FoodNavigator-USA (FNU) asked Robertson Allen, lead researcher on the Hartman Group’s latest snacking study, and SnackNation founder Sean Kelly, to weigh in.

Los Angeles-based SnackNation delivers snacks to offices and homes across the US and has just acquired the direct to consumer snacking subscription and consumer insights business Love with Food (Edgilife).

The Hartman Group has advised some of the world’s largest food and beverage companies on issues of portfolio management, brand renovation, consumer insights and innovation, but also works with emerging brands to help food companies understand what really makes consumers tick.

FNU: What is a snack?

Robertson: A snack is essentially a food or beverage occasion that falls outside of the realm of a meal. These kinds of occasions used to be few and far between, but as our lives have become busier many consumers have found themselves regularly needing a snack at certain points in the day.

FNU: Do younger consumers snack more?

Sean: 47% of consumers say they can’t make it through the day without a snack, and this number increases with younger populations like Millennials.

FNU: How much we are snacking and how does this vary according to age and other factors?

Robertson: The number of kids in a household increases, on average, the number of snacks a parent has in a single day. While adults without any kids have an average of 2 snacks a day, those with 3 kids have 2.5.

Another interesting finding from our latest snacking study is that there is a more complex interplay between what snacks parents are eating and what their kids are eating. There is often a lot of overlap.

Sean: People are approaching snacks in different ways. They still see them as treats but some Gen Z and Millennial consumers are snacking up to six times a day, so it’s not a treat between meals. Instead of having a meal replacement bar, they’re combining snacks to make meals – maybe three or four snacks, just like you’d build a plate with protein, fruits & veggies and grains – or they are just snacking throughout the day.

FNU: How do consumers talk about snacking?

Robertson: Consumers generally do not use the language of ‘mini meals,’ this is more of an industry term. Instead, they use a wide array of terms to describe what it is they are having—of course a ‘snack,’ but also a ‘bite’ or ‘nibble,’ or just ‘something.’

FNU: Have consumer perceptions of what constitutes a snack changed?

Sean: Based on the feedback we’re getting at SnackNation, people still want the junk food they’ve grown up eating, but with cleaner ingredients. However, they’re moving away from added sugar and towards protein and healthier fats.

Robertson: How Americans understand a ‘snack’ has changed quite a bit from, say, 30 years ago. Back then, a snack more often meant a ‘treat’ that was usually something sweet, and often for kids—the classic definition of junk food. Now, we have such a wide array of snack products that signal healthier alternatives, but still maintain an element of pleasure, adventure, and delight.

Rather than mere throwaway calories or uncontrolled indulgences antithetical to health and nutrition, snacking has become a more intentional strategy for sustenance between meals, supporting long-term health, and addressing specific health conditions. They are also a low-stakes way for consumers to try out new flavors, textures, and global culinary approaches.

FNU: What call outs are consumers looking for on pack when they snack?

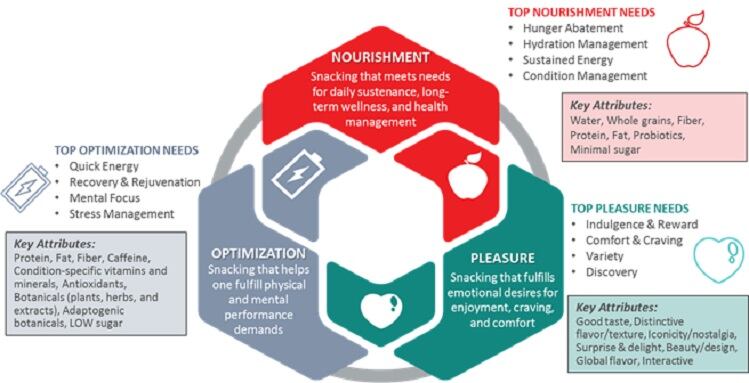

Robertson: Consumers usually aren’t looking for a single attribute like fiber to get out of a snack—though some do. At the Hartman Group we think of snacking occasions as being driven by one of three types of predominant needs—the needs for Nourishment, Optimization, and Pleasure. A single snacking occasion can meet one, two, or all of these needs.

Our research shows that 56% of all snacking occasions reflect a need for Nourishment, 34% reflect a need for Optimization, and 49% reflect a need for Pleasure.

While a clear point of differentiation that aligns to one of these areas is critical, snacks that connect to more than one of these drivers, and especially those that inject an element of pleasure or play, will be in a position to speak relevantly to a broader range of snacking occasions and capture consumer attention in a diversified landscape.

FNU: Is the fresh snacking segment a big growth opportunity?

Robertson: We have long observed among consumers that shopping the perimeter is a heuristic strategy in getting fresh, less processed food and in meeting health and wellness goals. So it makes a lot of sense for snacking brands to do what they can, within the realm of possibility, to get along that route and out of center store.

Perfect Bar is a great example of how a snacking product has been able to distinguish itself within a highly competitive category by drawing on elements of each of the three snacking drivers. It’s a clean-label organic ‘fresh’ bar that doesn’t feel like an ascetic choice for most consumers. And it is an interesting brand in that they have made the merchandising and product development decision to go to the fresh perimeter and the chilled section of the store. While consumers who are looking for a ‘bar’ may have a harder time finding it, they are also capturing those fresh perimeter shoppers.

Interested in healthy lunchbox snacks for kids?

Checkout our FOOD FOR KIDS conference in Chicago this November, which will ask questions including:

- What’s happening in the kids’ snacks category?

- Nutrition: What are parents looking for? How important are sugar levels and sweetener choices?

- Clean labels and kids’ snacks: What are parents looking for and avoiding?

- Are kids eating ‘kids’ products’ or are they eating the same snack brands/products as older household members?

- How and where are retailers merchandising snacks targeting children?

- Marketing and branding: How do you position a kids’ snacks brand?