At the same time, online shopping has evolved beyond a nice-to-have convenience for occasionally hectic weeks or the quarantine, to a lifestyle solution that will endure beyond the pandemic and force not just retailers, but manufacturers and even ingredient suppliers, to rethink their online marketing strategy, added experts gathered during Rabobank’s annual Food & Agribusiness Summit earlier this month.

“COVID is having a profound impact on the food system – often in ways that one expected,” with some trends, such as drinking coffee on-the-go, completely reversing, and accelerating so quickly that “we have advanced in the last 10 months what normally would have taken us 10 years to achieve,” making “2020 the new 2030,” Nicholas Fereday, Rabobank’s senior analyst, consumer foods, said during the conference.

Many of these changes will not revert once a vaccine for the coronavirus is widely available, he added, making them issues that food and beverage players across the value chain cannot simply ignore or wait out, but rather must address and adjust to.

Consumer demand for comfort, mental wellbeing

One of the most influential shifts in 2020 has been an increased awareness and demand for food and beverage products and brands that can offer support for mental and emotional wellbeing – not just physical health, Fereday said.

This is playing out in two ways, he said. The first is creating a demand for functional foods and beverages that can help manage stress and lift moods, and the second is a mass return to familiar, comforting and long-trusted brands.

“We’ve all been sharing a lot more in our Zoom calls and literally being more transparent as we open up our homes, our families, and of course our pets to the outside world. It is a lot more permissible now to talk about the stresses and strains during this mother of all anxiety inducing years, and this openness has let to conversations about business opportunities around mental health issues, such as anxiety reduction,” Fereday explained.

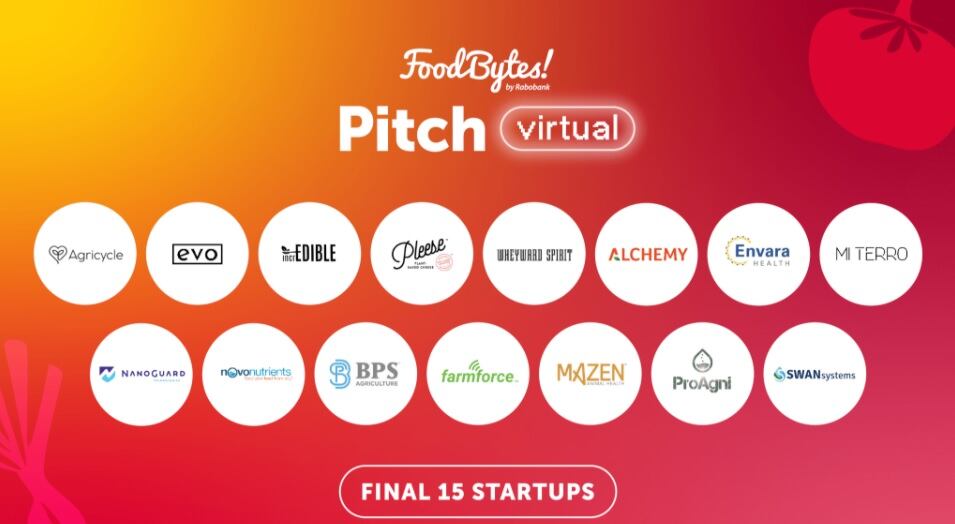

“For example,” he said, “as we have seen many times on the FoodBytes! platform, functional foods, such as those containing adaptogens, could help reduce our stress levels and lift our moods.”

While consumers are willing to take a chance of emerging brands that offer emotional and mental health support, they also are seeking comfort from long-established brands that for the past few years have received the cold should from shoppers.

“Consumers have returned to the old familiar brands of big food companies, suggesting perhaps it is their time to shine,” Fereday said.

However, he noted that consumers’ return to so-called big food was already underway before the pandemic, which he says simply accelerated it.

“I feel the tipping point for big food came a couple of years ago when they abandoned their obsession with cost-cutting and started focusing on growing their businesses,” he explained.

He added that while some large companies originally looked to emerging brands to help grow their business, either through acquisitions or accelerator programs that helped both big and small players alike, they increasingly are doing so on their own again.

“Large companies have stopped looking to smaller ones to solve their problems for them,” he said.

At the same time, he added, emerging brands have become less of a threat because they have been more significantly challenged by supply and demand during the pandemic than larger, more established players which can use their size to either gain priority status from suppliers and retailers or pull on a broader network to fill demand in a timely fashion.

Convenience saves time, eases mental and emotional pressures

Consumer adoption of e-commerce during the pandemic may have been fueled by fear of exposure to the novel coronavirus, but as consumers become more comfortable shopping online through long-term forced trial, they will continue to rely on it for its convenience long after the pandemic ends – embracing it as another mental health aid and time-saving solution.

“We will always fall back on what is easy and convenient, and that helps explain the current rise in online shopping,” Fereday said.

As ecommerce becomes an entrenched fact of life, players across the supply chain will need to evolve their communications and marketing strategies to better incorporate this path to market, added Roland Fumasi, North American regional head of RaboResearch.

“It’s really about positioning your company, your brand, your products in a way that plays well in the digital channel, in this new consumer landscape of living, working and eating more from home. I think that’s critical. And remember, it’s not just about consumer facing companies, because we know that the consumer expects the full farm to fork story already. So, consumer facing brands will expect their upstream producers to deliver the right digital marketing assets with the right digital story,” he explained.

Consumers searching for ways to simplify life and reduce obligations during the pandemic also is fueling their embrace of packaged foods rather than cooking from scratch – despite a short term spike in baking sourdough and banana bread in the spring, added Fereday.

“This relentless pursuit of convenience also explains why, even though we are all eating more at home, it is often an assembly of packaged foods, rather than really cooking from scratch,” he observed, adding this creates a notable, long-term opportunity for big food companies that have mastered production, distribution and marketing of packaged solutions.