Thom King, CEO of Icon Foods, which supplies a wide range of sweeteners from stevia and monk fruit to coconut sugar, erythritol and allulose, said: “Our R&D is stacked up four months out and we are expanding our lab to accommodate all of the brands looking to cut out added sugars.

“We have found the number one consumer driver is natural or clean label, followed by glycemic index and keto friendly.”

Stevia: Growing adoption

Drilling down into specific sweeteners, he said that stevia had come a long way in recent years as better-tasting steviol glycosides hit the market: “We are seeing a growing adoption, though there is a segment of the food community that still feels there are too many off-notes to overcome.”

RA99M – the latest product from Icon Foods – combines Reb A (the most prevalent steviol glycoside in the stevia leaf) and Reb M (a more scarce, but better tasting glycoside), and works particularly well in beverages and powdered drink mixes “where off-notes are deal breakers and erythritol is not an option,” said King.

“All stevia extracts have certain off notes and combining glycosides can create a masking effect. In the case of RA99M, the combination of Reb A 99 and RebM mask each other’s slight off notes. Additionally, there is a tremendous cost saving over simply using Reb M, which can be in excess of $450 per kilo.”

Icon Foods also distributes enzymatically treated steviol glycosides from Chinese firm BioLotus, he said: “We have found significant improvements in taste as well as yield are observed for all the Icon Foods glucosylated steviol glycosides. Are they natural? Yes. Is it a stevia leaf extract? No. But it definitely has a cleaner flavor and there is a significant cost saving.”

Monk fruit steadily growing in popularity

Monk fruit, meanwhile, is “steadily growing in popularity and costs have come down quite a bit since plants are able to scale,” although it is still more expensive than stevia, he said.

“We have found the combination of stevia and monk fruit to be the most popular since they mask each other’s off notes.”

Erythritol still a strong seller

While some consumers are avoiding sorbitol, mannitol and maltitol; erythritol is still a “very strong seller and growing market,” he added, although “pricing became a little choppy in fourth quarter of 2018 because of potential tariffs which have subsequently been postponed… Sugar alcohols continue to grow as fast as keto since they are the preferred keto sweeteners.”

Coconut, agave, maple

As for nutritive sweeteners that serve as sugar alternatives, he said, “Coconut palm sugar is our biggest selling nutritive sweetener and is still growing since it is Whole30 approved as well as Paleo. Brown sugar is also a solid seller.

“However, agave is flat and maybe down slightly since it is high in fructose and can take people out of keto. It is paleo and Whole30 but more refined than coconut palm sugar. We also have maple sugar and organic cane sugar and xylitol which are all steady movers.”

Allulose: 'This is a true game changer'

However, the real excitement right now is around allulose, a bulk sweetener that tastes and behaves like sugar but which no longer needs to be reported as an added sugar as it contributes virtually no calories and has no impact on blood sugar, he said.

“There will be thousands of new products coming out in the months to come… We have literally dozens of formulations we have queued up for customers just waiting for this ruling [from the FDA]. This is a true game changer in the sweetener category.”

Cargill: ‘Eversweet enables deeper calorie reductions than we’ve been able to achieve previously’

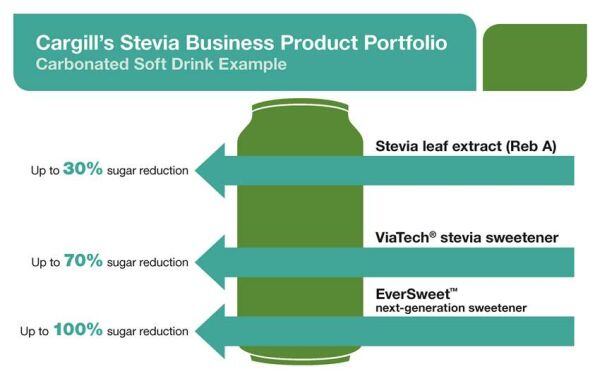

Andy Ohmes, global director of high intensity sweeteners at Cargill, said stevia was “growing significantly and will continue to be part of our growth strategy in the future.”

He added: “Truvia, our Reb A stevia leaf extract sweetener, is a great choice for small sugar reductions of less than 30%. ViaTech, also from the stevia leaf, can help with mid-range sugar reductions of 50-70%. For the really deep sugar reductions – up to 100% in many applications – we offer EverSweet, which is made through fermentation.”

EverSweet enables “deeper calorie reductions than we’ve been able to achieve previously,” he said. “For example, we’re seeing interest in beverages aimed at the sports nutrition market. Historically, formulators relied on sugar to mask off-flavors from the higher protein levels. EverSweet can help deliver the same results, but it keeps added sugar levels in check.

“Dairy is another space where product developers are feeling pressure to reduce sugar levels, but great taste is paramount. The flavor profile of EverSweet shines in these applications, which historically has been challenging, given the higher protein tends to suppress sweetness.”

He also noted strong demand for erythritol, which he said was “enjoying an uptick in use, with launches made with the ingredient doubling between 2012-17, according to Mintel. The frozen dairy space, in particular, continues to show heightened interest in using erythritol to formulate reduced-sugar options.”

Beneo: Palatinose is being used in over 40 products in the US market and growing

Beneo - perhaps best known for its chicory root fibers, which are widely used as a sugar reduction tool – said it was particularly excited about US demand for ‘slow carb’ isomaltulose (sold by Beneo under the brand name Palatinose), which is manufactured by the enzymatic rearrangement of sucrose from beets.

Tooth friendly Palatinose - which comprises glucose and fructose like regular table sugar but does not have the same impact on insulin and blood sugar – is “being used in over 40 products in the US market and growing,” said a Beneo spokeswoman.

While Palatinose has four calories per gram like regular sugar, it has a lower glycemic index and is digested more slowly than sugar, and is being marketed by brands keen to highlight its unique properties in their branding and marketing.

“The major categories include sports nutrition, performance and energy beverages, special nutrition, and meal replacement.”

Key brands using Palatinose include Endure by Kill Cliff, a sports drink marketed as providing sustained energy and fat oxidation; Xe Energy Multipler energy drinks by Well Beyond that are marketed as natural energy drinks without preservatives, artificial colors, sweeteners, or flavors; and BYLT by Elite Beverages, which is marketed as a natural beverage with Palatinose positioned as a “smart carb” allowing for “extended energy and fat oxidation*.”

* A 2016 study published in the journal Nutrients by Professor Daniel König and his team at the Department of Sports and Sport Sciences of the University of Freiburg, Germany, shows that with a pre-load of Palatinose, endurance athletes “maintained a more stable blood glucose profile and higher fat oxidation, which resulted in improved cycling performance compared with maltodextrin.” A 2017 study in Nutrients led by Professor Jeya Henry at the Singapore Institute for Clinical Sciences, also shows that Palatinose did not have the same effect on volunteers' blood sugar as sucrose, and improved fat burning.

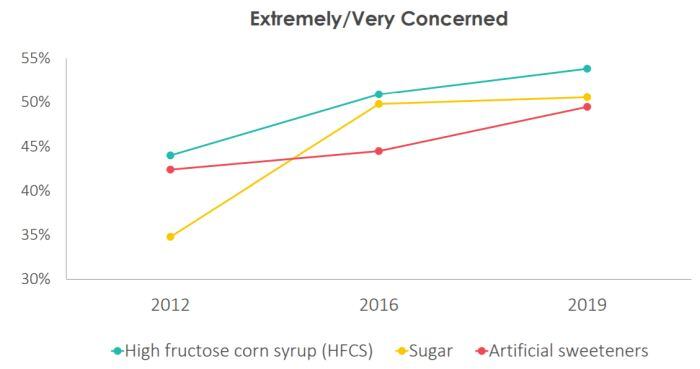

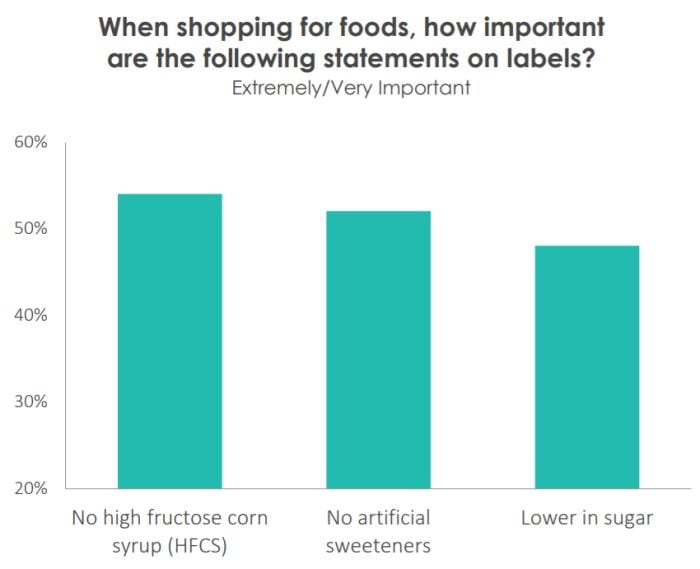

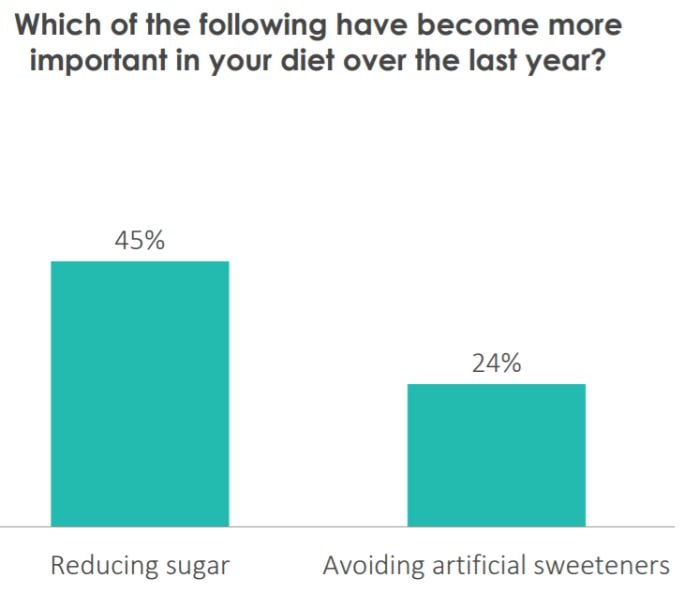

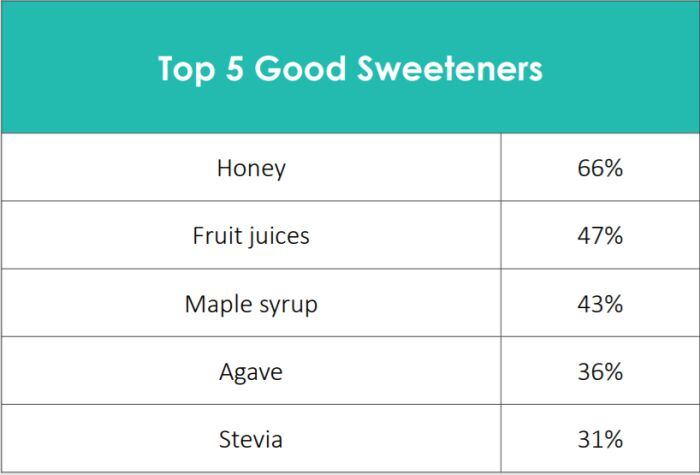

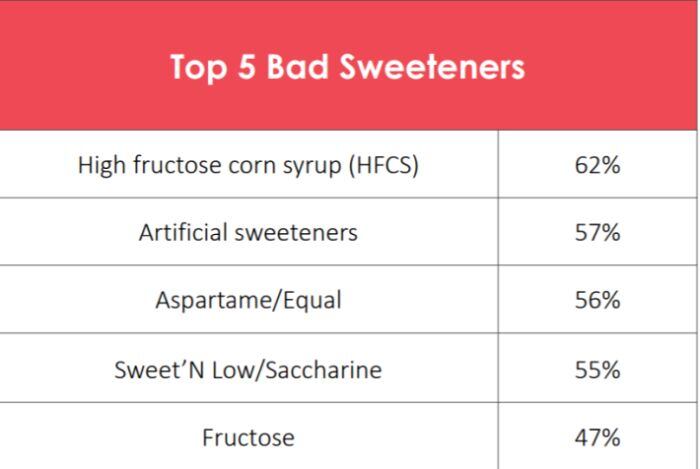

According to HealthFocus International’s 2019 USA Trend Study: Shoppers’ Journey Towards Living & Eating Healthier – which was conducted in November-December 2018 with 2,000+ respondents – the top five sweeteners for US consumers are honey, fruit juices, maple syrup, agave, and stevia, while the top five ‘bad’ sweeteners are high fructose corn syrup, artificial sweeteners, aspartame/Equal, saccharin/Sweet’N Low, and fructose.

Interested in sugar reduction? Checkout our FREE webinar on April 30, where deputy editor Elizabeth Crawford will lead an expert panel of speakers through a 45-minute discussion on how consumers’ views on sugar are changing the way they shop, and as a result the way food and beverage manufacturers are making products. You'll then get the opportunity to quiz panelists from Lily's Sweets, ALOHA, NuNaturals and more at THE SWEET SPOT: REDUCING SUGAR WITHOUT REDUCING FLAVOR.