It is also introducing 100% plant-based yogurts and mix-in products under the Chobani Oat brand, and launching a line of yogurt cups with oatmeal on the bottom and Greek yogurt on top (a reworking of a range introduced in 2014 and withdrawn in 2015).

While the US oatmilk category is still in its infancy (SPINS data for the 52 weeks to October 6 show US retail sales of shelf-stable and refrigerated oatmilk were around $60m, although this excludes Whole Foods Market) it is growing at an explosive rate, Chobani president Peter McGuinness told FoodNavigator-USA.

“It’s a relatively crowded, small but rapidly growing market with Planet Oat [from HP Hood] at #1, Silk Oat Yeah [from Danone North America] at #2, and Oatly at #3, but we think the market will continue to grow 4,5,6x.

“Oats are cover crops, they are extremely environmentally friendly, and they deliver great taste and nutrition, so they are the king of the plants right now. We’ve also been monitoring what’s happening the cafes, because oat works really well with coffee, much better than soy or almond.”

But the product and the brand has to be right, he said, referencing PepsiCo’s abortive attempt to get a slice of the action with the ill-fated Quaker Oat Beverage (read more HERE).

“The fact that Quaker Oat Beverage was discontinued so quickly is remarkable; this is a brand that has been known for oats for a hundred years.”

Chobani has deliberately steered clear of the term ‘oatmilk’

The label – ‘Chobani Oat’ - does not feature the word ‘oatmilk,’ which was deliberate, said McGuinness.

“Words matter and I think there’s a tremendous amount of confusion [with the use of dairy terms on plant-based products]. If you call something oatmilk, some consumers think you’re combining oats and dairy milk [something the Good Food Institute and the Plant Based Foods Association say is not backed up by consumer research] and we do think there will be regulation on this so we wanted to be on the right side of that from the beginning.”

(Rival Danone North America – which owns the Silk Oat Yeah brand and uses the term ‘dairy-free oatmilk’ on the label - takes a different view, recently telling the FDA that banning terms such as oatmilk or almondmilk that help shoppers understand how to identify and use its products “could make it more challenging for consumers to find the products they want on shelf and to understand what they are buying.”)

It was important to Hamdi that we make the products ourselves

From a formulation perspective, Chobani is bringing a trusted brand to the category using organic oats that are sun/air dried and do not use glyphosate as a dessicant, he said, and it has invested a significant sum to manufacture the products in-house at its Twin Falls plant in Idaho:

“It was a massive engineering undertaking but it was important to [Chobani founder] Hamdi [Ulukaya] that we do this ourselves to control the quality and craft and customer service. We’re delivering superior taste, texture, color and quality.”

Like Oatly, Chobani is making its oat base (from water and whole grain organic oats) using an enzymatic process to break down the starch naturally contained in its oats into simpler sugars, primarily maltose and glucose, which delivers an appealing flavor, said McGuinness. Sugar levels are roughly in line with the competition, while calcium is added, he added.

Ingredients, Chobani Oat (plain): Oat blend (water + whole grain oats), 2% of less of canola oil, sea salt, nutrient extract blend (fruit & veg sources), calcium carbonate, gellan gum, tricalcium phosphate, dipotassium phosphate.

Sugar levels: A 240ml serving of Chobani Oat plain contains 100 calories, 2g protein, 2g fiber and 8g sugar (to put this into perspective, dairy milk naturally contains 13 sugar per serving).

Pacific Foods oatmilk has 17g sugar, Dream Oat Beverage has 11g, Oatly Original has 7g, Happy Planet Original has 5g, Silk Oat Yeah and Planet Oat have 4g, and Califia Farms’ unsweetened oatmilk has 2g.

Creamer category ripe for disruption

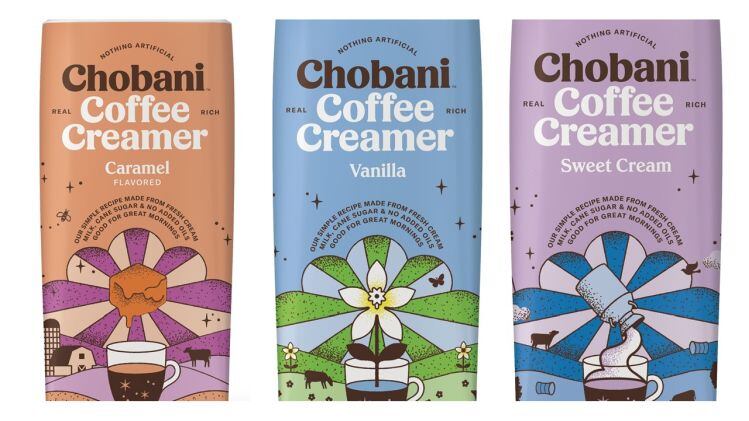

The move into the $3.5bn creamers category - which is dominated by Nestlé (coffee mate) and Danone (International Delight) "companies making creamers with no cream in them" - was a natural move for Chobani, which is coming in with a simple combination of fresh cream, milk, cane sugar and natural flavors (Caramel, Sweet Cream, Hazelnut, and Vanilla), said McGuinness.

"The creamers space is really interesting. The average age of that first interaction with coffee is now 13 years of age, and when you're a teenager drinking coffee, you like the idea of coffee, but not the taste of coffee, and you're drinking it light and sweet. When you talk to Dunkin Donuts, probably 95% of their coffee goes out light and sweet.

"But what many people may not realise when they are adding creamer is that the first three ingredients are water, sugar and vegetable oil [typically palm oil or soybean oil] and we think it's only a matter of time before people look at that and say, woah, I didn't realise I was pouring oil in my coffee. Most consumers think creamers contain cream."

'What you put in your coffee matters'

He added: "When we came into the yogurt category 12 years ago it was dominated by two big companies, Danone and Yoplait, making yogurt with sugar in the low 30s in grams and we came in with a product with 16g that was higher in protein, and it wasn't until someone came in and put out a better option that consumers realized what they were eating, and they migrated to the higher protein, lower sugar options.

"So we're going into new categories with the same playbook. It's what we call our DNNA: products that are delicious, nutritious, natural, and affordable. We think by putting a better option out there, we'll grow the market. What you put in your coffee matters."

From a manufacturing perspective, moving into creamers is also a logical move for Chobani, which has a lot of fresh cream in its factories from the yogurt-making process, he added.

Asked how Chobani creamer compared with half & half (half whole milk, half heavy cream) he said: "There's very little difference other than the sugar and the flavor - and we've got a little bit more cream than there is in half & half. We're going to look at developing half & half, which is another billion dollar market."

Dollar sales at Chobani up 9% in 2019

Critically all of the products launching in the coming weeks are incremental both to Chobani and to the categories in which they sit, said McGuinness, who said said Chobani's dollar sales were up 9% this year (Nielsen, US Food, 2019 YTD through 11/2/2019), significantly outpacing the overall yogurt category, which has just moved back into growth over the past 13 weeks.

Chobani Oat drinks: Launching in January 2020 (MSRP $3.99/52oz carton), they are designed to be consumed by the glass or added to coffee, cereal or smoothies. They come in Plain, Vanilla, Chocolate, and Plain Extra Creamy, with a barista blend appearing at on-premise retail shelves in December 2019.

Chobani plant-based Oat Blend cups: Launching this month, these are available in Vanilla, Strawberry Vanilla, Blueberry Pomegranate, and Peach Mandarin (MSRP $1.99/5.3oz cup). Each cup is made with a blend of water and organic whole grain oats, cane sugar, taioca flour, coconut, pea protein, locust bean gum, and live and active cultures.

Chobani Oat Blend with Crunch: Launching this month, these are available in Strawberry Granola Crunch, Blueberry Almond Crumble, and Peach Coconut Crunch (MSRP $1.99).

Chobani Greek Yogurt with oatmeal: With 4g fiber per serving, the cups are available in four flavors: Peach with brown sugar oatmeal, Banana with maple oatmeal, Apple Spice with brown sugar oatmeal, and Blueberry with maple oatmeal (MSRP $1.79/5.3oz cup).

Chobani Coffee Creamers: Hitting shelves in January 2020 (MSRP $3.99/24oz bottle), they are available in four flavors: Caramel, Sweet Cream, Hazelnut, and Vanilla.