Digital sales across the food retail landscape have grown considerably during the pandemic with retailers registering record revenue numbers. Comparatively, Kroger (for the 13 weeks ended on Aug. 15, 2020) saw digital sales increase 127% in Q2 2020. Walmart, which already had a robust online presence, saw ecommerce sales grow 97% for the 13 weeks ended July 26, 2020 (albeit off a much larger base as Walmart registered $137.7bn in total revenue in its Q2 2021 earnings).

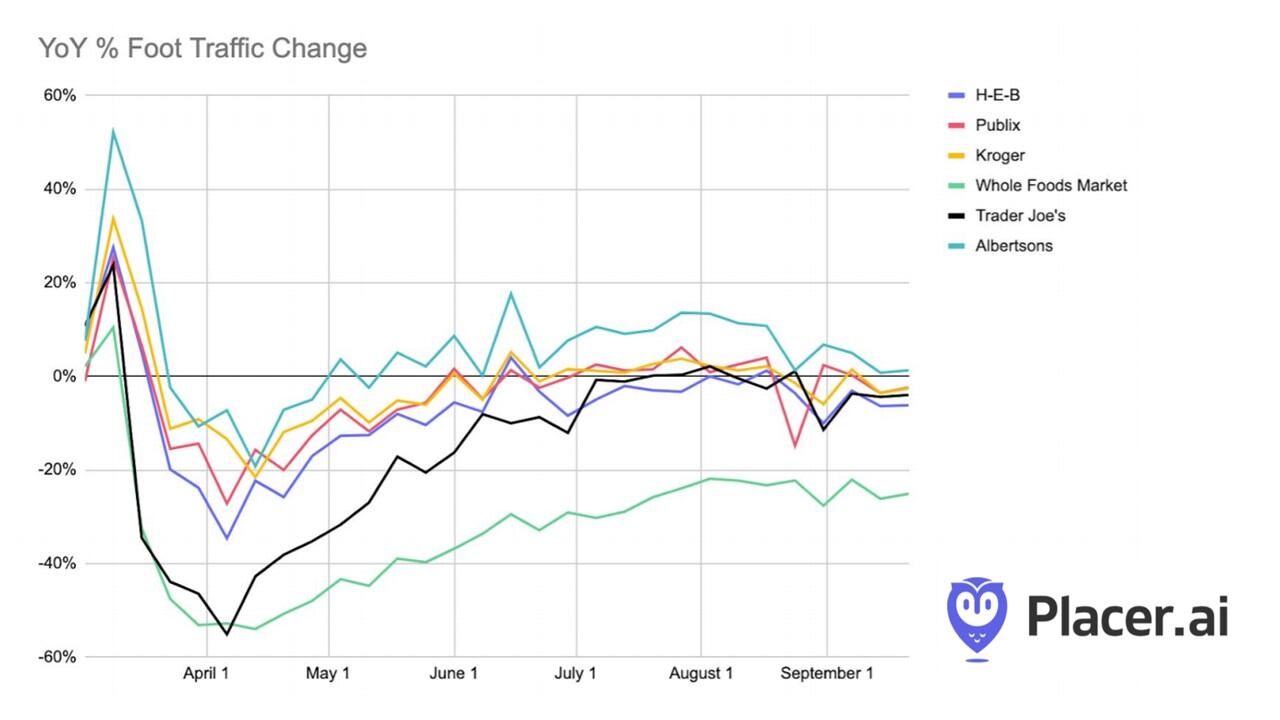

Speaking during the company's Q2 2020 earnings call, Albertsons president and CEO Vivek Sankaran said, "Many customers have shifted their shopping habits during the pandemic and we’ve adapted quickly. We are seeing customers are continuing to come to our stores less often but are buying much larger baskets including new categories as we fill their one-stop-shopping needs."

"This enduring shift in shopping habits is confirmed daily, despite the economy opening in most parts of the country. Importantly, all income segments have increased their spend with us. We are increasing our traction even with lower income shoppers who generally come a bit more and spend less per trip."

Albertsons' nine different private label lines comprised of more than 12,000 unique items have been a crucial sales driver for the company, noted Sankaran.

"On average our own brands drive a 1,000 basis point gross margin advantage compared to the national brands," he said.

'Signature', the company's mainstream private label brand available across its multiple store banners, is outpacing total store growth up over 15% in sales in Q2 2020.

As a result, the retailer is continuing to invest into its private label business with new products and assortment.

"We continue to innovate and introduce new items to the portfolio launching over 650 items so far this year as we expand into new categories," said Sankaran, who added that the company's two organic lifestyle brands (O Organics and Open Nature) together posted sales growth of 13.1% in Q2 with the addition of 39 new SKUs.

E-commerce takes off

Albertsons has seen its e-commerce solutions drive incremental household spend across all

customer segments, noted Sankaran.

"On average we see a 27% increase when in-store customers engage in e-commerce. It’s even more incremental with our less engaged customers who increased their spend with us 2.7x when they use our e-commerce solutions," he said.

Many e-commerce customers are using and continuing to order groceries for home delivery and through the retailer's expanding network of Drive Up and Go (DUG) pickup locations, according to Sankaran.

"Digital sales grew 243% year over year in Q2 driven by new customer acquisition precipitated in part by the addition of over 200 Drive Up and Go (DUG) stores bringing the total number of DUG locations to 950," he said.

By the end of the current fiscal year Albertsons said it will have 1,400 DUG locations within its store network and is on track to hit 1,800 locations by the end of fiscal year 2021.

To further support its digital business and e-commerce growth, Albertsons will be adding six new micro-fulfillment centers over the next 18 months.

"We are also very pleased with our progress of micro-fulfillment centers (MFCs). In fact, this quarter we saw an increase of over 25% in labor productivity in our two MFCs as we optimize this capability."

Shopper loyalty on the rise

Albertsons is seeing increased shopper adoption of its loyalty program, 'Just For U', which offers individual households personalized deals and promotions based on their spending habits.

The company has 23.5 million registered users enrolled in the loyalty program to date, an increase of 5 million users from the prior year.

"We’re finding that our customers love the personalized coupons and this approach is driving broader and deeper engagement as well as incremental purchases," said Sankaran.

"We saw an increase in our engaged households by nearly 11.3% quarter over quarter. This is important as on average the loyalty engaged households spend nearly 3.5x more per week than an under engaged loyalty household."

Looking ahead to its full fiscal 2020 outlook, Albertsons has forecasted a sales increase of at least 15.5% with digital sales continuing to be the driving force behind its growth.