Findings in the IRI Pacesetters report surveyed consumer behaviors and brand performance in 2019, during a pre-COVID-19 world.

"Only time will tell if the penchant for new products among certain groups will waver, or if new groups will become more inclined to explore new products," noted IRI.

Resurgence of the $100m brand

"For years, I’ve been talking about almost the death of the $100m launch, and this year it is truly that reversal.This year we didn't have big launches, we had gargantuan launches," Larry Levin, IRI executive vice president of consumer & shopper marketing, sales and thought Leadership, told FoodNavigator-USA.

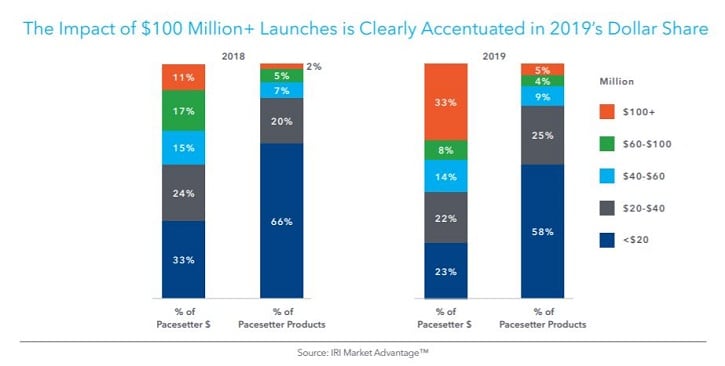

"If you've been following IRI New Product Pacesetters both on the food and beverages (F&B) side and the non-food side, there's always five or six $100m launches; this year we had ten. What really fascinated me was that the ten [$100m launches across F&B and non-food] made up 33% of Pacesetter dollars."

In 2018, just 2% of new product launches came from $100m brands, accumulating 11% of dollar sales. Looking at 2019, 5% of launches came from $100m brands and accounted for 33% of dollar sales.

New beverage takeover

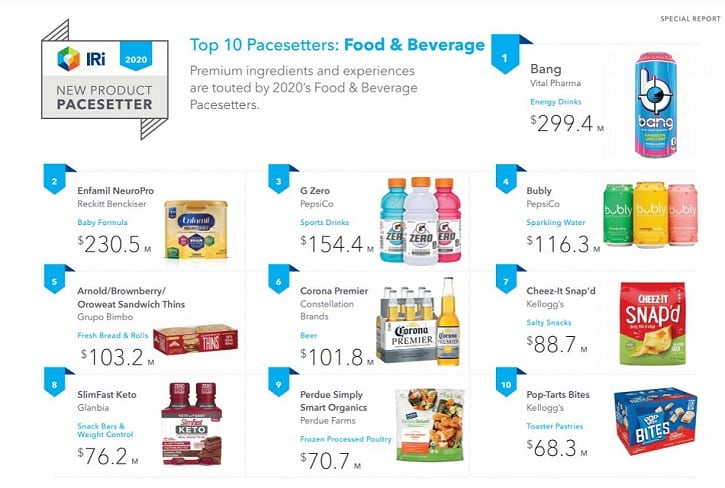

Of the top ten CPG launches of 2019, six of the top ten are beverages, according to the report: Bang (Vital Pharma), G Zero (PepsiCo), Bubly (PepsiCo), Corona Premier (Constellation Brands), and SlimFast Keto (Glanbia).

"In my opinion a couple of the beverages either are or masquerade as coming from small companies (referring to Bang and Bubly)," said Levin.

Asked whether it was fair to draw the correlation between big marketing and advertising budgets and big sales, Levin said not quite.

"With a product like Bubly, we found that of the total revenue between c-store and MULO, that about 25% to 30% of those dollar sales were associated with advertising. And that tends to be a rule thumb with big companies," he said.

"But when you look at Bang, there was hardly any money from a mass media perspective, but Bang made its impression on consumers through social media."

According to IRI, Bang spent just $2,200 on traditional media and generated almost $300m in multi-outlet sales. On social media, Bang has garnered 1.5 million followers on Instagram vs. 1.3 million Instagram followers of G Zero.

"Energy drinks always have a rightful spot in New Product Pacesetters," said Levin. "There's always a market for energy drinks, if you look at c-store sales energy drinks continue to grow ~10% year on year for at least two years in a row. Beverages in general have been a critical growth engine in this c-store channel."

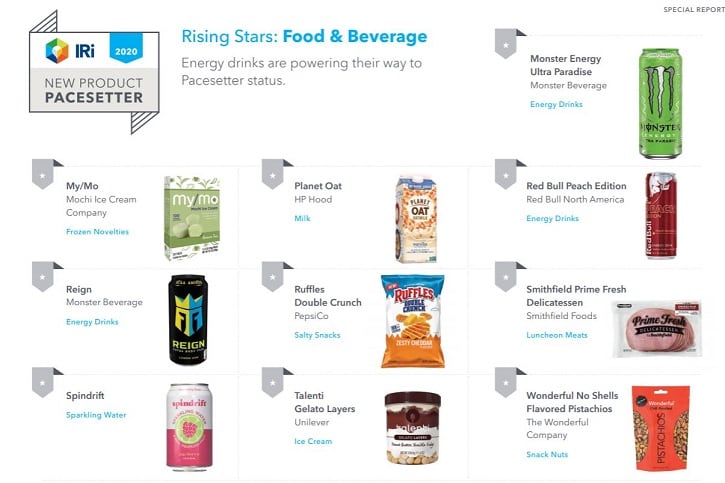

Looking at IRI New Product Pacesetters List of 'Rising Stars', three of the featured brands fall into the energy drink category: Monster Energy Ultra Paradise, Red Bull Peach Edition, and Reign (Monster Beverage).

"I think that a lot of the brands on the Rising Stars list are going to make their way onto the [2020] Pacesetters list because they were developed and sealed their pacesetter status before COVID or had a lot of their sales counted before COVID really hit," noted Levin.

'We forecast that product-launch timetables will play a more significant role in the coming years because of long-term effects from changed COVID-19 behaviors. This year, more than half of non-food Pacesetters and about one-third of food and beverage Pacesetters achieved 30% distribution or more in the first quarter of the calendar year. This timing holds year after year, represented across products earning Pacesetter status. Thus, it’s likely that the lion’s share of innovation for this year is already on the market, facing a never-anticipated COVID-19 environment."

How will COVID-19 impact new product innovation and consumer trial?

But how might the IRI Pacesetters of 2020 list look different than previous years as many CPG manufacturers had to pause or delay new product innovation projects to prioritize worker safety and supply chain resiliency?

According to Levin, packaging innovation (pack size, packaging function, and certainly hygienic value-adds such as single-serve or portioning capabilities) as a response to pantry stocking behaviors and less frequent in-store shopping trips will be a trend to watch.

"It will be interesting to see how much innovation this year is package innovation (i.e. General Mills' bulk bags of cereal), which doesn't really make its way to Pacesetters but becomes an important element to the way CPG manufacturers are responding to a consumer need," he said.

Regardless of the current climate, consumers will always want to try new products, he said.

"We still find that about 25% of consumers, even in this COVID environment, still want to try new products. The problem is going to be, how do you market these new products? Because a lot of times, new products are discovered on a treasure hunt and I don't know if a lot consumers are going to want to spend time in a store treasure hunting.

"So you're probably going to have to increase your marketing to let consumers know your products are out there."