Annual inflation for food at home surges 10%, calling into question future elasticities

This is the sixth straight month the CPI, which measures how much consumers pay for goods, has increased with the trajectory becoming progressively steeper each month since the start of the year – pushing back against previous predictions that inflation would start to slow by this point.

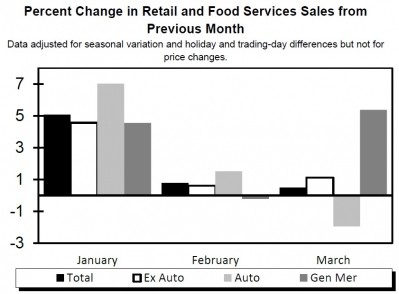

Month-over-month, the CPI for all items jumped 1.2% in March – a significant step up from the 0.8% increase reported in February and the 0.6% increase reported in January, according to data released this morning from the Bureau of Labor Statistics.

For all food, month-over-month inflation growth has flattened but remains steady at 1% in March following the same increase in February and a 0.9% increase in January. Food at home, however, is increasing at a faster pace month-over-month with a 1.5% jump in March, 1.4% in February and 1% in January, according to BLS.

In addition to food, energy (up 11% in March) and shelter (up 0.5% in March) were the main contributors to the increase in inflation during the month over February. In each cast, the trajectory of inflation is becoming steeper month-over-month, suggesting the overheated economy may not cool as quickly as some anticipated even as the Fed considers drastic actions to curb inflation.

The steady rise prompted the Fed to increase interest rates 0.25% in March for the first time since 2018, and is pushing it to consider raising the rate an additional 0.5% at its upcoming May meeting -- double the more traditional quarter point increase.

Produce prices rise month-over-month, but meat leads for full year

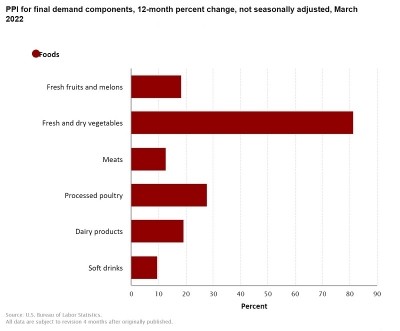

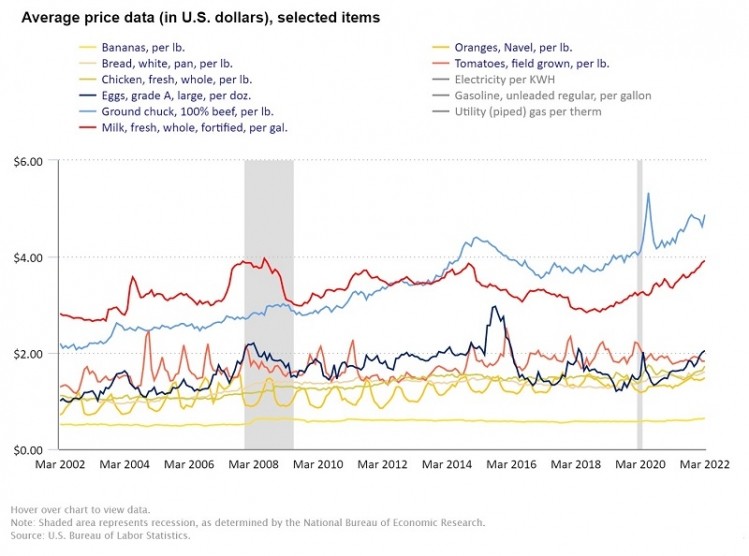

Within food, all six major grocery store food goop indexes increased in March, with the sharpest jump in fruits and vegetables at 1.5% following a 2.3% increase in February, according to BLS. As such, the price of navel oranges has jumped from $1.30 a pound in January 2021 to $1.45 in February 2022. The price of bananas increased to 63 cents per pound in February compared to 60 cents in January 2021.

While notably higher than the month-over-month increases in the meat, poultry, fish and eggs index (up 1% in March), and the index for nonalcoholic beverages and dairy (both up 1.2%), the increase for fruits and vegetables was the same as for cereals and bakery products.

Despite the sharp uptick in prices in the last two months, the index for fruits and vegetables at home lands in the middle of the pack for the last 12 months for a year-over-year increase of 8.5%.

Leading for the full year is the index for meat, poultry, fish and eggs, which is up 13.7% for the 12-month period. Within this index, the price ground chuck beef increased from $4.31 per pound in January 2021 to $4.87 in March 2022.

Following the meat index, was growth in other food at home at 10.3% and cereals and bakery products at 9.4%.

Coming in just under the inflation for fruits and vegetables is that of nonalcoholic beverages and beverage materials, up 8%, and dairy at 7%, according to the BLS.

Prices for food will likely continue to go up before they stabilize or drop as the Ukraine crisis places pressure on already vulnerable food supply chains – especially for grains and sunflower oil – but also on the availability of fertilizer, which could negatively impact American farmers' production costs and potentially yields in the coming years.

How long will elasticities hold?

While food sale elasticities have held well above those associated with historic consumer reactions to price increases, there are indications that shoppers may be pulling back or starting to trade down.

According to the Commerce Department, the growth of US spending slowed in February to 0.2% from January when spending shot up 2.7% from a dip in December that was most likely related to omicron cases surging and consumers retreating back to their homes.

Grocery shoppers also may be starting to feel sticker shock as many CPG manufactures consider yet another round of price increases and other cost management strategies, including maintaining price points but shrinking pack sizes.

Likewise, private label sales are also ticking up -- and indication of consumers becoming more price sensitive and looking for ways to reduce their grocery bills. According to the Private Label Manufacturers Association, sales of private label goods rose 6.5% in the first quarter year over year -- marking the third consecutive quarter of growth.

Private label sales in grocery are increasing most notably in deli-prepared and bakery, up 14.9% and 12.4% respectively in the first quarter of 2022.