18.2%).

Areas that registered double- to triple-digit growth include ice cream (56.2%), ready-to-drink coffee (26.5%), and liquid coffee creamer (11.9%). Dog food saw the most staggering increase in sales growing 123% this year compared to last year.

In food, ice cream products featuring a pumpkin flavor saw the largest growth compared to last year. Low-calorie ice cream brands Halo Top and Enlightened each debuted their seasonal offerings this past weeK:

Pumpkin-spice shares spotlight with other fall flavors

Four in five consumers say they look forward to fall seasonal items the most, Mintel research showed.

And the return of fall has also brought back pumpkin spice popularly featured in coffee shop drinks and baked goods. However some research shows pumpkin spice may not be as hot among consumers as it once was.

Broken down, pumpkin spice is a blend of versatile set of spices (cinnamon, nutmeg, allspice, clove, and ginger). Individually, each spice has grown in sales yet dollar growth for pumpkin spice specifically is down 2.2% compared to last year, according to Nielsen.

Menu mentions of pumpkin at frequented chains including Starbucks, Tim Hortons, and Caribou Coffee were down 30% from between the 2015 to 2017 fall seasons, Mintel Menu Insights found.

According to Amanda Topper, associate director of foodservice research at Mintel, quick service restaurants (QSR) are expanding their fall coffee menu with flavors such as chestnut praline, horchata, maple pecan, and vanilla cardamom.

However, pumpkin spice is not going anywhere but there is room for offering limited-time that are a twist on familiar flavors such as caramel, vanilla, and butterscotch, Topper noted.

“Good or bad, pumpkin spice is here to stay with operators like Starbucks and Dunkin’ Donuts likely to continue offering the ‘classic’ flavor during the fall season,” she said.

“However, as these declines show, there is room for additional flavors that can appeal to consumers that are not among the pumpkin spice faithful. Operators should consider offering a variety of fall seasonal coffee flavors, featuring new and classic options, to appeal to a wide consumer base.”