Our panel included:

- REUBEN CANADA, founder & CEO of Canada Enterprises, which makes spicy ginger beverage Jin+Ja.

- TOM BURKEMPER, senior director, merchandising, at convenience store chain 7-Eleven.

- JONAS FELICIANO, senior beverages analyst at Euromonitor International.

- CRAIG MCCARTHY, director of strategy at design and innovation firm Altitude.

Watch the debate on demand by registering HERE.

WHAT’S HAPPENING IN THE US BEVERAGES MARKET?

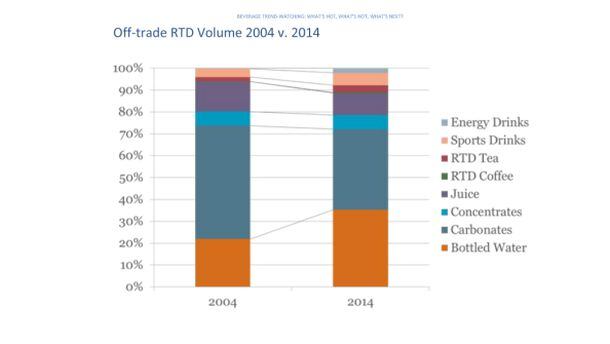

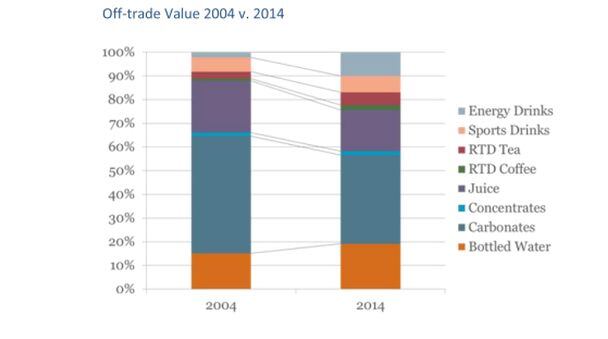

We tracked off trade ready-to-drink beverage volumes from 2004 to 2014 and two things really stood out:

First, the rise of bottled water [including still, flavored & carbonated waters], moving from a volume share of 22% in 2004 to 35% in 2014.

Second is the decline of carbonates… which moved from over a 50% share in 2004 down to just over 37% in 2014. Consumers are moving away from soda in general and diets in particular, which could be due to concerns about artificial sweeteners or because there are simply so many other beverage options out there that people are no long consuming a Diet Coke or a regular Coke per day.

The top three brands [Coca-Cola, Pepsi and Dr Pepper] have steadily lost market share over the last 10 years owing to the proliferation of consumer choice. In 2004 the top three brands were Coke (7.9%), Pepsi (5.8%) and Diet Coke (4.8%). In 2014 the biggest were Coke (5.5%), Pepsi (5.3%) and Red Bull (4.2%).

Some of the biggest jumps from a value perspective were within energy drinks. In 2004 they only accounted for about 2.2% of retail sales whereas in 2014, that number jumped to 10% of all sales of soft drinks in the United States.

Juice… continues to decline both in volume and value… but we’re seeing… a trend towards premiumization [cold-pressed HPP juices etc].

WHAT DO RETAILERS WANT?

Tom Burkemper: Beverages are extremely important for convenience retailers; if you include alcohol on average you’re probably looking at close to a third of the business and a significant proportion of the profitability… but we don’t have much space… so we have to be very selective.

C-stores are a great way to build a new beverage brand. If consumers want to try something, a $2 or $3 or $4 spend is a good way to sample different items until they find what they want, so we are bringing in more variety.

We look at new item innovation on a daily basis and probably have over 1,000 items presented to us each year. A product like Jin+Ja may not be right for every single 7-Eleven store in the country but it has its place in certain parts of the country and certain stores, so items like this may not represent a significant amount of dollar revenue initially, but they are growing at substantially higher rates.

[On trends] there’s a growing trend away from carbonated soft drinks but they still represent a large proportion of volumes so you can’t just walk away from that category, but we’re seeing growth in healthier and better-for-you options from water to teas to isotonics, more all-natural simpler ingredient formulations and beverages with health properties.

Energy/functional beverages is a huge opportunity for growth as household penetration is still fairly low at 20% or so, so there are tremendous opportunities, while it’s also a profitable category for retailer. I’d agree [that almond milk, cold pressed juices, coconut water, and kombucha are all hot trends], but we’re also seeing growth around joint, brain, and bone health, vision, protein and muscle recovery, immunity, gluten free, probiotics and digestive health, and energy.

At a macro level, Hispanics generally are seeking sweeter and flavor forward profiles in their beverages which align with their country of origin. They tend to prefer more tropical flavors, horchata, carbonated soft drinks and energy and are well connected through mobile devices in sharing and communicating their preferences.

WHAT DO CONSUMERS WANT?

Jonas Feliciano: Consumers are looking for new experiences, so trying new products is very important. They are also looking for calories with content.

Sugar has become a major concern for American consumers, but they are not eschewing it altogether… It’s more that if they are going to consume sugar and calories, they want to know what else is this product doing for me? Are there health benefits? Energy, relaxation, digestive health?

They also want products that are found in nature, not in the laboratory, ingredients that they know and understand.

Reuben Canada: Our consumers are looking for a unique and premium but safe and simple ingredient list product that has known quantities when it comes to health.

That may seem like a paradox - unique offerings but simple ingredients- but when you look at the cold box you see that there are emerging brands out there that have figured this out, from premium green teas to cold pressed juices.

I put ginger, green tea and cayenne pepper in Jin+Ja and it’s the health and taste properties that I found attractive. Today’s consumers are looking for authentic products and ingredients, so less is more.

Who buys our products? Educated shoppers shop at mainstream grocery and c-stores as well as Whole Foods and they are willing to pay a premium for quality products like Jin+Ja.

WILL KEURIG COLD BE A HIT?

Craig McCarthy: It has fantastic potential but they have to get the experience right. It can’t be the same as the traditional Keurig. Keurig provides fresh brew coffee in a single serving, but single serving soda isn’t an advantage.

In many ways Keurig cold is going to be less convenient than what’s currently available so they are going to have to do something to make it more compelling.

Maybe it’s learning from homebrew and making people part of the experience, making it fun and a social device like Margaritaville, part of the party and part of the experience.

Jonas Feliciano: When word first came out, there was a lot of initial excitement but so many questions have come up. Comparing what Keurig has done with hot vs carbonates is really apples and oranges. I’m too lazy to brew a pot of coffee because I don’t want to deal with the grounds and filter but there is nothing difficult about opening a can of Coke. So the convenience factor is not really there.

I’m excited by Drinkfinity [from PepsiCo] I think the marketing behind it is really strong…

‘Fairlife in every fridge in America!’ CEO predicts rebirth of US milk

To watch this debate, plus all the other sessions in our beverage innovation summit, CLICK HERE.

Our summit was sponsored by Ingredion, DuPont Nutrition & Health, Glanbia, AIDP and Virun NutraBiosciences, and supported by Hilmar Ingredients, Cargill (ViaTech), and Cognizin.